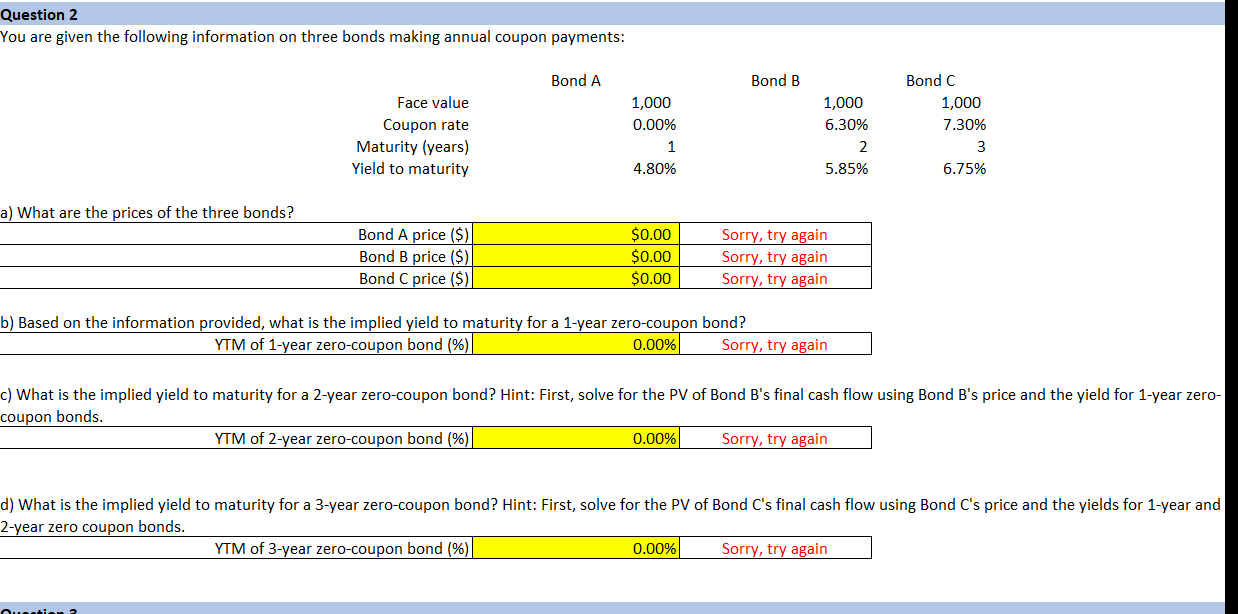

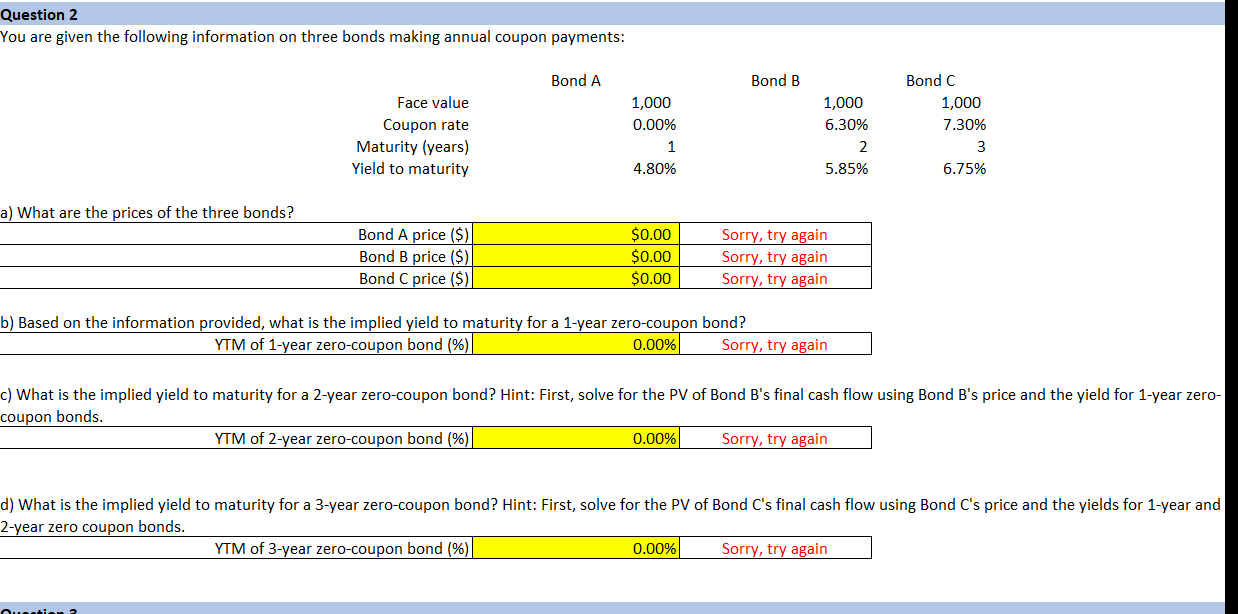

Question 2 You are given the following information on three bonds making annual coupon payments: Bond A Bond B 1,000 0.00% Face value Coupon rate Maturity (years) Yield to maturity 1,000 6.30% 2 5.85% Bond C 1,000 7.30% 3 6.75% 1 4.80% a) What are the prices of the three bonds? Bond A price ($) Bond B price ($) Bond C price ($) $0.00 $0.00 $0.00 Sorry, try again Sorry, try again Sorry, try again b) Based on the information provided, what is the implied yield to maturity for a 1-year zero-coupon bond? YTM of 1-year zero-coupon bond (%)| 0.00% Sorry, try again c) What is the implied yield to maturity for a 2-year zero-coupon bond? Hint: First, solve for the PV of Bond B's final cash flow using Bond B's price and the yield for 1-year zero- coupon bonds. YTM of 2-year zero-coupon bond (%) 0.00% Sorry, try again d) What is the implied yield to maturity for a 3-year zero-coupon bond? Hint: First, solve for the PV of Bond C's final cash flow using Bond C's price and the yields for 1-year and 2-year zero coupon bonds. YTM of 3-year zero-coupon bond (%) 0.00% Sorry, try again numin Question 2 You are given the following information on three bonds making annual coupon payments: Bond A Bond B 1,000 0.00% Face value Coupon rate Maturity (years) Yield to maturity 1,000 6.30% 2 5.85% Bond C 1,000 7.30% 3 6.75% 1 4.80% a) What are the prices of the three bonds? Bond A price ($) Bond B price ($) Bond C price ($) $0.00 $0.00 $0.00 Sorry, try again Sorry, try again Sorry, try again b) Based on the information provided, what is the implied yield to maturity for a 1-year zero-coupon bond? YTM of 1-year zero-coupon bond (%)| 0.00% Sorry, try again c) What is the implied yield to maturity for a 2-year zero-coupon bond? Hint: First, solve for the PV of Bond B's final cash flow using Bond B's price and the yield for 1-year zero- coupon bonds. YTM of 2-year zero-coupon bond (%) 0.00% Sorry, try again d) What is the implied yield to maturity for a 3-year zero-coupon bond? Hint: First, solve for the PV of Bond C's final cash flow using Bond C's price and the yields for 1-year and 2-year zero coupon bonds. YTM of 3-year zero-coupon bond (%) 0.00% Sorry, try again numin