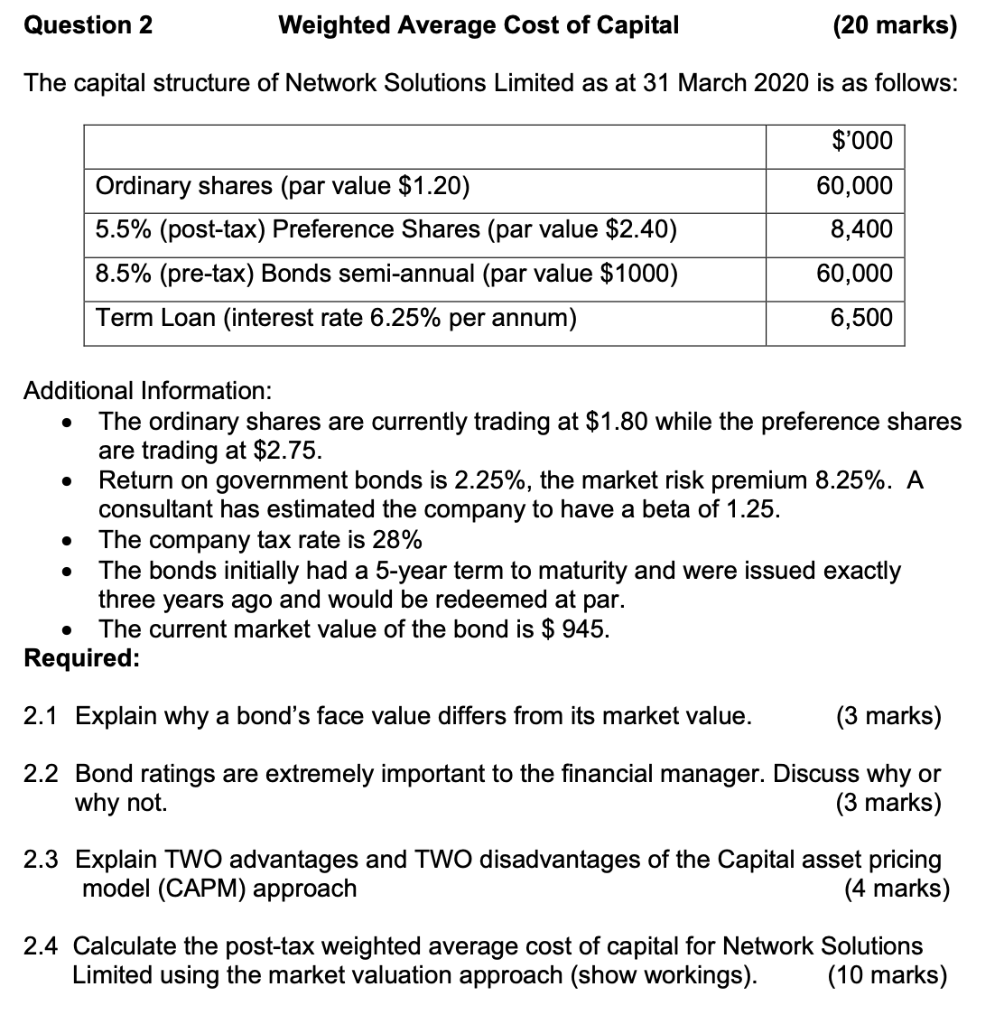

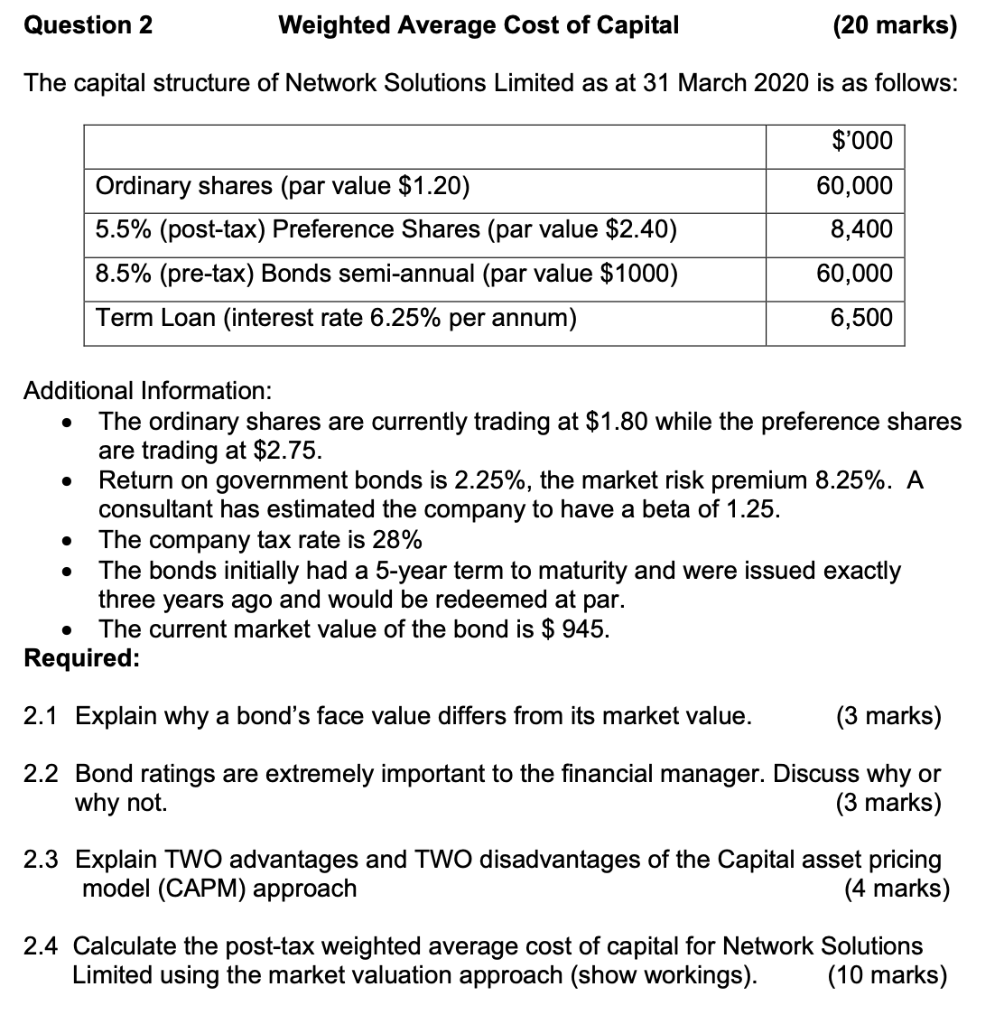

Question 2 Weighted Average Cost of Capital (20 marks) The capital structure of Network Solutions Limited as at 31 March 2020 is as follows: Ordinary shares (par value $1.20) 5.5% (post-tax) Preference Shares (par value $2.40) 8.5% (pre-tax) Bonds semi-annual (par value $1000) Term Loan (interest rate 6.25% per annum) $'000 60,000 8,400 60,000 6,500 Additional Information: The ordinary shares are currently trading at $1.80 while the preference shares are trading at $2.75. Return on government bonds is 2.25%, the market risk premium 8.25%. A consultant has estimated the company to have a beta of 1.25. The company tax rate is 28% The bonds initially had a 5-year term to maturity and were issued exactly three years ago and would be redeemed at par. The current market value of the bond is $ 945. Required: . 2.1 Explain why a bond's face value differs from its market value. (3 marks) 2.2 Bond ratings are extremely important to the financial manager. Discuss why or why not. (3 marks) 2.3 Explain TWO advantages and TWO disadvantages of the Capital asset pricing model (CAPM) approach (4 marks) 2.4 Calculate the post-tax weighted average cost of capital for Network Solutions Limited using the market valuation approach (show workings). (10 marks) Question 2 Weighted Average Cost of Capital (20 marks) The capital structure of Network Solutions Limited as at 31 March 2020 is as follows: Ordinary shares (par value $1.20) 5.5% (post-tax) Preference Shares (par value $2.40) 8.5% (pre-tax) Bonds semi-annual (par value $1000) Term Loan (interest rate 6.25% per annum) $'000 60,000 8,400 60,000 6,500 Additional Information: The ordinary shares are currently trading at $1.80 while the preference shares are trading at $2.75. Return on government bonds is 2.25%, the market risk premium 8.25%. A consultant has estimated the company to have a beta of 1.25. The company tax rate is 28% The bonds initially had a 5-year term to maturity and were issued exactly three years ago and would be redeemed at par. The current market value of the bond is $ 945. Required: . 2.1 Explain why a bond's face value differs from its market value. (3 marks) 2.2 Bond ratings are extremely important to the financial manager. Discuss why or why not. (3 marks) 2.3 Explain TWO advantages and TWO disadvantages of the Capital asset pricing model (CAPM) approach (4 marks) 2.4 Calculate the post-tax weighted average cost of capital for Network Solutions Limited using the market valuation approach (show workings). (10 marks)