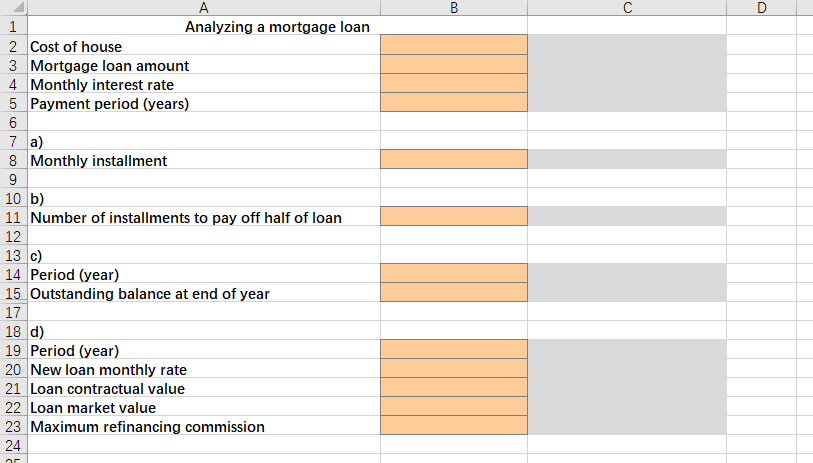

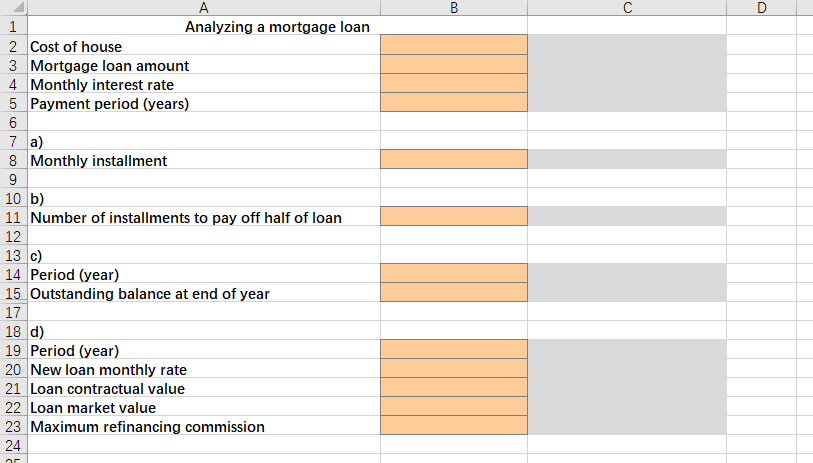

Question 2 You financed the purchase of a $425,000 home with a down payment in cash of 20% of the purchase price. The remaining 80% is financed with a mortgage with a 0.80% monthly interest rate over the next 20 years. The mortgage is repaid with equal monthly installments at the end of each month. a) Compute the monthly installments on the mortgage. b) How many installments will it take to pay off half of the loan? Your answer can be left as a decimal; you do not need to round up to reach the next monthly installment. c) What is the outstanding principal balance of the mortgage after 5 years (i.e., after 60 installments)? d) Ten years later (after 120 installments), your bank manager offers to refinance your mortgage with a new loan carrying a 0.75% monthly interest rate for a one-time commission. What is the maximum commission you would be willing to pay to refinance your mortgage? B D . 1 Analyzing a mortgage loan 2 Cost of house 3 Mortgage loan amount 4 Monthly interest rate 5 Payment period (years) 6 7 a) 8 Monthly installment 9 10 b) 11 Number of installments to pay off half of loan 12 13 c) 14 Period (year) 15 Outstanding balance at end of year 17 18 d) 19 Period (year) 20 New loan monthly rate 21 Loan contractual value 22 Loan market value 23 Maximum refinancing commission 24 Question 2 You financed the purchase of a $425,000 home with a down payment in cash of 20% of the purchase price. The remaining 80% is financed with a mortgage with a 0.80% monthly interest rate over the next 20 years. The mortgage is repaid with equal monthly installments at the end of each month. a) Compute the monthly installments on the mortgage. b) How many installments will it take to pay off half of the loan? Your answer can be left as a decimal; you do not need to round up to reach the next monthly installment. c) What is the outstanding principal balance of the mortgage after 5 years (i.e., after 60 installments)? d) Ten years later (after 120 installments), your bank manager offers to refinance your mortgage with a new loan carrying a 0.75% monthly interest rate for a one-time commission. What is the maximum commission you would be willing to pay to refinance your mortgage? B D . 1 Analyzing a mortgage loan 2 Cost of house 3 Mortgage loan amount 4 Monthly interest rate 5 Payment period (years) 6 7 a) 8 Monthly installment 9 10 b) 11 Number of installments to pay off half of loan 12 13 c) 14 Period (year) 15 Outstanding balance at end of year 17 18 d) 19 Period (year) 20 New loan monthly rate 21 Loan contractual value 22 Loan market value 23 Maximum refinancing commission 24