Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 XYZ Corp. has a return on common equity (ROCE) of 40%. It has a financial leverage of 40% and an after-tax net borrowing

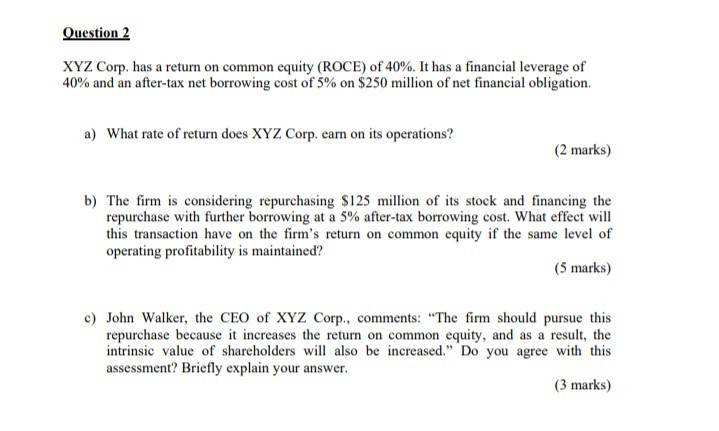

Question 2 XYZ Corp. has a return on common equity (ROCE) of 40%. It has a financial leverage of 40% and an after-tax net borrowing cost of 5% on $250 million of net financial obligation. a) What rate of return does XYZ Corp. earn on its operations? (2 marks) b) The firm is considering repurchasing $125 million of its stock and financing the repurchase with further borrowing at a 5% after-tax borrowing cost. What effect will this transaction have on the firm's return on common equity if the same level of operating profitability is maintained? (5 marks) c) John Walker, the CEO of XYZ Corp., comments: "The firm should pursue this repurchase because it increases the return on common equity, and as a result, the intrinsic value of shareholders will also be increased." Do you agree with this assessment? Briefly explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started