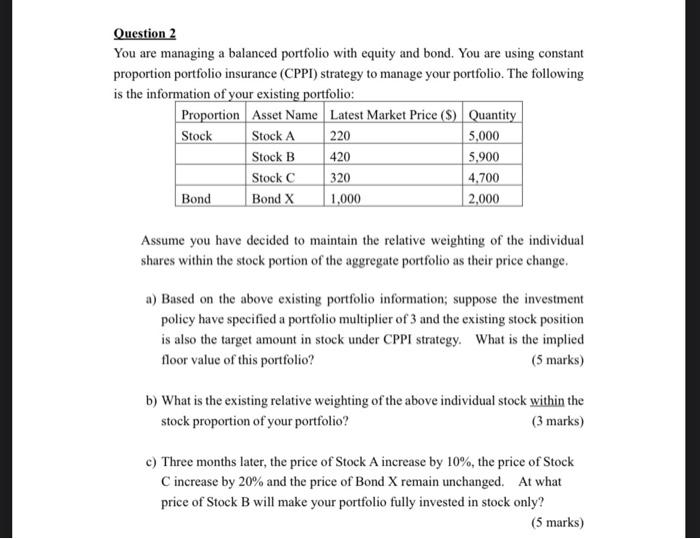

Question 2 You are managing a balanced portfolio with equity and bond. You are using constant proportion portfolio insurance (CPPI) strategy to manage your portfolio. The following is the information of your existing portfolio: Proportion Asset Name Latest Market Price (s) Quantity Stock Stock A 220 5,000 Stock B 5,900 Stock C 320 4.700 Bond Bond X 1,000 2,000 420 Assume you have decided to maintain the relative weighting of the individual shares within the stock portion of the aggregate portfolio as their price change a) Based on the above existing portfolio information; suppose the investment policy have specified a portfolio multiplier of 3 and the existing stock position is also the target amount in stock under CPPI strategy. What is the implied floor value of this portfolio? (5 marks) b) What is the existing relative weighting of the above individual stock within the stock proportion of your portfolio? (3 marks) c) Three months later, the price of Stock A increase by 10%, the price of Stock C increase by 20% and the price of Bond X remain unchanged. At what price of Stock B will make your portfolio fully invested in stock only? (5 marks) Question 2 You are managing a balanced portfolio with equity and bond. You are using constant proportion portfolio insurance (CPPI) strategy to manage your portfolio. The following is the information of your existing portfolio: Proportion Asset Name Latest Market Price (s) Quantity Stock Stock A 220 5,000 Stock B 5,900 Stock C 320 4.700 Bond Bond X 1,000 2,000 420 Assume you have decided to maintain the relative weighting of the individual shares within the stock portion of the aggregate portfolio as their price change a) Based on the above existing portfolio information; suppose the investment policy have specified a portfolio multiplier of 3 and the existing stock position is also the target amount in stock under CPPI strategy. What is the implied floor value of this portfolio? (5 marks) b) What is the existing relative weighting of the above individual stock within the stock proportion of your portfolio? (3 marks) c) Three months later, the price of Stock A increase by 10%, the price of Stock C increase by 20% and the price of Bond X remain unchanged. At what price of Stock B will make your portfolio fully invested in stock only