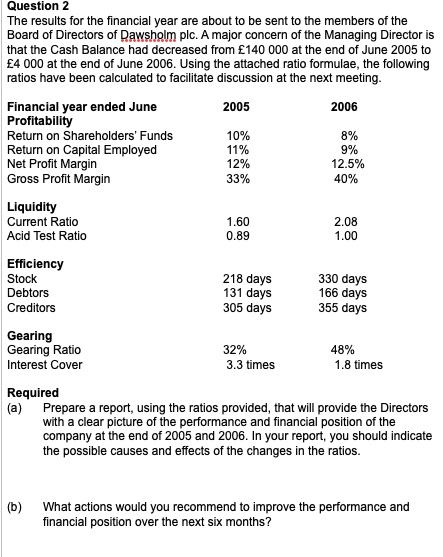

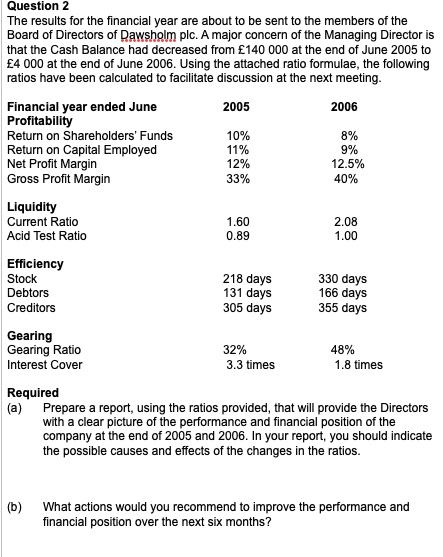

Question 2 The results for the financial year are about to be sent to the members of the Board of Directors of Dawsholm plc. A major concern of the Managing Director is that the Cash Balance had decreased from 140 000 at the end of June 2005 to 4 000 at the end of June 2006. Using the attached ratio formulae, the following ratios have been calculated to facilitate discussion at the next meeting. 2005 2006 Financial year ended June Profitability Return on Shareholders' Funds Return on Capital Employed Net Profit Margin Gross Profit Margin 10% 11% 12% 33% 8% 9% 12.5% 40% Liquidity Current Ratio Acid Test Ratio 1.60 0.89 2.08 1.00 Efficiency Stock Debtors Creditors 218 days 131 days 305 days 330 days 166 days 355 days Gearing Gearing Ratio Interest Cover 32% 3.3 times 48% 1.8 times Required Prepare a report, using the ratios provided, that will provide the Directors with a clear picture of the performance and financial position of the company at the end of 2005 and 2006. In your report, you should indicate the possible causes and effects of the changes in the ratios. (b) What actions would you recommend to improve the performance and financial position over the next six months? Question 2 The results for the financial year are about to be sent to the members of the Board of Directors of Dawsholm plc. A major concern of the Managing Director is that the Cash Balance had decreased from 140 000 at the end of June 2005 to 4 000 at the end of June 2006. Using the attached ratio formulae, the following ratios have been calculated to facilitate discussion at the next meeting. 2005 2006 Financial year ended June Profitability Return on Shareholders' Funds Return on Capital Employed Net Profit Margin Gross Profit Margin 10% 11% 12% 33% 8% 9% 12.5% 40% Liquidity Current Ratio Acid Test Ratio 1.60 0.89 2.08 1.00 Efficiency Stock Debtors Creditors 218 days 131 days 305 days 330 days 166 days 355 days Gearing Gearing Ratio Interest Cover 32% 3.3 times 48% 1.8 times Required Prepare a report, using the ratios provided, that will provide the Directors with a clear picture of the performance and financial position of the company at the end of 2005 and 2006. In your report, you should indicate the possible causes and effects of the changes in the ratios. (b) What actions would you recommend to improve the performance and financial position over the next six months