Answered step by step

Verified Expert Solution

Question

1 Approved Answer

----------------------------------------------------- QUESTION 2 -------------------------------------------------------------- Wilkins Food Products Incorporated acquired a packaging machine from Lawrence Specialists Corporation. Lawrence completed construction of the machine on January 1,

----------------------------------------------------- QUESTION 2 --------------------------------------------------------------

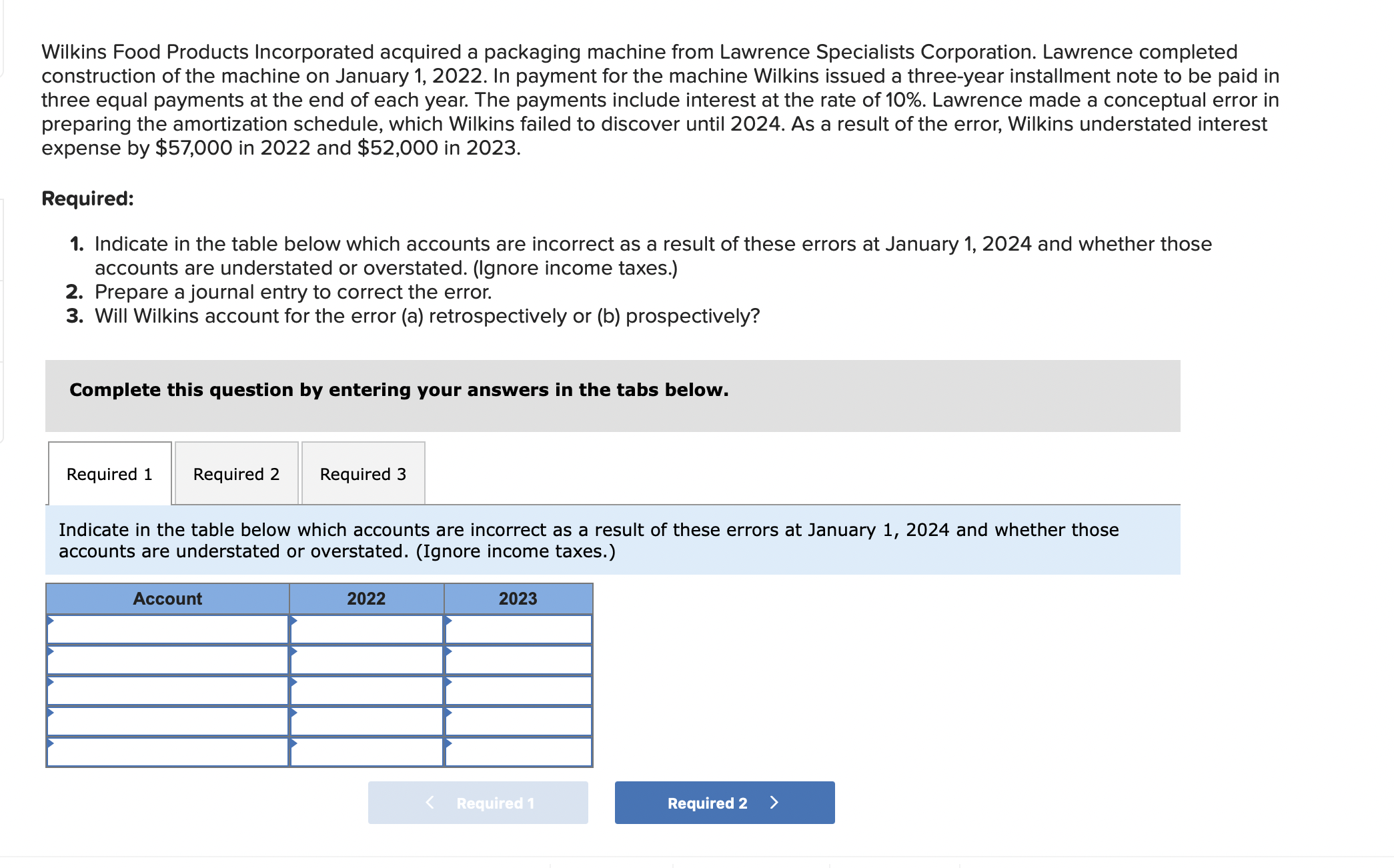

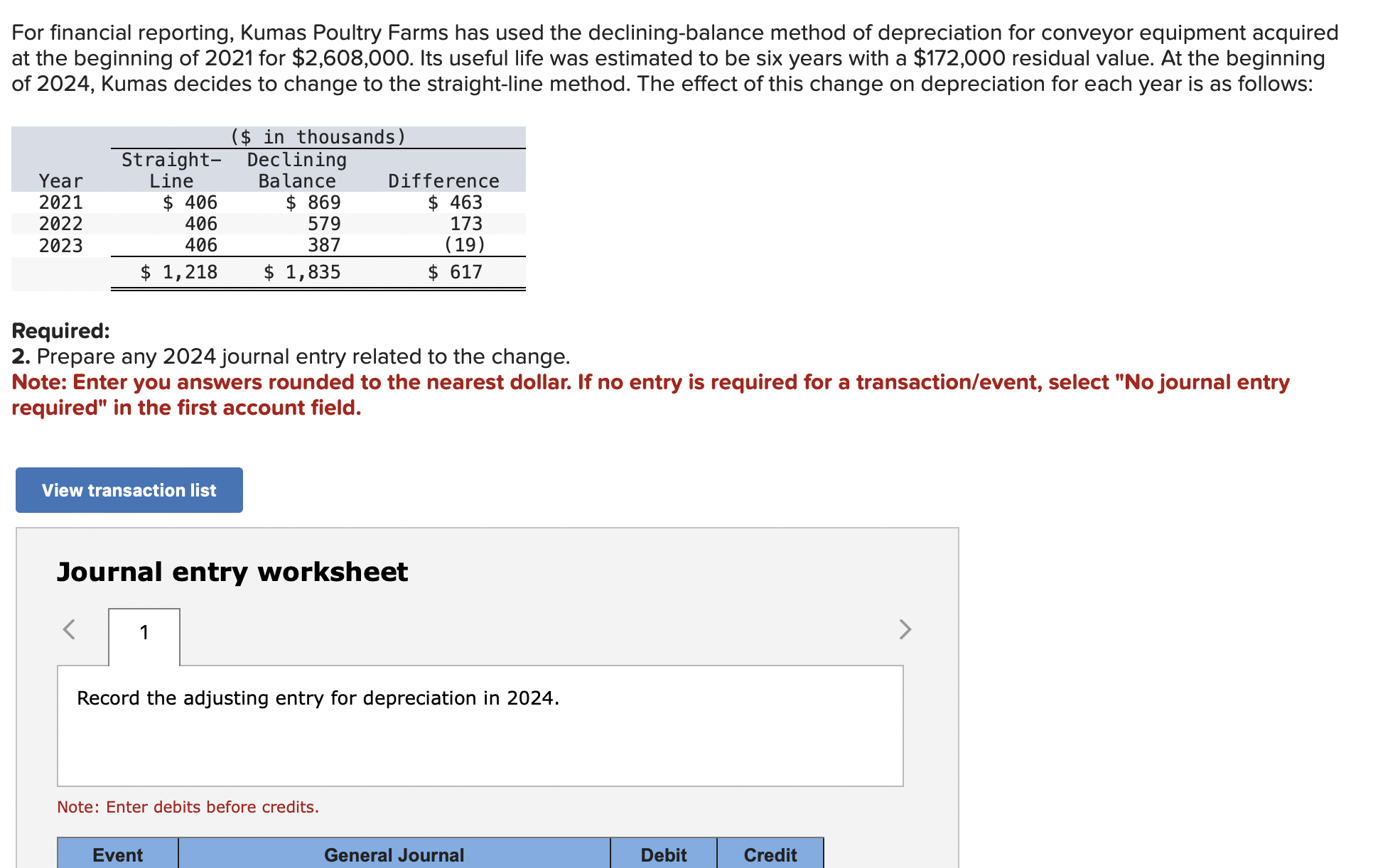

Wilkins Food Products Incorporated acquired a packaging machine from Lawrence Specialists Corporation. Lawrence completed construction of the machine on January 1, 2022. In payment for the machine Wilkins issued a three-year installment note to be paid in three equal payments at the end of each year. The payments include interest at the rate of 10%. Lawrence made a conceptual error in preparing the amortization schedule, which Wilkins failed to discover until 2024. As a result of the error, Wilkins understated interest expense by $57,000 in 2022 and $52,000 in 2023. Required: 1. Indicate in the table below which accounts are incorrect as a result of these errors at January 1, 2024 and whether those accounts are understated or overstated. (Ignore income taxes.) 2. Prepare a journal entry to correct the error. 3. Will Wilkins account for the error (a) retrospectively or (b) prospectively? Complete this question by entering your answers in the tabs below. Indicate in the table below which accounts are incorrect as a result of these errors at January 1,2024 and whether those accounts are understated or overstated. (Ignore income taxes.) For financial reporting, Kumas Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2021 for $2,608,000. Its useful life was estimated to be six years with a $172,000 residual value. At the beginning of 2024, Kumas decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows: Required: 2. Prepare any 2024 journal entry related to the change. Note: Enter you answers rounded to the nearest dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet

Wilkins Food Products Incorporated acquired a packaging machine from Lawrence Specialists Corporation. Lawrence completed construction of the machine on January 1, 2022. In payment for the machine Wilkins issued a three-year installment note to be paid in three equal payments at the end of each year. The payments include interest at the rate of 10%. Lawrence made a conceptual error in preparing the amortization schedule, which Wilkins failed to discover until 2024. As a result of the error, Wilkins understated interest expense by $57,000 in 2022 and $52,000 in 2023. Required: 1. Indicate in the table below which accounts are incorrect as a result of these errors at January 1, 2024 and whether those accounts are understated or overstated. (Ignore income taxes.) 2. Prepare a journal entry to correct the error. 3. Will Wilkins account for the error (a) retrospectively or (b) prospectively? Complete this question by entering your answers in the tabs below. Indicate in the table below which accounts are incorrect as a result of these errors at January 1,2024 and whether those accounts are understated or overstated. (Ignore income taxes.) For financial reporting, Kumas Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2021 for $2,608,000. Its useful life was estimated to be six years with a $172,000 residual value. At the beginning of 2024, Kumas decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows: Required: 2. Prepare any 2024 journal entry related to the change. Note: Enter you answers rounded to the nearest dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started