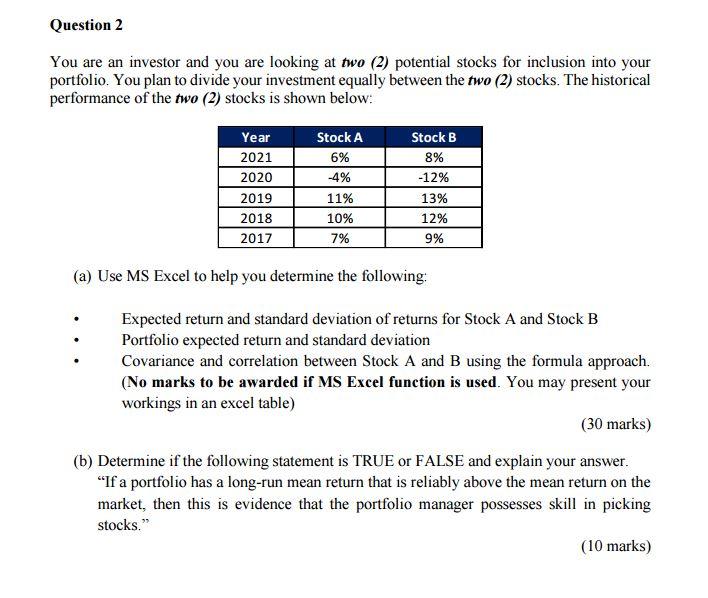

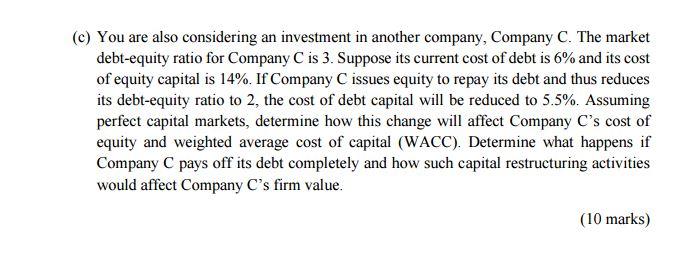

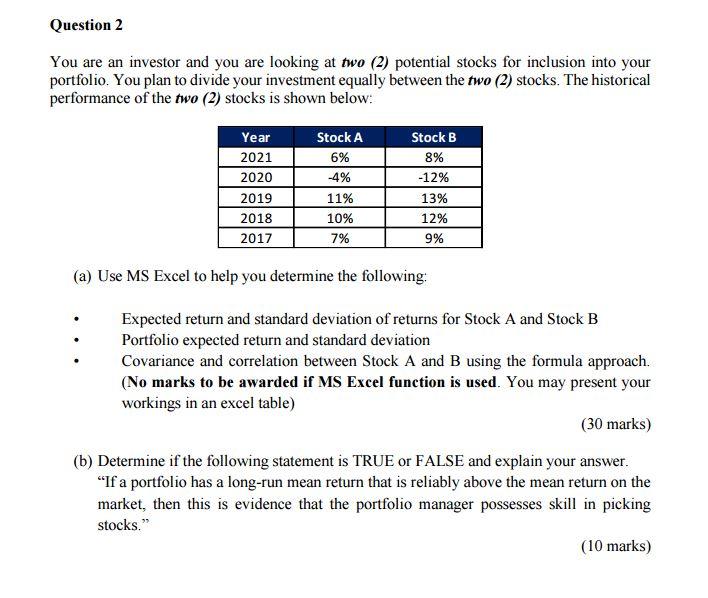

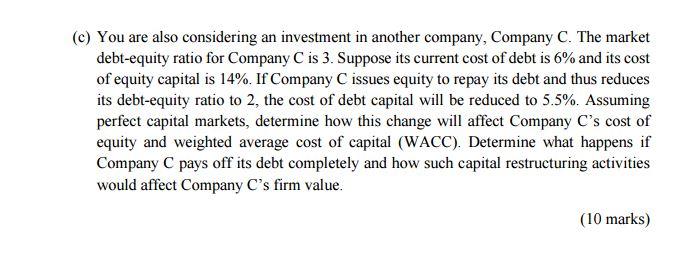

Question 2 You are an investor and you are looking at two (2) potential stocks for inclusion into your portfolio. You plan to divide your investment equally between the two (2) stocks. The historical performance of the two (2) stocks is shown below: Year 2021 2020 2019 2018 2017 Stock A 6% -4% 11% 10% 7% Stock B 8% -12% 13% 12% 9% (a) Use MS Excel to help you determine the following: Expected return and standard deviation of returns for Stock A and Stock B Portfolio expected return and standard deviation Covariance and correlation between Stock A and B using the formula approach. (No marks to be awarded if MS Excel function is used. You may present your workings in an excel table) (30 marks) (b) Determine if the following statement is TRUE or FALSE and explain your answer. "If a portfolio has a long-run mean return that is reliably above the mean return on the market, then this is evidence that the portfolio manager possesses skill in picking stocks." (10 marks) (C) You are also considering an investment in another company, Company C. The market debt-equity ratio for Company C is 3. Suppose its current cost of debt is 6% and its cost of equity capital is 14%. If Company C issues equity to repay its debt and thus reduces its debt-equity ratio to 2, the cost of debt capital will be reduced to 5.5%. Assuming perfect capital markets, determine how this change will affect Company C's cost of equity and weighted average cost of capital (WACC). Determine what happens if Company C pays off its debt completely and how such capital restructuring activities would affect Company C's firm value. (10 marks) Question 2 You are an investor and you are looking at two (2) potential stocks for inclusion into your portfolio. You plan to divide your investment equally between the two (2) stocks. The historical performance of the two (2) stocks is shown below: Year 2021 2020 2019 2018 2017 Stock A 6% -4% 11% 10% 7% Stock B 8% -12% 13% 12% 9% (a) Use MS Excel to help you determine the following: Expected return and standard deviation of returns for Stock A and Stock B Portfolio expected return and standard deviation Covariance and correlation between Stock A and B using the formula approach. (No marks to be awarded if MS Excel function is used. You may present your workings in an excel table) (30 marks) (b) Determine if the following statement is TRUE or FALSE and explain your answer. "If a portfolio has a long-run mean return that is reliably above the mean return on the market, then this is evidence that the portfolio manager possesses skill in picking stocks." (10 marks) (C) You are also considering an investment in another company, Company C. The market debt-equity ratio for Company C is 3. Suppose its current cost of debt is 6% and its cost of equity capital is 14%. If Company C issues equity to repay its debt and thus reduces its debt-equity ratio to 2, the cost of debt capital will be reduced to 5.5%. Assuming perfect capital markets, determine how this change will affect Company C's cost of equity and weighted average cost of capital (WACC). Determine what happens if Company C pays off its debt completely and how such capital restructuring activities would affect Company C's firm value. (10 marks)