Answered step by step

Verified Expert Solution

Question

1 Approved Answer

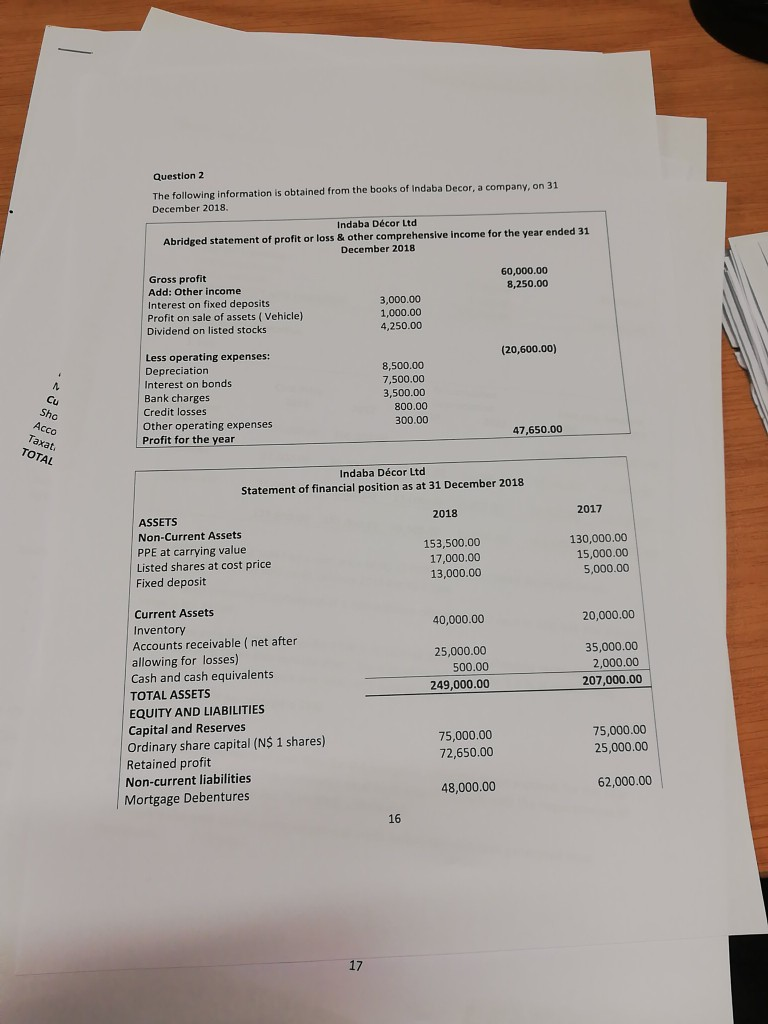

Question 2 The following information is obtained from the books of Indaba Decor, a company, on 31 December 2018 Indaba Dcor Ltd Abridged statement of

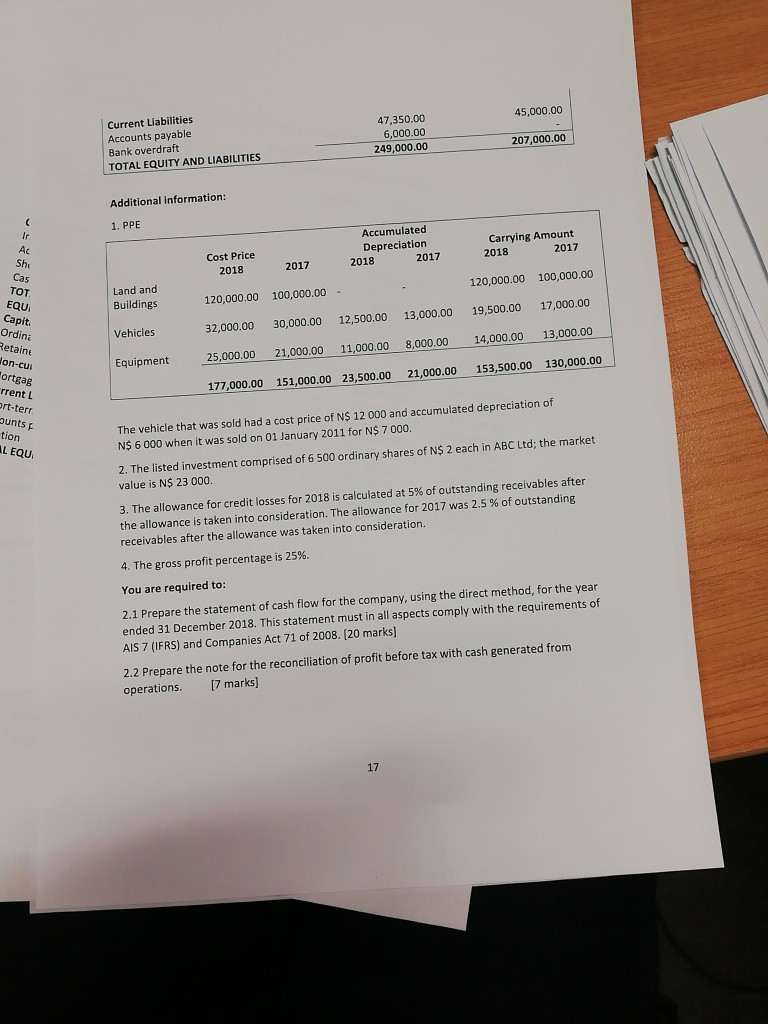

Question 2 The following information is obtained from the books of Indaba Decor, a company, on 31 December 2018 Indaba Dcor Ltd Abridged statement of profit or loss & other comprehensive income for the year ended 31 December 2018 60,000.00 8,250.00 Gross profit Add: Other income Interest on fixed deposits Profit on sale of assets (Vehicle) Dividend on listed stocks 3,000.00 1,000.00 4,250.00 (20,600.00) Less operating expenses: Depreciation Interest on bonds Bank charges Credit losses Other operating expenses Profit for the year 8,500.00 7,500.00 3,500.00 800.00 300.00 Sho Acco Taxat. TOTAL 47,650.00 Indaba Dcor Ltd Statement of financial position as at 31 December 2018 2018 2017 ASSETS Non-Current Assets PPE at carrying value Listed shares at cost price Fixed deposit 153,500.00 17,000.00 13,000.00 130,000.00 15,000.00 5,000.00 40,000.00 20,000.00 25,000.00 500.00 249,000.00 35,000.00 2,000.00 207,000.00 Current Assets Inventory Accounts receivable ( net after allowing for losses) Cash and cash equivalents TOTAL ASSETS EQUITY AND LIABILITIES Capital and Reserves Ordinary share capital (N$ 1 shares) Retained profit Non-current liabilities Mortgage Debentures 75,000.00 72,650.00 75,000.00 25,000.00 48,000.00 62,000.00 Current Liabilities Accounts payable Bank overdraft TOTAL EQUITY AND LIABILITIES 45,000.00 47,350.00 6,000.00 249,000.00 207,000.00 Additional information: 1. PPE Cost Price 2018 Accumulated Depreciation 2018 2017 2017 Carrying Amount 2018 2017 Land and EQU Buildings Capit. 120,000.00 100,000.00 Ordina Vehicles 120,000.00 32,000.00 25,000.00 100,000.00 - 30,000.00 12,500.00 21,000.00 11,000.00 13,000.00 8,000.00 19,500.00 14,000.00 17,000.00 13,000.00 Equipment Retaint lon-cui ortgas rrent L t-terr punts tion 177,000.00 151,000.00 23,500.00 21,000.00 153,500.00 130,000.00 LEQU. The vehicle that was sold had a cost price of N$ 12 000 and accumulated depreciation of N$ 6 000 when it was sold on 01 January 2011 for N$ 7000. 2. The listed investment comprised of 6 500 ordinary shares of N$ 2 each in ABC Ltd; the market value is N$ 23 000. 3. The allowance for credit losses for 2018 is calculated at 5% of outstanding receivables after the allowance is taken into consideration. The allowance for 2017 was 2.5% of outstanding receivables after the allowance was taken into consideration. 4. The gross profit percentage is 25%. You are required to: 2.1 Prepare the statement of cash flow for the company, using the direct method, for the year ended 31 December 2018. This statement must in all aspects comply with the requirements of AIS 7 (IFRS) and Companies Act 71 of 2008. [20 marks) 2.2 Prepare the note for the reconciliation of profit before tax with cash generated from operations. [7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started