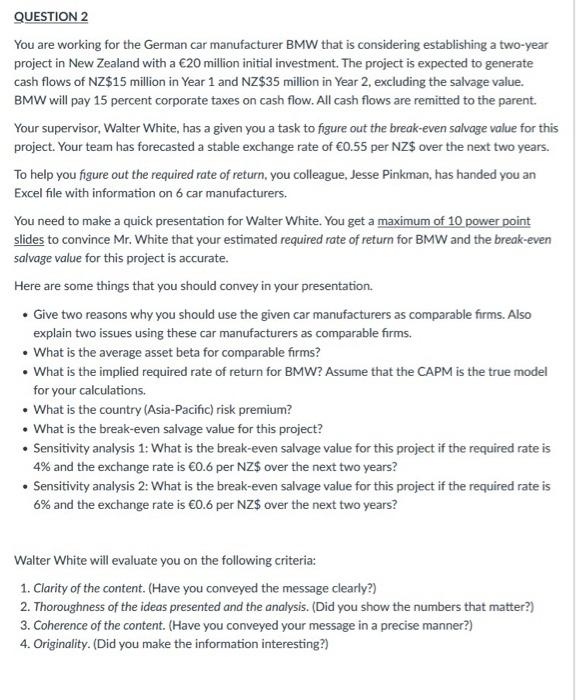

QUESTION 2 You are working for the German car manufacturer BMW that is considering establishing a two-year project in New Zealand with a 20 million initial investment. The project is expected to generate cash flows of NZ\$15 million in Year 1 and NZ\$35 million in Year 2, excluding the salvage value. BMW will pay 15 percent corporate taxes on cash flow. All cash flows are remitted to the parent. Your supervisor, Walter White, has a given you a task to figure out the break-even salvage value for this project. Your team has forecasted a stable exchange rate of 0.55 per NZ\$ over the next two years. To help you figure out the required rate of return, you colleague, Jesse Pinkman, has handed you an Excel file with information on 6 car manufacturers. You need to make a quick presentation for Walter White. You get a maximum of 10 power point slides to convince Mr. White that your estimated required rate of return for BMW and the break-even salvage value for this project is accurate. Here are some things that you should convey in your presentation. - Give two reasons why you should use the given car manufacturers as comparable firms. Also explain two issues using these car manufacturers as comparable firms. - What is the average asset beta for comparable firms? - What is the implied required rate of return for BMW? Assume that the CAPM is the true model for your calculations. - What is the country (Asia-Pacific) risk premium? - What is the break-even salvage value for this project? - Sensitivity analysis 1: What is the break-even salvage value for this project if the required rate is 4% and the exchange rate is 0.6 per NZ\$ over the next two years? - Sensitivity analysis 2 : What is the break-even salvage value for this project if the required rate is 6% and the exchange rate is 0.6 per NZ\$ over the next two years? Walter White will evaluate you on the following criteria: 1. Clarity of the content. (Have you conveyed the message clearly?) 2. Thoroughness of the ideas presented and the analysis. (Did you show the numbers that matter?) 3. Coherence of the content. (Have you conveyed your message in a precise manner?) 4. Originality. (Did you make the information interesting?)