Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The TREE division and the BRANCH division manufacture and sell similar products. However, the two divisions operate independently of each other in different geographical

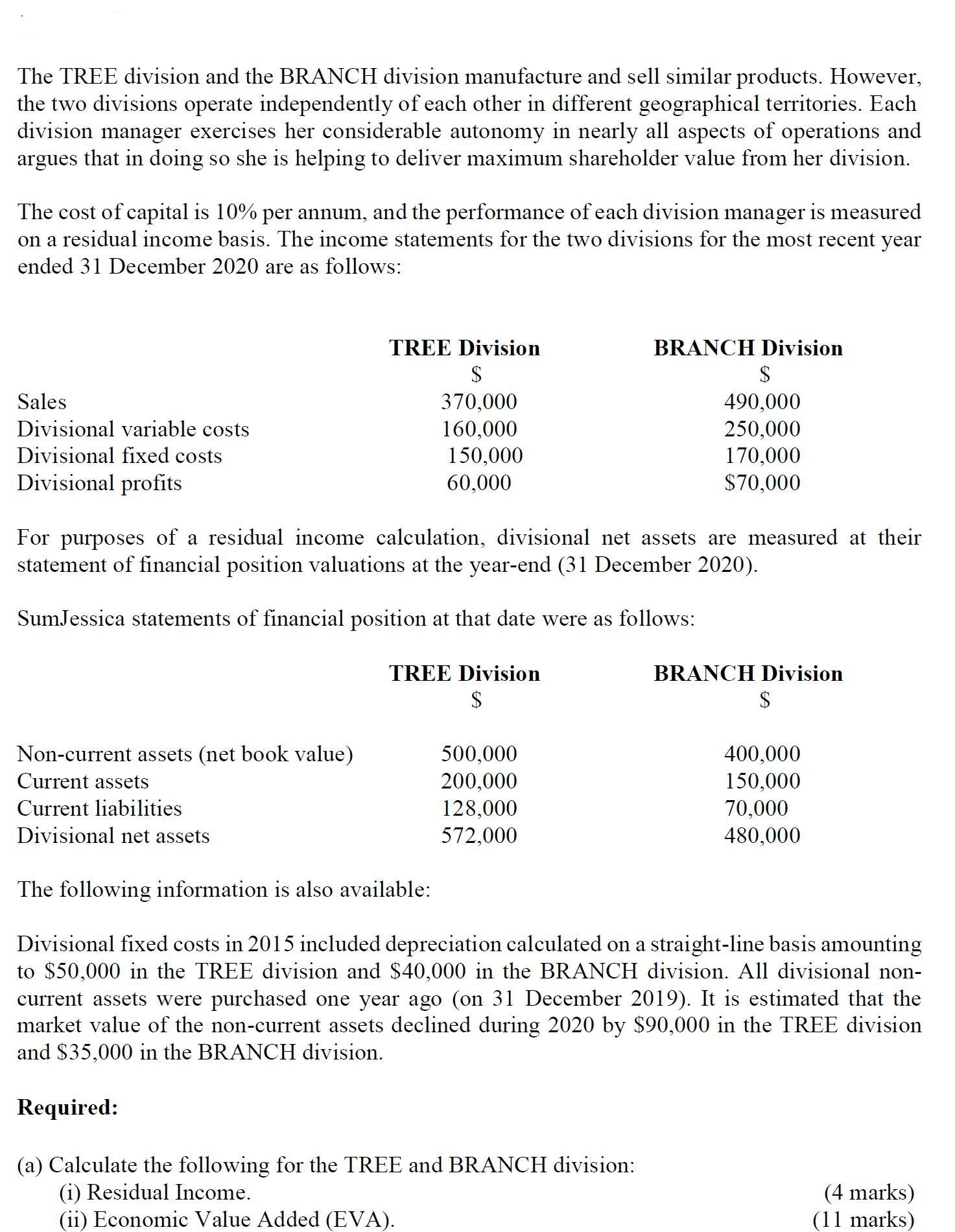

The TREE division and the BRANCH division manufacture and sell similar products. However, the two divisions operate independently of each other in different geographical territories. Each division manager exercises her considerable autonomy in nearly all aspects of operations and argues that in doing so she is helping to deliver maximum shareholder value from her division. The cost of capital is 10% per annum, and the performance of each division manager is measured on a residual income basis. The income statements for the two divisions for the most recent year ended 31 December 2020 are as follows: TREE Division BRANCH Division 2$ $ Sales 490,000 370,000 160,000 150,000 60,000 Divisional variable costs Divisional fixed costs 250,000 170,000 $70,000 Divisional profits For purposes of a residual income calculation, divisional net assets are measured at their statement of financial position valuations at the year-end (31 December 2020). SumJessica statements of financial position at that date were as follows: TREE Division BRANCH Division $ Non-current assets (net book value) 500,000 200,000 128,000 400,000 150,000 70,000 Current assets Current liabilities Divisional net assets 572,000 480,000 The following information is also available: Divisional fixed costs in 2015 included depreciation calculated on a straight-line basis amounting to $50,000 in the TREE division and $40,000 in the BRANCH division. All divisional non- current assets were purchased one year ago (on 31 December 2019). It is estimated that the market value of the non-current assets declined during 2020 by $90,000 in the TREE division and $35,000 in the BRANCH division. Required: (a) Calculate the following for the TREE and BRANCH division: (i) Residual Income. (ii) Economic Value Added (EVA). (4 marks) (11 marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started