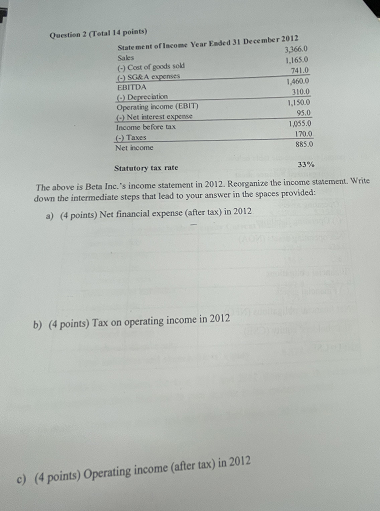

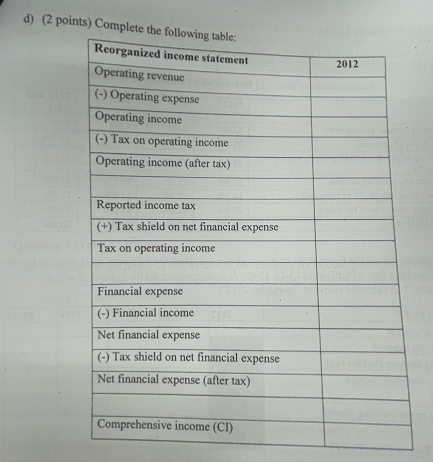

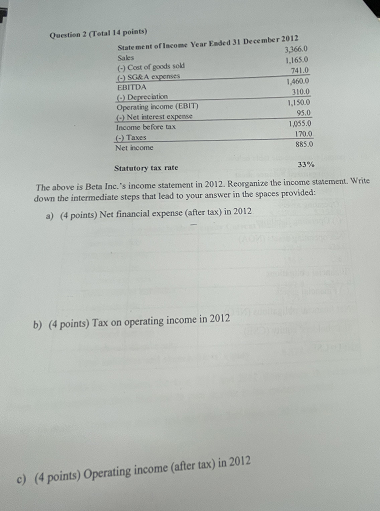

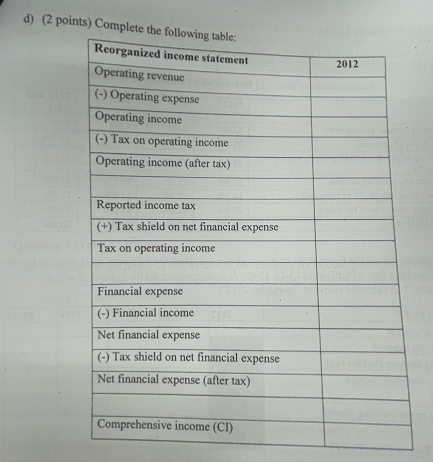

Question 2 (Total 14 points) Statement of Income Year Ended 31 December 2012 Sales 3.366.0 (-) Cost of goods sold 1.165.0 SGR A expenses 741.0 EBITDA 1.460.0 Depreciation 310.0 Operating income (EBIT) 1.1 500 c) Net interest experne 95.0 Income before tax Takes 170,0 Net income 8850 1,055.0 Statutory tax rate 33% The above is Beta Inc.'s income statement in 2012. Reorganize the income statement. Write down the intermediate steps that lead to your answer in the spaces provided: a) (4 points) Net financial expense (after tax) in 2012 b) (4 points) Tax on operating income in 2012 c) (4 points) Operating income (after tax) in 2012 2012 d) (2 points) Complete the following table: Reorganized income statement Operating revenue (-) Operating expense Operating income - Tax on operating income Operating income (after tax) Reported income tax (+) Tax shield on net financial expense Tax on operating income Financial expense (-) Financial income Net financial expense (-) Tax shield on net financial expense Net financial expense (after tax) Comprehensive income (CI) Question 2 (Total 14 points) Statement of Income Year Ended 31 December 2012 Sales 3.366.0 (-) Cost of goods sold 1.165.0 SGR A expenses 741.0 EBITDA 1.460.0 Depreciation 310.0 Operating income (EBIT) 1.1 500 c) Net interest experne 95.0 Income before tax Takes 170,0 Net income 8850 1,055.0 Statutory tax rate 33% The above is Beta Inc.'s income statement in 2012. Reorganize the income statement. Write down the intermediate steps that lead to your answer in the spaces provided: a) (4 points) Net financial expense (after tax) in 2012 b) (4 points) Tax on operating income in 2012 c) (4 points) Operating income (after tax) in 2012 2012 d) (2 points) Complete the following table: Reorganized income statement Operating revenue (-) Operating expense Operating income - Tax on operating income Operating income (after tax) Reported income tax (+) Tax shield on net financial expense Tax on operating income Financial expense (-) Financial income Net financial expense (-) Tax shield on net financial expense Net financial expense (after tax) Comprehensive income (CI)