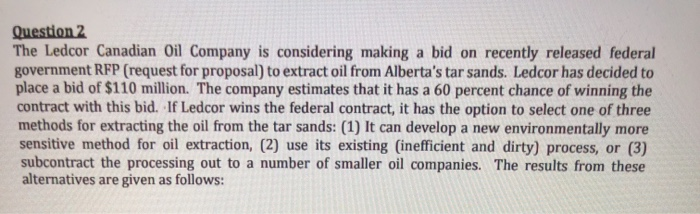

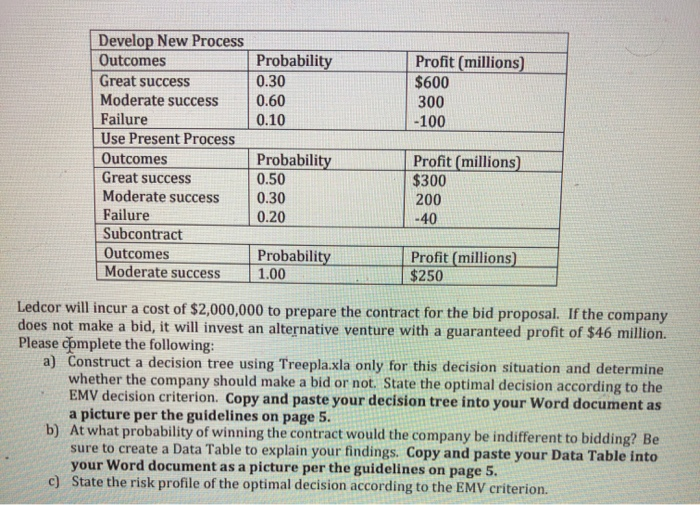

Question 2 The Ledcor Canadian Oil Company is considering making a bid on recently released federal government RFP (request for proposal) to extract oil from Alberta's tar sands. Ledcor has decided to place a bid of $110 million. The company estimates that it has a 60 percent chance of winning the contract with this bid. If Ledcor wins the federal contract, it has the option to select one of three methods for extracting the oil from the tar sands: (1) It can develop a new environmentally more sensitive method for oil extraction, (2) use its existing inefficient and dirty) process, or (3) subcontract the processing out to a number of smaller oil companies. The results from these alternatives are given as follows: Profit (millions) $600 300 -100 Develop New Process Outcomes Probability Great success 0.30 Moderate success 0.60 Failure 0.10 Use Present Process Outcomes Probability Great success 0.50 Moderate success 0.30 Failure 0.20 Subcontract Outcomes Probability Moderate success 1.00 Profit (millions $300 200 -40 Profit (millions) $250 Ledcor will incur a cost of $2,000,000 to prepare the contract for the bid proposal. If the company does not make a bid, it will invest an alternative venture with a guaranteed profit of $46 million. Please complete the following: a) Construct a decision tree using Treepla.xla only for this decision situation and determine whether the company should make a bid or not. State the optimal decision according to the EMV decision criterion. Copy and paste your decision tree into your Word document as a picture per the guidelines on page 5. b) At what probability of winning the contract would the company be indifferent to bidding? Be sure to create a Data Table to explain your findings. Copy and paste your Data Table into your Word document as a picture per the guidelines on page 5. c) State the risk profile of the optimal decision according to the EMV criterion. Question 2 The Ledcor Canadian Oil Company is considering making a bid on recently released federal government RFP (request for proposal) to extract oil from Alberta's tar sands. Ledcor has decided to place a bid of $110 million. The company estimates that it has a 60 percent chance of winning the contract with this bid. If Ledcor wins the federal contract, it has the option to select one of three methods for extracting the oil from the tar sands: (1) It can develop a new environmentally more sensitive method for oil extraction, (2) use its existing inefficient and dirty) process, or (3) subcontract the processing out to a number of smaller oil companies. The results from these alternatives are given as follows: Profit (millions) $600 300 -100 Develop New Process Outcomes Probability Great success 0.30 Moderate success 0.60 Failure 0.10 Use Present Process Outcomes Probability Great success 0.50 Moderate success 0.30 Failure 0.20 Subcontract Outcomes Probability Moderate success 1.00 Profit (millions $300 200 -40 Profit (millions) $250 Ledcor will incur a cost of $2,000,000 to prepare the contract for the bid proposal. If the company does not make a bid, it will invest an alternative venture with a guaranteed profit of $46 million. Please complete the following: a) Construct a decision tree using Treepla.xla only for this decision situation and determine whether the company should make a bid or not. State the optimal decision according to the EMV decision criterion. Copy and paste your decision tree into your Word document as a picture per the guidelines on page 5. b) At what probability of winning the contract would the company be indifferent to bidding? Be sure to create a Data Table to explain your findings. Copy and paste your Data Table into your Word document as a picture per the guidelines on page 5. c) State the risk profile of the optimal decision according to the EMV criterion