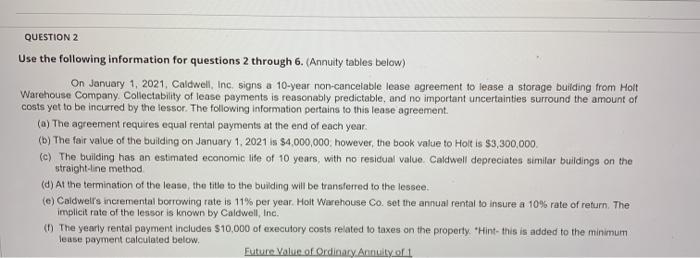

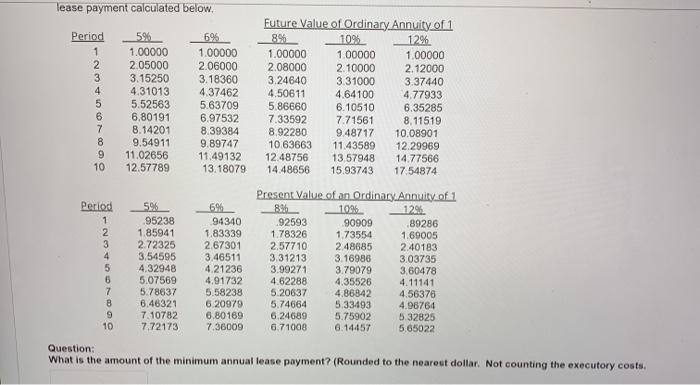

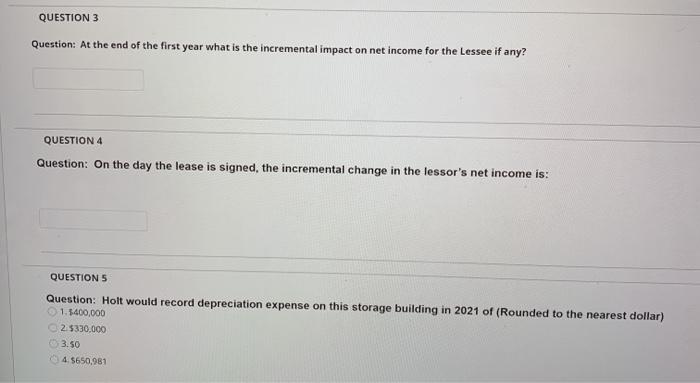

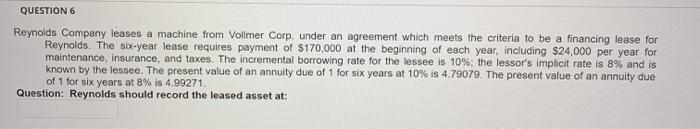

QUESTION 2 Use the following information for questions 2 through 6. Annuity tables below) On January 1, 2021. Caldwell, Inc. signs a 10-year non-cancelable lease agreement to lease a storage building from Holt Warehouse Company Collectability of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information portains to this lease agreement (a) The agreement requires equal rental payments at the end of each year. (b) The fair value of the building on January 1, 2021 is $4,000,000, however, the book value to Holt is $3,300,000 (c) The building has an estimated economic life of 10 years, with no residual value. Caldwell depreciates similar buildings on the straight-line method (a) At the termination of the lease, the title to the building will be transferred to the lessee. (e) Caldwells incremental borrowing rate is 11% per year. Holt Warehouse Co set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Caldwell, Inc. () The yearly rental payment includes $10,000 of executory costs related to taxes on the property. 'Hint- this is added to the minimum Jease payment calculated below. Future Value of Ordinary Annuity or lease payment calculated below. Period 1 2 3 4 5 6 7 8 9 10 596 1.00000 2.05000 3.15250 4.31013 5.52563 6.80191 8.14201 9.54911 11.02656 12.57789 696 1.00000 2.06000 3.18360 4.37462 5.63709 6.97532 8.39384 9.89747 11.49132 13.18079 Future Value of Ordinary Annuity of 1 10% 12% 1.00000 1.00000 1.00000 2.08000 2. 10000 2.12000 3.24640 3.31000 3.37440 4.50611 4.64100 4.77933 5.86660 6.10510 6.35285 7.33592 7.71561 8,11519 8.92280 9.48717 10.08901 10 63663 11.43589 12.29969 12.48756 13.57948 14.77566 14.48656 15.93743 17.54874 Period 1 2 3 4 5 6 7 B 9 10 596 95238 1.85941 2.72325 3.54595 4.32948 5.07569 5.78637 6.46321 7.10782 7.72173 6% 94340 1.83339 2.67301 3,46511 4.21236 4.91732 5.58238 6.20979 6.80169 7.36009 Present Value of an ordinary. Annuity of 1 8% 10% 1295 92593 90909 89286 1.78326 1.73554 1.69005 2.57710 248685 2.40183 3.31213 3.16986 3.03735 3.99271 3.79079 3.60478 4.62288 4.35526 4.11141 5.20637 4.86842 4.56376 5.74664 5.33493 4.96764 6.24689 5.75902 5.32825 6.71008 6.14457 5.65022 Question: What is the amount of the minimum annual lease payment? (Rounded to the nearest dollar. Not counting the executory costs. QUESTION 3 Question: At the end of the first year what is the incremental impact on net income for the Lessee if any? QUESTION 4 Question: On the day the lease is signed, the incremental change in the lessor's net income is: QUESTION 5 Question: Holt would record depreciation expense on this storage building in 2021 of (Rounded to the nearest dollar) 1.3400,000 2.5330,000 3.50 4.5650.981 QUESTION 6 Reynolds Company leases a machine from Vollmer Corp. under an agreement which meets the criteria to be a financing lease for Reynolds. The six-year lease requires payment of $170,000 at the beginning of each year, including $24,000 per year for maintenance, insurance, and taxes. The incremental borrowing rate for the lessee is 10%, the lessor's implicit rate is 8% and is known by the lessee. The present value of an annuity due of 1 for six years at 10% is 4.79079. The present value of an annuity due of 1 for six years at 8% is 4.99271 Question: Reynolds should record the leased asset at