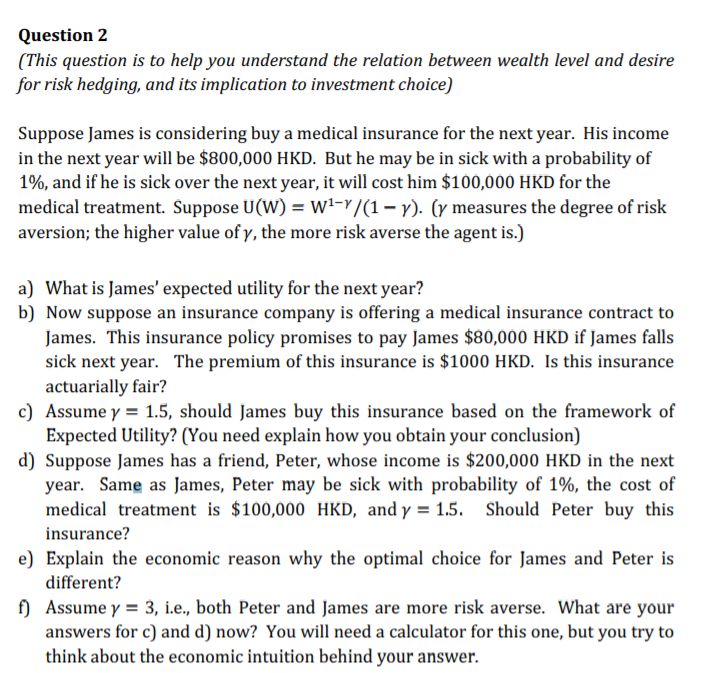

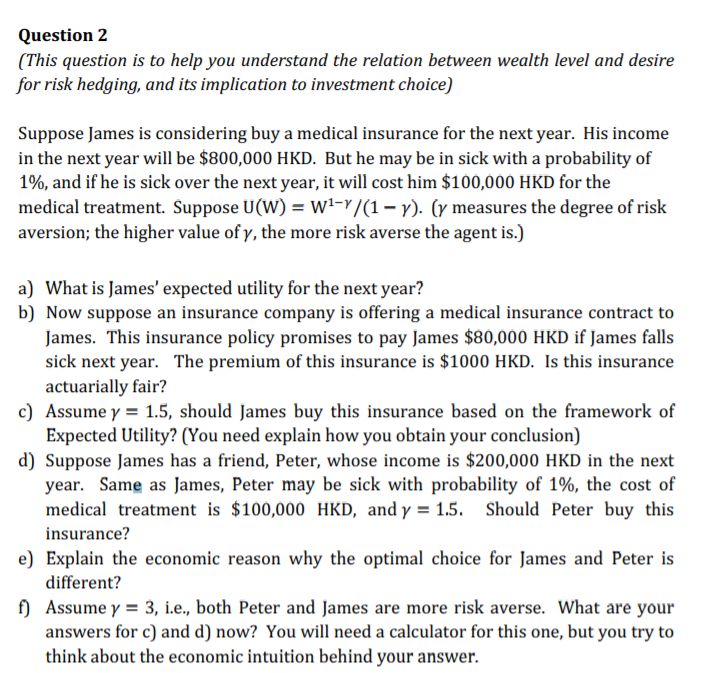

Question 2 (This question is to help you understand the relation between wealth level and desire for risk hedging, and its implication to investment choice) Suppose James is considering buy a medical insurance for the next year. His income in the next year will be $800,000 HKD. But he may be in sick with a probability of 1%, and if he is sick over the next year, it will cost him $100,000 HKD for the medical treatment. Suppose U(W) = W1-7/(1-7). (y measures the degree of risk aversion; the higher value of y, the more risk averse the agent is.) a) What is James' expected utility for the next year? b) Now suppose an insurance company is offering a medical insurance contract to James. This insurance policy promises to pay James $80,000 HKD if James falls sick next year. The premium of this insurance is $1000 HKD. Is this insurance actuarially fair? c) Assume y = 1.5, should James buy this insurance based on the framework of Expected Utility? (You need explain how you obtain your conclusion) d) Suppose James has a friend, Peter, whose income is $200,000 HKD in the next year. Same as James, Peter may be sick with probability of 1%, the cost of medical treatment is $100,000 HKD, and y = 1.5. Should Peter buy this insurance? e) Explain the economic reason why the optimal choice for James and Peter is different? f) Assume y = 3, i.e., both Peter and James are more risk averse. What are your answers for c) and d) now? You will need a calculator for this one, but you try to think about the economic intuition behind your answer. Question 2 (This question is to help you understand the relation between wealth level and desire for risk hedging, and its implication to investment choice) Suppose James is considering buy a medical insurance for the next year. His income in the next year will be $800,000 HKD. But he may be in sick with a probability of 1%, and if he is sick over the next year, it will cost him $100,000 HKD for the medical treatment. Suppose U(W) = W1-7/(1-7). (y measures the degree of risk aversion; the higher value of y, the more risk averse the agent is.) a) What is James' expected utility for the next year? b) Now suppose an insurance company is offering a medical insurance contract to James. This insurance policy promises to pay James $80,000 HKD if James falls sick next year. The premium of this insurance is $1000 HKD. Is this insurance actuarially fair? c) Assume y = 1.5, should James buy this insurance based on the framework of Expected Utility? (You need explain how you obtain your conclusion) d) Suppose James has a friend, Peter, whose income is $200,000 HKD in the next year. Same as James, Peter may be sick with probability of 1%, the cost of medical treatment is $100,000 HKD, and y = 1.5. Should Peter buy this insurance? e) Explain the economic reason why the optimal choice for James and Peter is different? f) Assume y = 3, i.e., both Peter and James are more risk averse. What are your answers for c) and d) now? You will need a calculator for this one, but you try to think about the economic intuition behind your