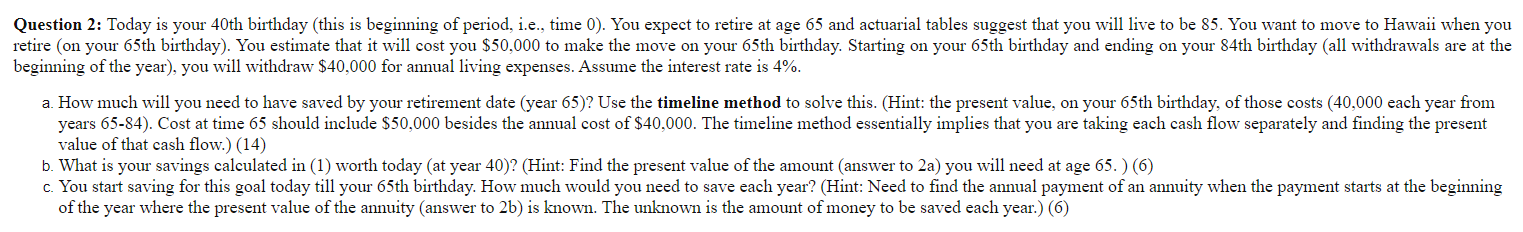

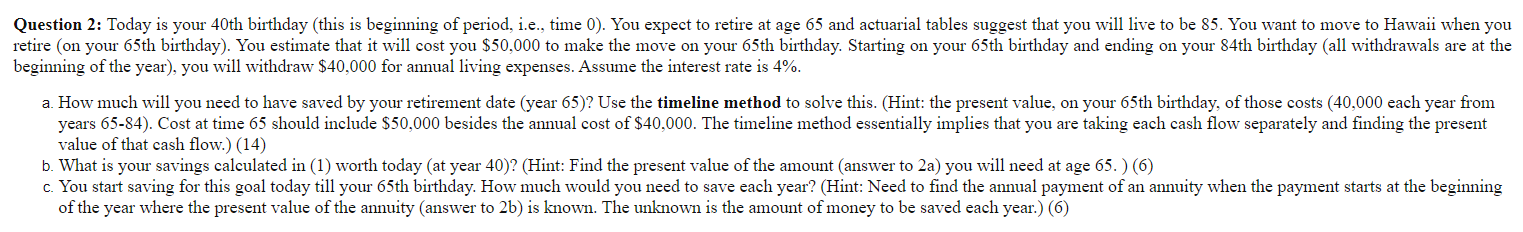

Question 2: Today is your 40th birthday (this is beginning of period, i.e., time 0). You expect to retire at age 65 and actuarial tables suggest that you will live to be 85. You want to move to Hawaii when you retire (on your 65th birthday). You estimate that it will cost you $50,000 to make the move on your 65th birthday. Starting on your 65th birthday and ending on your 84th birthday (all withdrawals are at the beginning of the year), you will withdraw $40,000 for annual living expenses. Assume the interest rate is 4%. a How much will you need to have saved by your retirement date (year 65)? Use the timeline method to solve this. (Hint: the present value, on your 65th birthday, of those costs (40,000 each year from years 65-84). Cost at time 65 should include $50,000 besides the annual cost of $40,000. The timeline method essentially implies that you are taking each cash flow separately and finding the present value of that cash flow.) (14) b. What is your savings calculated in (1) worth today (at year 40)? (Hint: Find the present value of the amount (answer to 2a) you will need at age 65.) (6) c. You start saving for this goal today till your 65th birthday. How much would you need to save each year? (Hint: Need to find the annual payment of an annuity when the payment starts at the beginning of the year where the present value of the annuity answer to 2b) is known. The unknown is the amount of money to be saved each year.) 6) Question 2: Today is your 40th birthday (this is beginning of period, i.e., time 0). You expect to retire at age 65 and actuarial tables suggest that you will live to be 85. You want to move to Hawaii when you retire (on your 65th birthday). You estimate that it will cost you $50,000 to make the move on your 65th birthday. Starting on your 65th birthday and ending on your 84th birthday (all withdrawals are at the beginning of the year), you will withdraw $40,000 for annual living expenses. Assume the interest rate is 4%. a How much will you need to have saved by your retirement date (year 65)? Use the timeline method to solve this. (Hint: the present value, on your 65th birthday, of those costs (40,000 each year from years 65-84). Cost at time 65 should include $50,000 besides the annual cost of $40,000. The timeline method essentially implies that you are taking each cash flow separately and finding the present value of that cash flow.) (14) b. What is your savings calculated in (1) worth today (at year 40)? (Hint: Find the present value of the amount (answer to 2a) you will need at age 65.) (6) c. You start saving for this goal today till your 65th birthday. How much would you need to save each year? (Hint: Need to find the annual payment of an annuity when the payment starts at the beginning of the year where the present value of the annuity answer to 2b) is known. The unknown is the amount of money to be saved each year.) 6)