Answered step by step

Verified Expert Solution

Question

1 Approved Answer

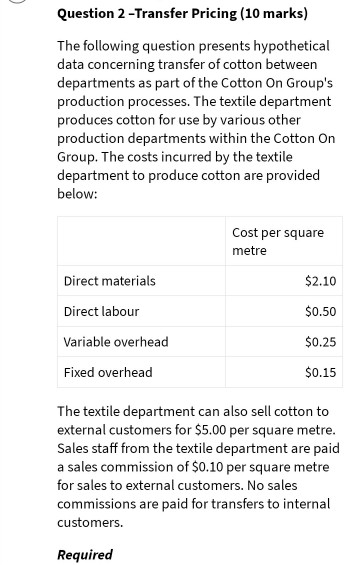

Question 2 -Transfer Pricing (10 marks) The following question presents hypothetical data concerning transfer of cotton between departments as part of the Cotton On Group's

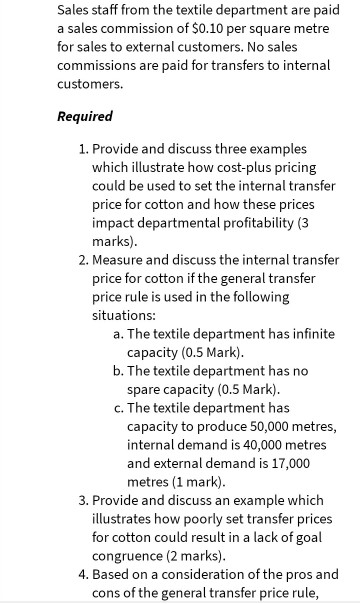

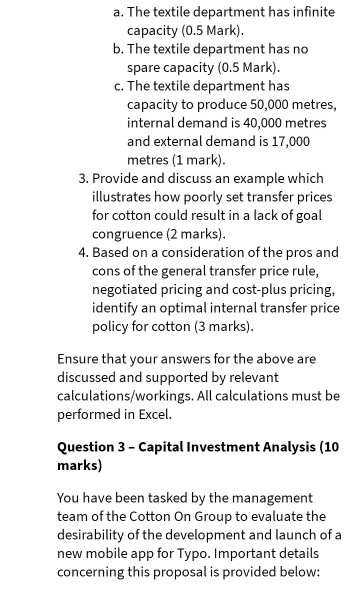

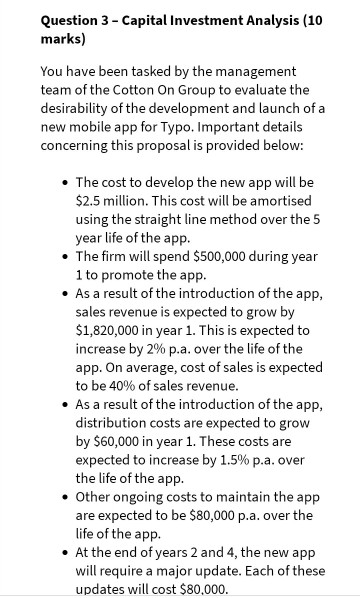

Question 2 -Transfer Pricing (10 marks) The following question presents hypothetical data concerning transfer of cotton between departments as part of the Cotton On Group's production processes. The textile department produces cotton for use by various other production departments within the Cotton On Group. The costs incurred by the textile department to produce cotton are provided below: Cost per square metre $2.10 Direct materials Direct labour $0.50 $0.25 Variable overhead Fixed overhead $0.15 The textile department can also sell cotton to external customers for $5.00 per square metre. Sales staff from the textile department are paid a sales commission of $0.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required Sales staff from the textile department are paid a sales commission of $0.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required 1. Provide and discuss three examples which illustrate how cost-plus pricing could be used to set the internal transfer price for cotton and how these prices impact departmental profitability (3 marks). 2. Measure and discuss the internal transfer price for cotton if the general transfer price rule is used in the following situations: a. The textile department has infinite capacity (0.5 Mark). b. The textile department has no spare capacity (0.5 Mark). c. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres and external demand is 17,000 metres (1 mark). 3. Provide and discuss an example which illustrates how poorly set transfer prices for cotton could result in a lack of goal congruence (2 marks). 4. Based on a consideration of the pros and cons of the general transfer price rule, a. The textile department has infinite capacity (0.5 Mark). b. The textile department has no spare capacity (0.5 Mark). c. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres and external demand is 17,000 metres (1 mark). 3. Provide and discuss an example which illustrates how poorly set transfer prices for cotton could result in a lack of goal congruence (2 marks). 4. Based on a consideration of the pros and cons of the general transfer price rule, negotiated pricing and cost-plus pricing, identify an optimal internal transfer price policy for cotton (3 marks). Ensure that your answers for the above are discussed and supported by relevant calculations/workings. All calculations must be performed in Excel Question 3 - Capital Investment Analysis (10 marks) You have been tasked by the management team of the Cotton On Group to evaluate the desirability of the development and launch of a new mobile app for Typo. Important details concerning this proposal is provided below: Question 3 - Capital Investment Analysis (10 marks) You have been tasked by the management team of the Cotton On Group to evaluate the desirability of the development and launch of a new mobile app for Typo. Important details concerning this proposal is provided below: The cost to develop the new app will be $2.5 million. This cost will be amortised using the straight line method over the 5 year life of the app. The firm will spend $500,000 during year 1 to promote the app. As a result of the introduction of the app, sales revenue is expected to grow by $1,820,000 in year 1. This is expected to increase by 2% p.a. over the life of the app. On average, cost of sales is expected to be 40% of sales revenue. As a result of the introduction of the app, distribution costs are expected to grow by $60,000 in year 1. These costs are expected to increase by 1.5% p.a. over the life of the app. Other ongoing costs to maintain the app are expected to be $80,000 p.a. over the life of the app. At the end of years 2 and 4, the new app will require a major update. Each of these updates will cost $80,000. At the end of years 2 and 4, the new app will require a major update. Each of these updates will cost $80,000. The firm's tax rate is 30%. The firm requires a 16% required rate of return on all potential investments. All calculations must be performed in Excel. Required In relation to the above proposal: 1. Calculate the annual after tax cash flows (1 mark) and annual after tax profit (1 mark). 2. Calculate the payback period (0.5 mark). 3. Calculate the net present value (0.5 mark) 4. Calculate the internal rate of return (0.5 mark) 5. Calculate the accounting rate of return (0.5 mark) 6. Provide an overview of key environmental factors that the firm should consider when evaluating the proposal (2 marks). 7. Based on an assessment of the above and other factors, discuss whether the firm should go ahead with the proposal (2 marks). 8. Discuss how sensitive your 2. Calculate the payback period (0.5 mark). 3. Calculate the net present value (0.5 mark) 4. Calculate the internal rate of return (0.5 mark) 5. Calculate the accounting rate of return (0.5 mark) 6. Provide an overview of key environmental factors that the firm should consider when evaluating the proposal (2 marks). 7. Based on an assessment of the above and other factors, discuss whether the firm should go ahead with the proposal (2 marks). 8. Discuss how sensitive your recommendations are to changes in assumptions in regards to the financial impact of the new capital investment. In your discussion, include examples which illustrate how changes to at least two assumptions impact the financial analysis (2 marks). Ensure that your answers for the above are discussed and supported by relevant calculations/workings. Question 2 -Transfer Pricing (10 marks) The following question presents hypothetical data concerning transfer of cotton between departments as part of the Cotton On Group's production processes. The textile department produces cotton for use by various other production departments within the Cotton On Group. The costs incurred by the textile department to produce cotton are provided below: Cost per square metre $2.10 Direct materials Direct labour $0.50 $0.25 Variable overhead Fixed overhead $0.15 The textile department can also sell cotton to external customers for $5.00 per square metre. Sales staff from the textile department are paid a sales commission of $0.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required Sales staff from the textile department are paid a sales commission of $0.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required 1. Provide and discuss three examples which illustrate how cost-plus pricing could be used to set the internal transfer price for cotton and how these prices impact departmental profitability (3 marks). 2. Measure and discuss the internal transfer price for cotton if the general transfer price rule is used in the following situations: a. The textile department has infinite capacity (0.5 Mark). b. The textile department has no spare capacity (0.5 Mark). c. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres and external demand is 17,000 metres (1 mark). 3. Provide and discuss an example which illustrates how poorly set transfer prices for cotton could result in a lack of goal congruence (2 marks). 4. Based on a consideration of the pros and cons of the general transfer price rule, a. The textile department has infinite capacity (0.5 Mark). b. The textile department has no spare capacity (0.5 Mark). c. The textile department has capacity to produce 50,000 metres, internal demand is 40,000 metres and external demand is 17,000 metres (1 mark). 3. Provide and discuss an example which illustrates how poorly set transfer prices for cotton could result in a lack of goal congruence (2 marks). 4. Based on a consideration of the pros and cons of the general transfer price rule, negotiated pricing and cost-plus pricing, identify an optimal internal transfer price policy for cotton (3 marks). Ensure that your answers for the above are discussed and supported by relevant calculations/workings. All calculations must be performed in Excel Question 3 - Capital Investment Analysis (10 marks) You have been tasked by the management team of the Cotton On Group to evaluate the desirability of the development and launch of a new mobile app for Typo. Important details concerning this proposal is provided below: Question 3 - Capital Investment Analysis (10 marks) You have been tasked by the management team of the Cotton On Group to evaluate the desirability of the development and launch of a new mobile app for Typo. Important details concerning this proposal is provided below: The cost to develop the new app will be $2.5 million. This cost will be amortised using the straight line method over the 5 year life of the app. The firm will spend $500,000 during year 1 to promote the app. As a result of the introduction of the app, sales revenue is expected to grow by $1,820,000 in year 1. This is expected to increase by 2% p.a. over the life of the app. On average, cost of sales is expected to be 40% of sales revenue. As a result of the introduction of the app, distribution costs are expected to grow by $60,000 in year 1. These costs are expected to increase by 1.5% p.a. over the life of the app. Other ongoing costs to maintain the app are expected to be $80,000 p.a. over the life of the app. At the end of years 2 and 4, the new app will require a major update. Each of these updates will cost $80,000. At the end of years 2 and 4, the new app will require a major update. Each of these updates will cost $80,000. The firm's tax rate is 30%. The firm requires a 16% required rate of return on all potential investments. All calculations must be performed in Excel. Required In relation to the above proposal: 1. Calculate the annual after tax cash flows (1 mark) and annual after tax profit (1 mark). 2. Calculate the payback period (0.5 mark). 3. Calculate the net present value (0.5 mark) 4. Calculate the internal rate of return (0.5 mark) 5. Calculate the accounting rate of return (0.5 mark) 6. Provide an overview of key environmental factors that the firm should consider when evaluating the proposal (2 marks). 7. Based on an assessment of the above and other factors, discuss whether the firm should go ahead with the proposal (2 marks). 8. Discuss how sensitive your 2. Calculate the payback period (0.5 mark). 3. Calculate the net present value (0.5 mark) 4. Calculate the internal rate of return (0.5 mark) 5. Calculate the accounting rate of return (0.5 mark) 6. Provide an overview of key environmental factors that the firm should consider when evaluating the proposal (2 marks). 7. Based on an assessment of the above and other factors, discuss whether the firm should go ahead with the proposal (2 marks). 8. Discuss how sensitive your recommendations are to changes in assumptions in regards to the financial impact of the new capital investment. In your discussion, include examples which illustrate how changes to at least two assumptions impact the financial analysis (2 marks). Ensure that your answers for the above are discussed and supported by relevant calculations/workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started