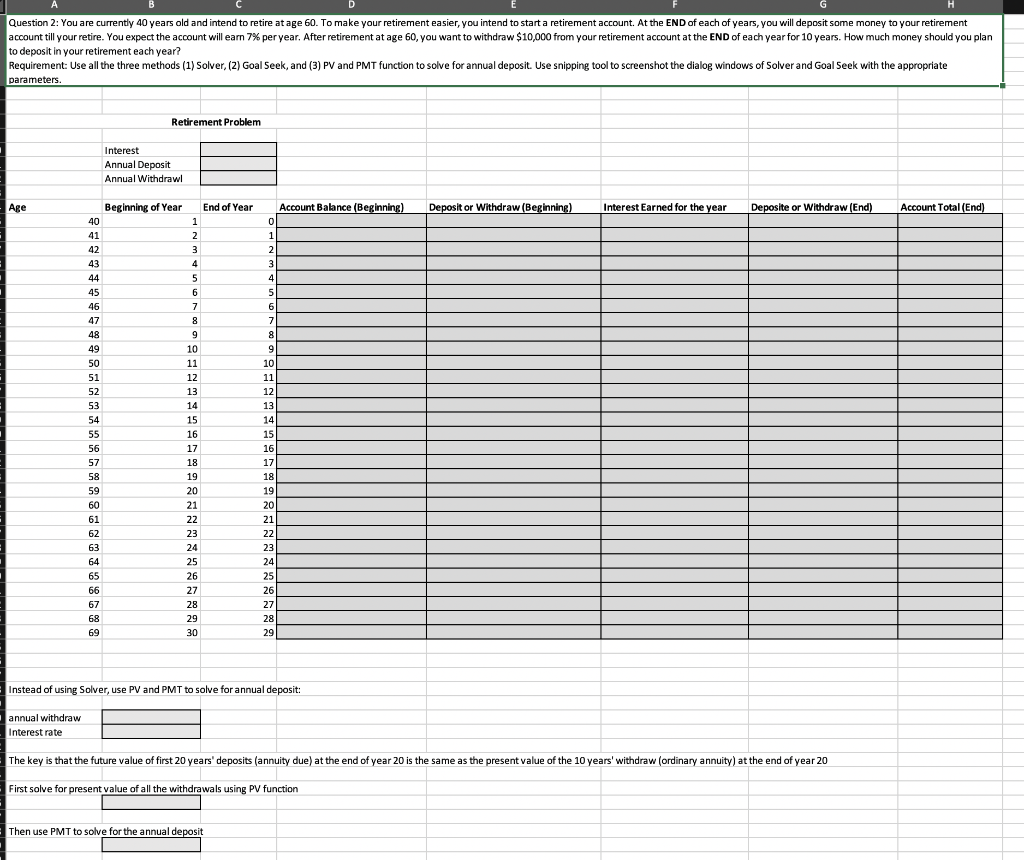

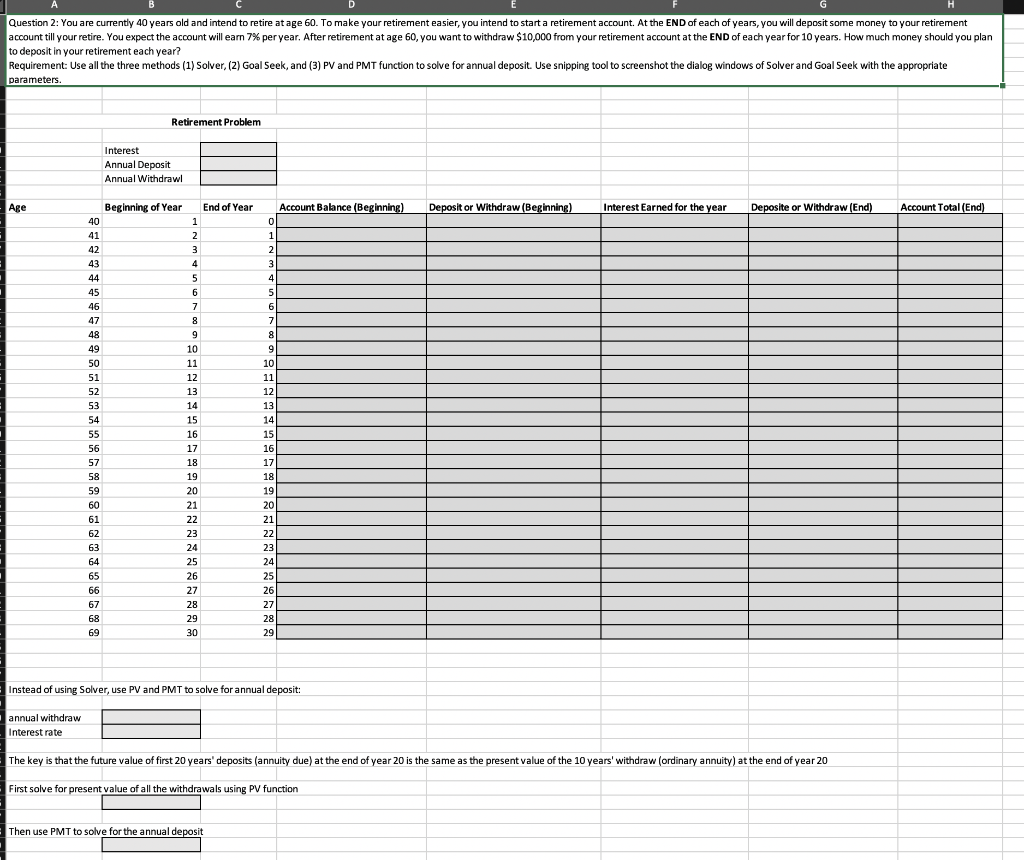

Question 2: You are currently 40 years old and intend to retire at age 60. To make your retirement easier, you intend to start a retirement account. At the END of each of years, you will deposit some money to your retirement account till your retire. You expect the account will earn 7% per year. After retirement at age 60, you want to withdraw $10,000 from your retirement account at the END of each year for 10 years. How much money should you plan to deposit in your retirement each year? Requirement: Use all the three methods (1) Solver, (2) Goal Seek, and (3) PV and PMT function to solve for annual deposit. Use snipping tool to screenshot the dialog windows of Solver and Goal Seek with the appropriate parameters.

Question 2: You are currently 40 years old and intend to retire at age 60. To make your retirement easier, you intend to start a retirement account. At the END of each of years, you will deposit some money to your retirement account till your retire. You expect the account will earn 7% per year. After retirement at age 60, you want to withdraw $10,000 from your retirement account at the END of each year for 10 years. How much money should you plan to deposit in your retirement each year? Requirement: Use all the three methods (1) Solver, (2) Goal Seek, and (3) PV and PMT function to solve for annual deposit. Use snipping tool to screenshot the dialog windows of Solver and Goal Seek with the appropriate parameters Retirement Problem Interest Annual Deposit Annual Withdrawl Age End of Year Account Balance (Beginning) Deposit or Withdraw (Beginning) Interest Earned for the year Deposite or Withdraw (End) Account Total (End) 0 Beginning of Year 40 41 42 43 1 2 3 3 1 2 2 4 5 3 4 44 45 6 5 7 6 46 47 7 8 9 48 8 49 9 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 65 66 67 68 69 Instead of using Solver, use PV and PMT to solve for annual deposit: annual withdraw Interest rate The key is that the future value of first 20 years' deposits (annuity due) at the end of year 20 is the same as the present value of the 10 years' withdraw (ordinary annuity) at the end of year 20 First solve for present value of all the withdrawals using PV function Then use PMT to solve for the annual deposit Question 2: You are currently 40 years old and intend to retire at age 60. To make your retirement easier, you intend to start a retirement account. At the END of each of years, you will deposit some money to your retirement account till your retire. You expect the account will earn 7% per year. After retirement at age 60, you want to withdraw $10,000 from your retirement account at the END of each year for 10 years. How much money should you plan to deposit in your retirement each year? Requirement: Use all the three methods (1) Solver, (2) Goal Seek, and (3) PV and PMT function to solve for annual deposit. Use snipping tool to screenshot the dialog windows of Solver and Goal Seek with the appropriate parameters Retirement Problem Interest Annual Deposit Annual Withdrawl Age End of Year Account Balance (Beginning) Deposit or Withdraw (Beginning) Interest Earned for the year Deposite or Withdraw (End) Account Total (End) 0 Beginning of Year 40 41 42 43 1 2 3 3 1 2 2 4 5 3 4 44 45 6 5 7 6 46 47 7 8 9 48 8 49 9 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 65 66 67 68 69 Instead of using Solver, use PV and PMT to solve for annual deposit: annual withdraw Interest rate The key is that the future value of first 20 years' deposits (annuity due) at the end of year 20 is the same as the present value of the 10 years' withdraw (ordinary annuity) at the end of year 20 First solve for present value of all the withdrawals using PV function Then use PMT to solve for the annual deposit