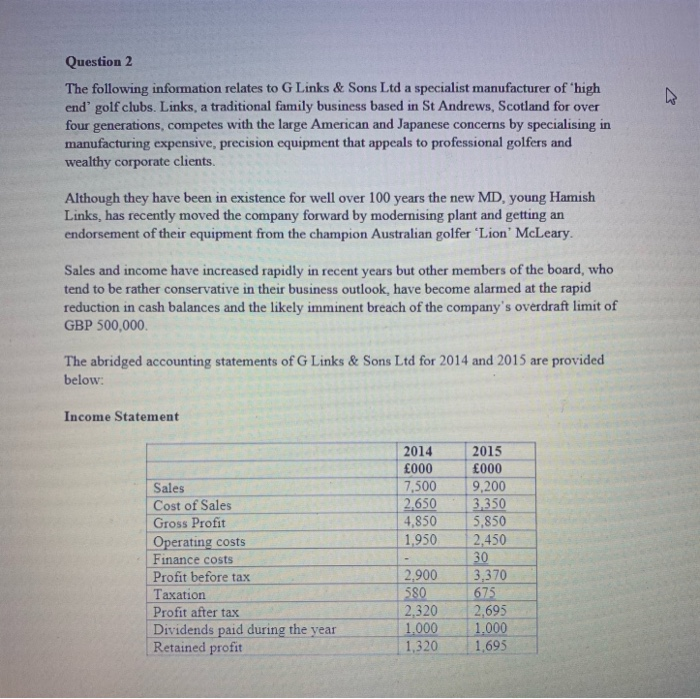

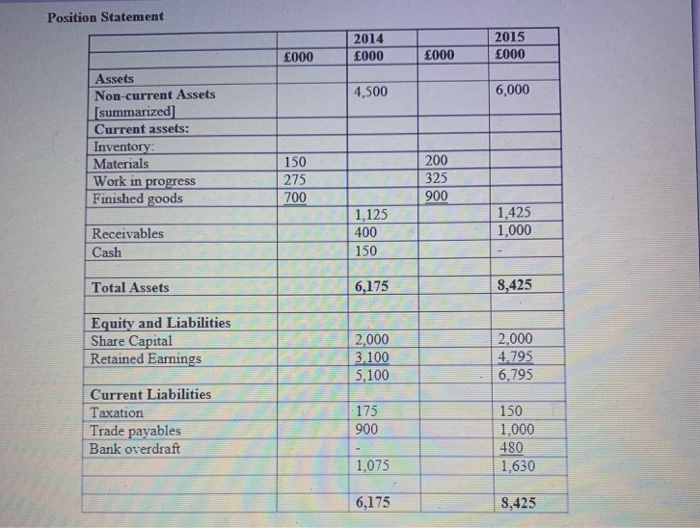

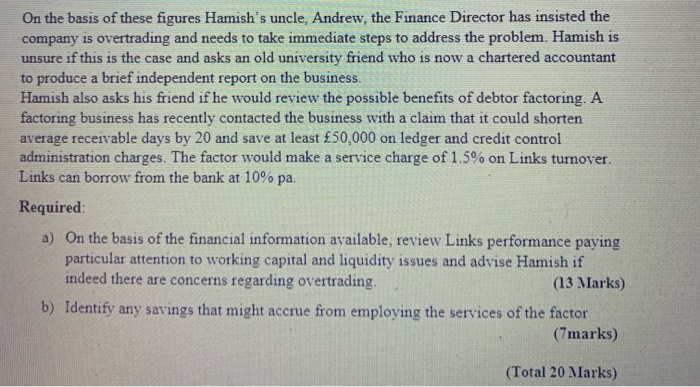

Question 2 The following information relates to G Links & Sons Ltd a specialist manufacturer of 'high end' golf clubs. Links, a traditional family business based in St Andrews, Scotland for over four generations, competes with the large American and Japanese concerns by specialising in manufacturing expensive, precision equipment that appeals to professional golfers and wealthy corporate clients. Although they have been in existence for well over 100 years the new MD, young Hamish Links, has recently moved the company forward by modernising plant and getting an endorsement of their equipment from the champion Australian golfer 'Lion' McLeary. Sales and income have increased rapidly in recent years but other members of the board, who tend to be rather conservative in their business outlook, have become alarmed at the rapid reduction in cash balances and the likely imminent breach of the company's overdraft limit of GBP 500,000 The abridged accounting statements of G Links & Sons Ltd for 2014 and 2015 are provided below: Income Statement 2014 000 7,500 2,650 4,850 1,950 Sales Cost of Sales Gross Profit Operating costs Finance costs Profit before tax Taxation Profit after tax Dividends paid during the year Retained profit 2015 000 9,200 3,350 5,850 2,450 30 3,370 675 2,695 1.000 1,695 2,900 580 2,320 1.000 1,320 Position Statement 2014 000 2015 000 000 000 4,500 6,000 Assets Non-current Assets [summarized] Current assets: Inventory: Materials Work in progress Finished goods 150 275 700 200 325 900 1,125 400 150 1,425 1,000 Receivables Cash Total Assets 6,175 8,425 Equity and Liabilities Share Capital Retained Earnings 2,000 3.100 5,100 2.000 4.793 6,795 Current Liabilities Taxation Trade payables Bank overdraft 175 900 150 1,000 480 1,630 1,075 6,175 9,425 On the basis of these figures Hamish's uncle, Andrew, the Finance Director has insisted the company is overtrading and needs to take immediate steps to address the problem. Hamish is unsure if this is the case and asks an old university friend who is now a chartered accountant to produce a brief independent report on the business. Hamish also asks his friend if he would review the possible benefits of debtor factoring. A factoring business has recently contacted the business with a claim that it could shorten average receivable days by 20 and save at least 50,000 on ledger and credit control administration charges. The factor would make a service charge of 1.5% on Links turnover. Links can borrow from the bank at 10% pa. Required: a) On the basis of the financial information available, review Links performance paying particular attention to working capital and liquidity issues and advise Hamish if indeed there are concerns regarding overtrading. (13 Marks) b) Identify any savings that might accrue from employing the services of the factor (7marks) (Total 20 Marks)