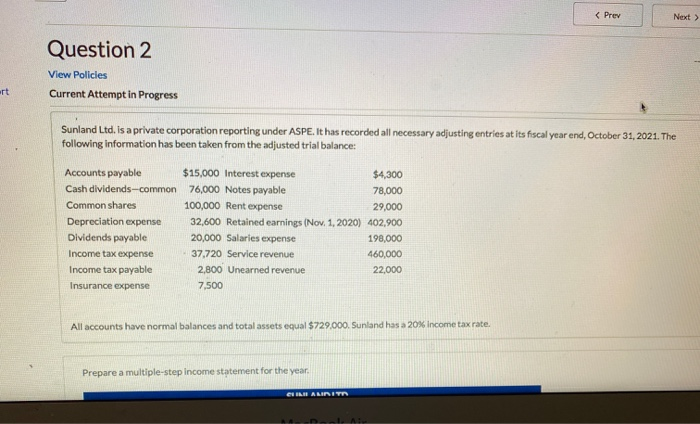

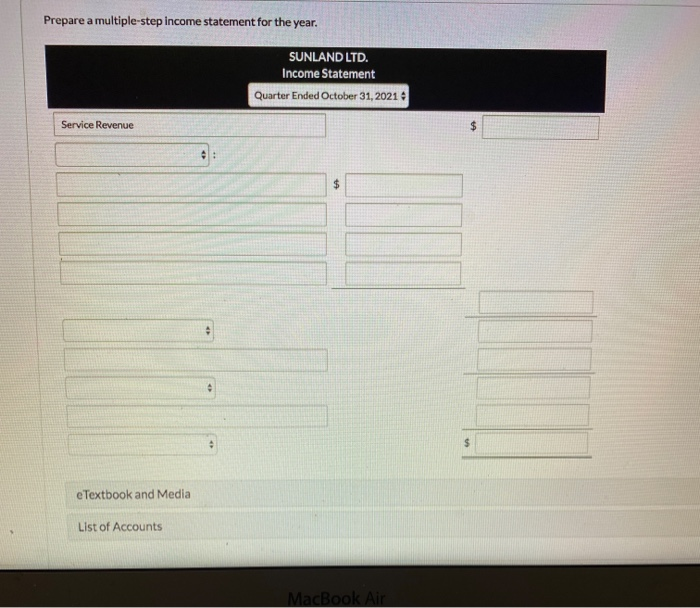

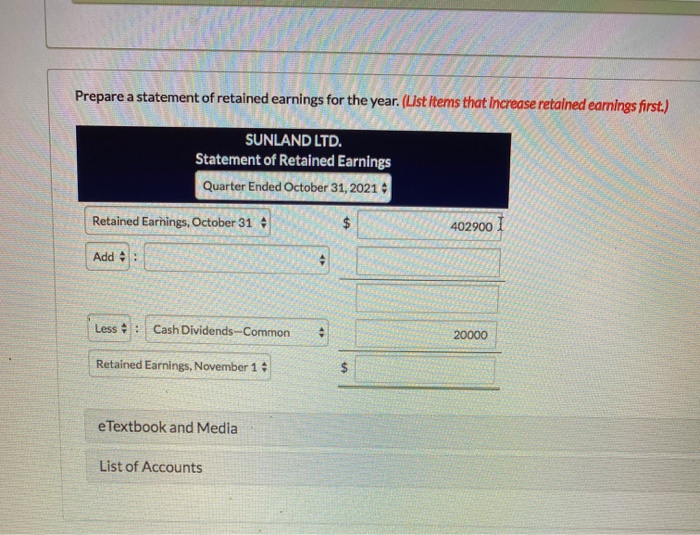

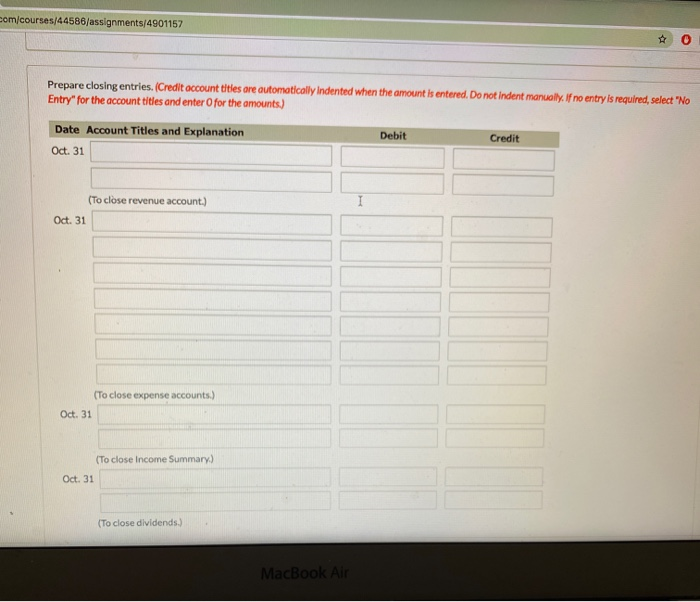

Question 2 View Policies Current Attempt in Progress Sunland Ltd. is a private corporation reporting under ASPE. It has recorded all necessary adjusting entries at its fiscal year end, October 31, 2021. The following information has been taken from the adjusted trial balance: Accounts payable in $15,000 Interest expense $4,300 Cash dividends-common 76,000 Notes payable 78,000 Common shares 100,000 Rent expense 29,000 Depreciation expense 32,600 Retained earnings (Nov. 1, 2020) 402,900 Dividends payable 20,000 Salaries expense 198,000 Income tax expense 37,720 Service revenue 460,000 Income tax payable 2,800 Unearned revenue 22,000 Insurance expense 7,500 All accounts have normal balances and total assets equal $729.000. Sunland has a 20% Income tax rate. Prepare a multiple-step income statement for the year. Prepare a multiple step income statement for the year. SUNLAND LTD. Income Statement Quarter Ended October 31, 2021 Service Revenue eTextbook and Media List of Accounts MacBook Air Prepare a statement of retained earnings for the year. (List items that increase retained earnings first.) SUNLAND LTD. Statement of Retained Earnings Quarter Ended October 31, 2021 4 Retained Earnings, October 31 4029001 "27 Add 11 Less : Cash Dividends-Common Retained Earnings, November 14 e Textbook and Media List of Accounts com/courses/44586/assignments/4901157 * O Prepare closing entries. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Oct. 31 Debit Credit (To close revenue account.) Oct. 31 (To close expense accounts.) Oct. 31 (To close Income Summary) Oct. 31 (To close dividends.) MacBook Air Question 2 View Policies Current Attempt in Progress Sunland Ltd. is a private corporation reporting under ASPE. It has recorded all necessary adjusting entries at its fiscal year end, October 31, 2021. The following information has been taken from the adjusted trial balance: Accounts payable in $15,000 Interest expense $4,300 Cash dividends-common 76,000 Notes payable 78,000 Common shares 100,000 Rent expense 29,000 Depreciation expense 32,600 Retained earnings (Nov. 1, 2020) 402,900 Dividends payable 20,000 Salaries expense 198,000 Income tax expense 37,720 Service revenue 460,000 Income tax payable 2,800 Unearned revenue 22,000 Insurance expense 7,500 All accounts have normal balances and total assets equal $729.000. Sunland has a 20% Income tax rate. Prepare a multiple-step income statement for the year. Prepare a multiple step income statement for the year. SUNLAND LTD. Income Statement Quarter Ended October 31, 2021 Service Revenue eTextbook and Media List of Accounts MacBook Air Prepare a statement of retained earnings for the year. (List items that increase retained earnings first.) SUNLAND LTD. Statement of Retained Earnings Quarter Ended October 31, 2021 4 Retained Earnings, October 31 4029001 "27 Add 11 Less : Cash Dividends-Common Retained Earnings, November 14 e Textbook and Media List of Accounts com/courses/44586/assignments/4901157 * O Prepare closing entries. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Oct. 31 Debit Credit (To close revenue account.) Oct. 31 (To close expense accounts.) Oct. 31 (To close Income Summary) Oct. 31 (To close dividends.) MacBook Air