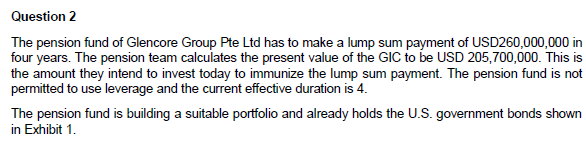

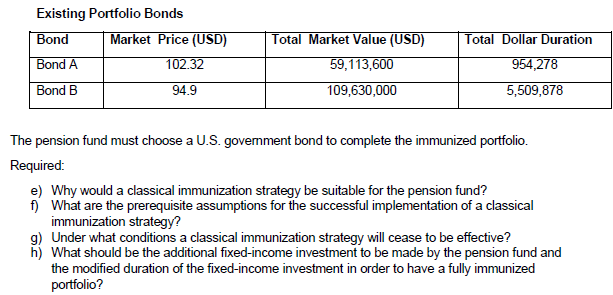

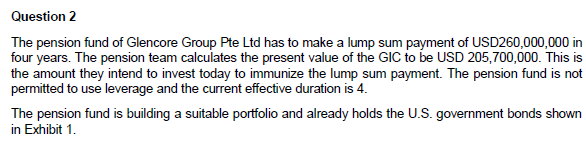

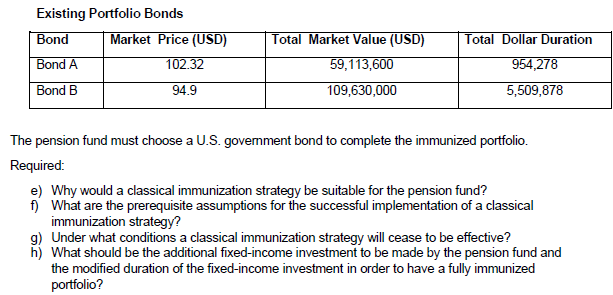

Question 2 The pension fund of Glencore Group Pte Ltd has to make a lump sum payment of USD260,000,000 in four years. The pension team calculates the present value of the GIC to be USD 205,700,000. This is the amount they intend to invest today to immunize the lump sum payment. The pension fund is not permitted to use leverage and the current effective duration is 4. The pension fund is building a suitable portfolio and already holds the U.S. government bonds shown in Exhibit 1. Existing Portfolio Bonds Bond Market Price (USD) Bond A 102.32 Bond B 94.9 Total Market Value (USD) 59,113,600 109,630,000 Total Dollar Duration 954,278 5,509,878 The pension fund must choose a U.S. government bond to complete the immunized portfolio. Required: e) Why would a classical immunization strategy be suitable for the pension fund? f) What are the prerequisite assumptions for the successful implementation of a classical immunization strategy? g) Under what conditions a classical immunization strategy will cease to be effective? h) What should be the additional fixed-income investment to be made by the pension fund and the modified duration of the fixed-income investment in order to have a fully immunized portfolio? Question 2 The pension fund of Glencore Group Pte Ltd has to make a lump sum payment of USD260,000,000 in four years. The pension team calculates the present value of the GIC to be USD 205,700,000. This is the amount they intend to invest today to immunize the lump sum payment. The pension fund is not permitted to use leverage and the current effective duration is 4. The pension fund is building a suitable portfolio and already holds the U.S. government bonds shown in Exhibit 1. Existing Portfolio Bonds Bond Market Price (USD) Bond A 102.32 Bond B 94.9 Total Market Value (USD) 59,113,600 109,630,000 Total Dollar Duration 954,278 5,509,878 The pension fund must choose a U.S. government bond to complete the immunized portfolio. Required: e) Why would a classical immunization strategy be suitable for the pension fund? f) What are the prerequisite assumptions for the successful implementation of a classical immunization strategy? g) Under what conditions a classical immunization strategy will cease to be effective? h) What should be the additional fixed-income investment to be made by the pension fund and the modified duration of the fixed-income investment in order to have a fully immunized portfolio