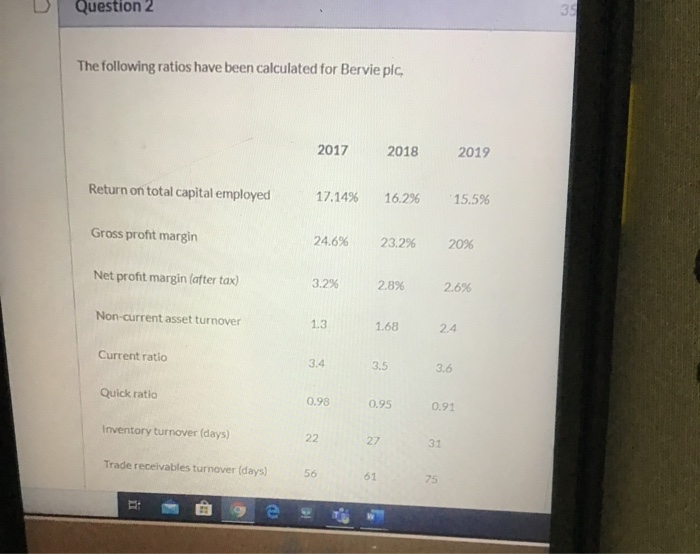

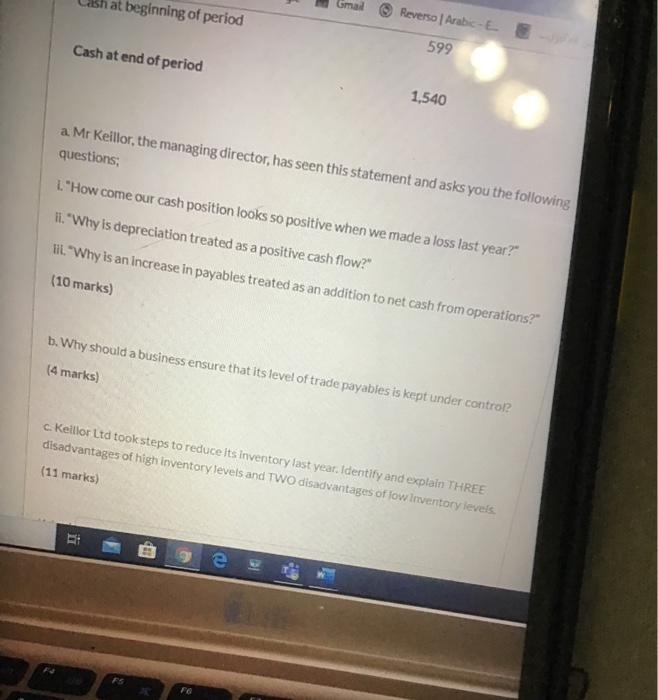

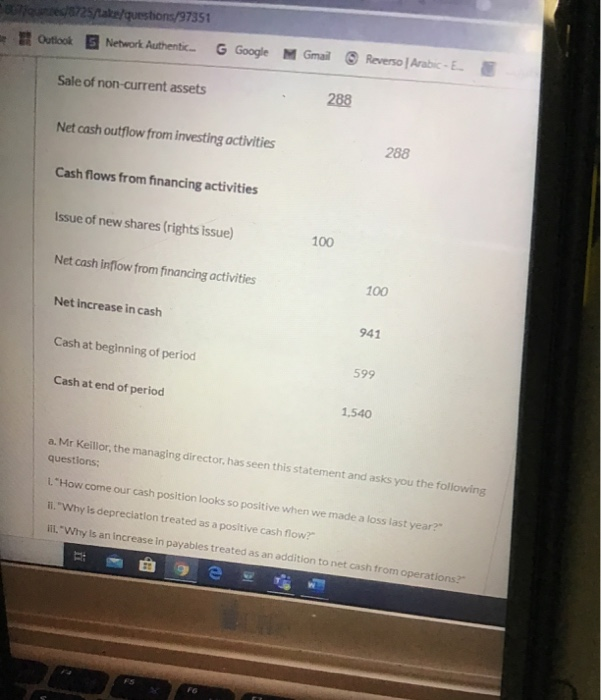

Question 2 The following ratios have been calculated for Bervie plc, 2017 2018 2019 Return on total capital employed 17.14% 16.2% 15.5% Gross profit margin 24.6% 23.2% 20% Net profit margin (after tax) 3.2% 28% 26% Non-current asset turnover 1.3 1.68 24 Current ratio 3,5 Quick ratio 0.95 0.91 Inventory turnover (days) 27 31 Trade receivables turnover (days) 56 et de Lahat beginning of period Gmail * Reverso | Arabic-E Cash at end of period 599 1,540 a. Mr Keillor, the managing director, has seen this statement and asks you the following questions; 1. "How come our cash position looks so positive when we made a loss last year?" 11. "Why is depreciation treated as a positive cash flow?" III. "Why is an increase in payables treated as an addition to net cash from operations?" (10 marks) b. Why should a business ensure that its level of trade payables is kept under control? (4 marks) c. Keillor Ltd took steps to reduce its inventory last year. Identify and explain THREE disadvantages of high inventory levels and TWO disadvantages of low Inventory levels. (11 marks) 1725/take/questions/97351 Outlook Network Authentic.. G Google M Gmail * Reverso Arabic-E Sale of non-current assets 288 Net cash outflow from investing activities 288 Cash flows from financing activities Issue of new shares (rights issue) 100 Net cash inlow from financing activities 100 Net increase in cash 941 Cash at beginning of period Cash at end of period 599 1,540 a. Mr Keillor, the managing director, has seen this statement and asks you the following questions; 1."How come our cash position looks so positive when we made a loss last year?" 11. "Why is depreciation treated as a positive cash flow?" 11. "Why is an increase in payables treated as an addition to net cash from operations Question 2 The following ratios have been calculated for Bervie plc, 2017 2018 2019 Return on total capital employed 17.14% 16.2% 15.5% Gross profit margin 24.6% 23.2% 20% Net profit margin (after tax) 3.2% 28% 26% Non-current asset turnover 1.3 1.68 24 Current ratio 3,5 Quick ratio 0.95 0.91 Inventory turnover (days) 27 31 Trade receivables turnover (days) 56 et de Lahat beginning of period Gmail * Reverso | Arabic-E Cash at end of period 599 1,540 a. Mr Keillor, the managing director, has seen this statement and asks you the following questions; 1. "How come our cash position looks so positive when we made a loss last year?" 11. "Why is depreciation treated as a positive cash flow?" III. "Why is an increase in payables treated as an addition to net cash from operations?" (10 marks) b. Why should a business ensure that its level of trade payables is kept under control? (4 marks) c. Keillor Ltd took steps to reduce its inventory last year. Identify and explain THREE disadvantages of high inventory levels and TWO disadvantages of low Inventory levels. (11 marks) 1725/take/questions/97351 Outlook Network Authentic.. G Google M Gmail * Reverso Arabic-E Sale of non-current assets 288 Net cash outflow from investing activities 288 Cash flows from financing activities Issue of new shares (rights issue) 100 Net cash inlow from financing activities 100 Net increase in cash 941 Cash at beginning of period Cash at end of period 599 1,540 a. Mr Keillor, the managing director, has seen this statement and asks you the following questions; 1."How come our cash position looks so positive when we made a loss last year?" 11. "Why is depreciation treated as a positive cash flow?" 11. "Why is an increase in payables treated as an addition to net cash from operations