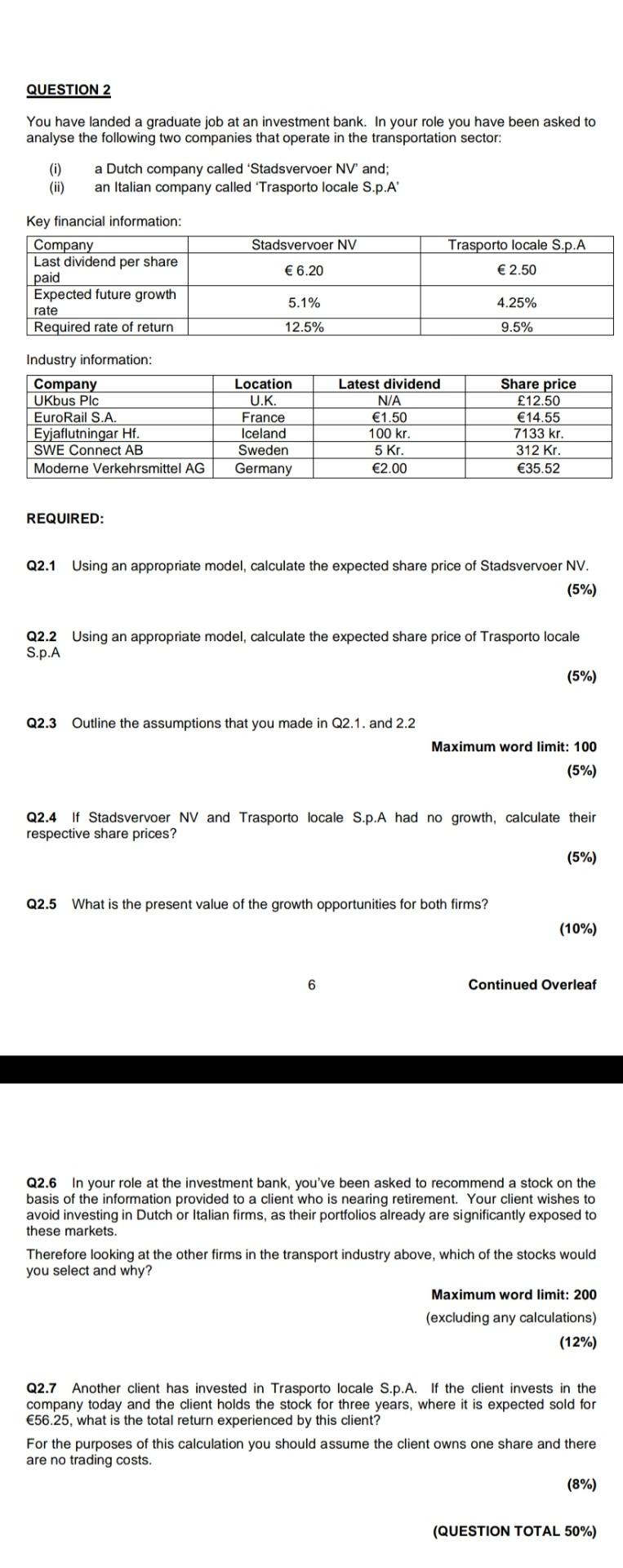

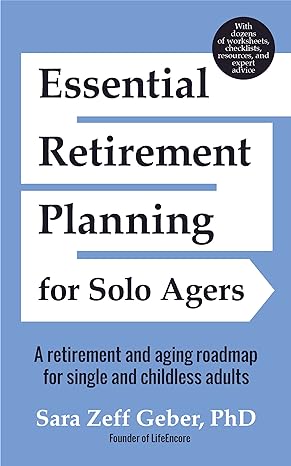

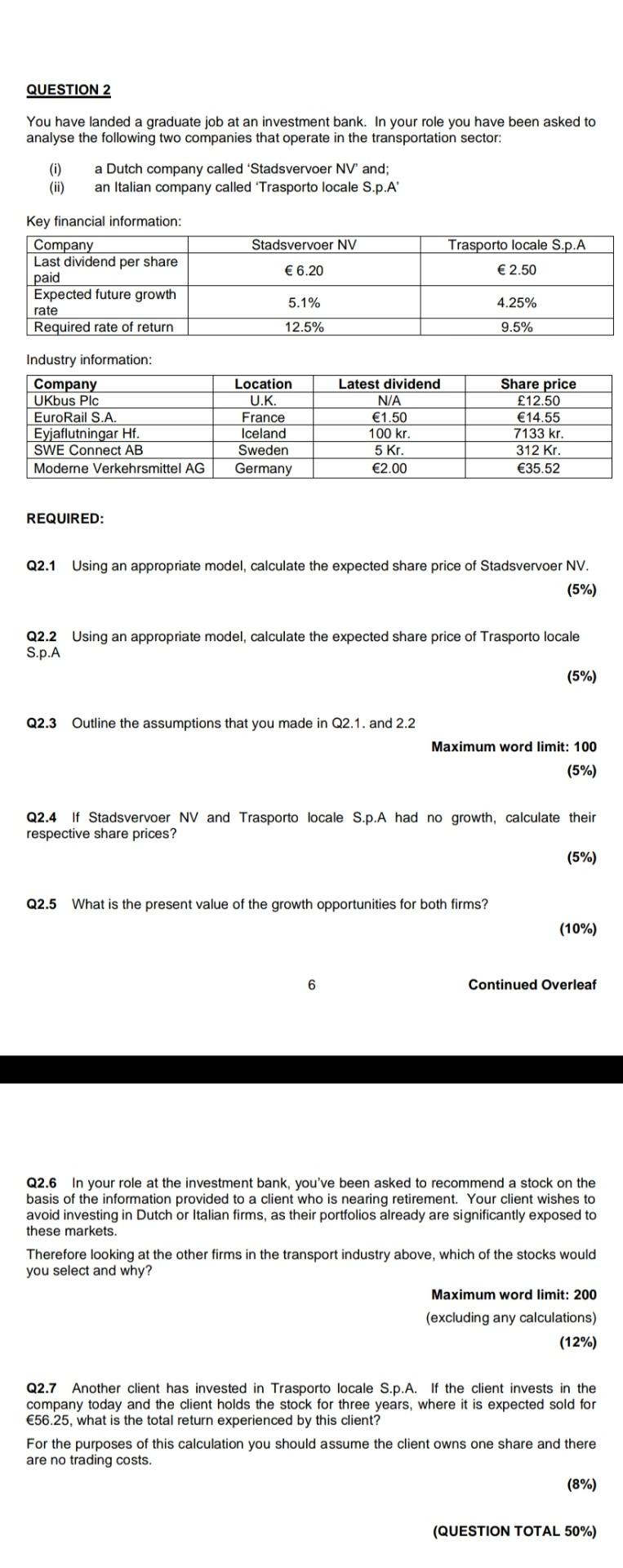

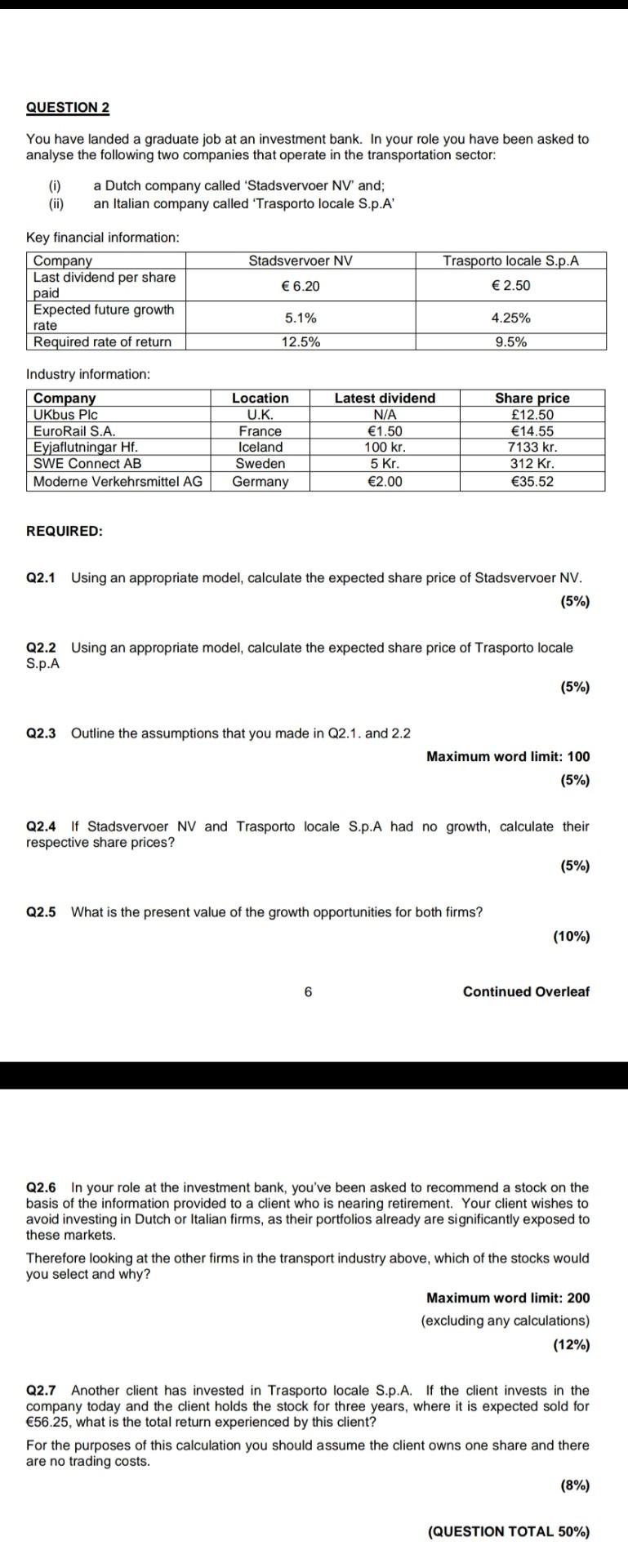

QUESTION 2 You have landed a graduate job at an investment bank. In your role you have been asked to analyse the following two companies that operate in the transportation sector: (i) a Dutch company called Stadsvervoer NV and; (ii) an Italian company called Trasporto locale S.p.A Key financial information: Company Stadsvervoer NV Trasporto locale S.p.A Last dividend per share paid 6.20 2.50 Expected future growth rate 5.1% 4.25% Required rate of return 12.5% 9.5% Industry information: Company Location Latest dividend Share price UKbus Plc U.K. N/A 12.50 EuroRail S.A. France 1.50 14.55 Eyjaflutningar Hf. Iceland 100 kr. 7133 kr. SWE Connect AB Sweden 5 Kr. 312 Kr. Moderne Verkehrsmittel AG Germany 2.00 35.52 REQUIRED: Q2.1 Using an appropriate model, calculate the expected share price of Stadsvervoer NV. (5%) Q2.2 Using an appropriate model, calculate the expected share price of Trasporto locale S.p.A (5%) Q2.3 Outline the assumptions that you made in Q2.1. and 2.2 Maximum word limit: 100 (5%) Q2.4 If Stadsvervoer NV and Trasporto locale S.p.A had no growth, calculate their respective share prices? (5%) Q2.5 What is the present value of the growth opportunities for both firms? Q2.6 In your role at the investment bank, youve been asked to recommend a stock on the basis of the information provided to a client who is nearing retirement. Your client wishes to avoid investing in Dutch or Italian firms, as their portfolios already are significantly exposed to these markets. Therefore looking at the other firms in the transport industry above, which of the stocks would you select and why? Maximum word limit: 200 (excluding any calculations) (12%) Q2.7 Another client has invested in Trasporto locale S.p.A. If the client invests in the company today and the client holds the stock for three years, where it is expected sold for 56.25, what is the total return experienced by this client? For the purposes of this calculation you should assume the client owns one share and there are no trading costs.

You have landed a graduate job at an investment bank. In your role you have been asked to analyse the following two companies that operate in the transportation sector: (i) a Dutch company called Stadsvervoer NV and; (ii) an Italian company called Trasporto locale S.p.A Key financial information: Company Stadsvervoer NV Trasporto locale S.p.A Last dividend per share paid 6.20 2.50 Expected future growth rate 5.1% 4.25% Required rate of return 12.5% 9.5% Industry information: Company Location Latest dividend Share price UKbus Plc U.K. N/A 12.50 EuroRail S.A. France 1.50 14.55 Eyjaflutningar Hf. Iceland 100 kr. 7133 kr. SWE Connect AB Sweden 5 Kr. 3

12 Kr. Moderne Verkehrsmittel AG Germany 2.00 35.52 REQUIRED: Q2.1 Using an appropriate model, calculate the expected share price of Stadsvervoer NV. (5%) Q2.2 Using an appropriate model, calculate the expected share price of Trasporto locale S.p.A (5%) Q2.3 Outline the assumptions that you made in Q2.1. and 2.2 Maximum word limit: 100 (5%) Q2.4 If Stadsvervoer NV and Trasporto locale S.p.A had no growth, calculate their respective share prices? (5%) Q2.5 What is the present value of the growth opportunities for both firms? In your role at the investment bank, youve been asked to recommend a stock on the basis of the information provided to a client who is nearing retirement. Your client wishes to avoid investing in Dutch or Italian firms, as their portfolios already are significantly exposed to these markets. Therefore looking at the other firms in the transport industry above, which of the stocks would you select and why? Maximum word limit: 200 (excluding any calculations) (12%) Q2.7 Another client has invested in Trasporto locale S.p.A. If the client invests in the company today and the client holds the stock for three years, where it is expected sold for 56.25, what is the total return experienced by this client? For the purposes of this calculation you should assume the client owns one share and there are no trading costs.

QUESTION 2 You have landed a graduate job at an investment bank. In your role you have been asked to analyse the following two companies that operate in the transportation sector: (0) (ii) a Dutch company called 'Stadsvervoer NV and; an Italian company called 'Trasporto locale S.p.A' Stadsvervoer NV Trasporto locale S.p.A Key financial information: Company Last dividend per share paid Expected future growth rate Required rate of return 6.20 2.50 5.1% 4.25% 12.5% 9.5% Industry information: Company UKbus Plc EuroRail S.A. Eyjaflutningar Hf. SWE Connect AB Moderne Verkehrsmittel AG Location U.K. France Iceland Sweden Germany Latest dividend N/A 1.50 100 kr. 5 kr. 2.00 Share price 12.50 14.55 7133 kr. 312 Kr. 35.52 REQUIRED: Q2.1 Using an appropriate model, calculate the expected share price of Stadsvervoer NV. (5%) Q2.2 Using an appropriate model, calculate the expected share price of Trasporto locale S.p.A (5%) Q2.3 Outline the assumptions that you made in Q2.1. and 2.2 Maximum word limit: 100 (5%) Q2.4 If Stadsvervoer NV and Trasporto locale S.p.A had no growth, calculate their respective share prices? (5%) Q2.5 What is the present value of the growth opportunities for both firms? (10%) 6 Continued Overleaf Q2.6 In your role at the investment bank, you've been asked to recommend a stock on the basis of the information provided to a client who is nearing retirement. Your client wishes to avoid investing in Dutch or Italian firms, as their portfolios already are significantly exposed to these markets. Therefore looking at the other firms in the transport industry above, which of the stocks would you select and why? Maximum word limit: 200 (excluding any calculations) (12%) Q2.7 Another client has invested in Trasporto locale S.p.A. If the client invests in the company today and the client holds the stock for three years, where it is expected sold for 56.25, what is the total return experienced by this client? For the purposes of this calculation you should assume the client owns one share and there are no trading costs. (8%) (QUESTION TOTAL 50%) QUESTION 2 You have landed a graduate job at an investment bank. In your role you have been asked to analyse the following two companies that operate in the transportation sector: (0) (ii) a Dutch company called 'Stadsvervoer NV' and; an Italian company called 'Trasporto locale S.p.A' Stadsvervoer NV Key financial information: Company Last dividend per share paid Expected future growth rate Required rate of return Trasporto locale S.p.A 2.50 6.20 5.1% 4.25% 12.5% 9.5% Industry information: Company UKbus Pic EuroRail S.A. Eyjaflutningar Hf. SWE Connect AB Moderne Verkehrsmittel AG Location U.K. France Iceland Sweden Germany Latest dividend N/A 1.50 100 kr. 5 Kr. 2.00 Share price 12.50 14.55 7133 kr. 312 kr. 35.52 REQUIRED: Q2.1 Using an appropriate model, calculate the expected share price of Stadsvervoer NV. (5%) Q2.2 Using an appropriate model, calculate the expected share price of Trasporto locale S.p.A (5%) Q2.3 Outline the assumptions that you made in Q2.1. and 2.2 Maximum word limit: 100 (5%) Q2.4 If Stadsvervoer NV and Trasporto locale S.p.A had no growth, calculate their respective share prices? (5%) Q2.5 What is the present value of the growth opportunities for both firms? (10%) 6 Continued Overleaf Q2.6 In your role at the investment bank, you've been asked to recommend a stock on the basis of the information provided to a client who is nearing retirement. Your client wishes to avoid investing in Dutch or Italian firms, as their portfolios already are significantly exposed to these markets. Therefore looking at the other firms in the transport industry above, which of the stocks would you select and why? Maximum word limit: 200 (excluding any calculations) (12%) Q2.7 Another client has invested in Trasporto locale S.p.A. If the client invests in the company today and the client holds the stock for three years, where it is expected sold for 56.25, what is the total return experienced by this client? For the purposes of this calculation you should assume the client owns one share and there are no trading costs. (8%) (QUESTION TOTAL 50%) QUESTION 2 You have landed a graduate job at an investment bank. In your role you have been asked to analyse the following two companies that operate in the transportation sector: (0) (ii) a Dutch company called 'Stadsvervoer NV and; an Italian company called 'Trasporto locale S.p.A' Stadsvervoer NV Trasporto locale S.p.A Key financial information: Company Last dividend per share paid Expected future growth rate Required rate of return 6.20 2.50 5.1% 4.25% 12.5% 9.5% Industry information: Company UKbus Plc EuroRail S.A. Eyjaflutningar Hf. SWE Connect AB Moderne Verkehrsmittel AG Location U.K. France Iceland Sweden Germany Latest dividend N/A 1.50 100 kr. 5 kr. 2.00 Share price 12.50 14.55 7133 kr. 312 Kr. 35.52 REQUIRED: Q2.1 Using an appropriate model, calculate the expected share price of Stadsvervoer NV. (5%) Q2.2 Using an appropriate model, calculate the expected share price of Trasporto locale S.p.A (5%) Q2.3 Outline the assumptions that you made in Q2.1. and 2.2 Maximum word limit: 100 (5%) Q2.4 If Stadsvervoer NV and Trasporto locale S.p.A had no growth, calculate their respective share prices? (5%) Q2.5 What is the present value of the growth opportunities for both firms? (10%) 6 Continued Overleaf Q2.6 In your role at the investment bank, you've been asked to recommend a stock on the basis of the information provided to a client who is nearing retirement. Your client wishes to avoid investing in Dutch or Italian firms, as their portfolios already are significantly exposed to these markets. Therefore looking at the other firms in the transport industry above, which of the stocks would you select and why? Maximum word limit: 200 (excluding any calculations) (12%) Q2.7 Another client has invested in Trasporto locale S.p.A. If the client invests in the company today and the client holds the stock for three years, where it is expected sold for 56.25, what is the total return experienced by this client? For the purposes of this calculation you should assume the client owns one share and there are no trading costs. (8%) (QUESTION TOTAL 50%) QUESTION 2 You have landed a graduate job at an investment bank. In your role you have been asked to analyse the following two companies that operate in the transportation sector: (0) (ii) a Dutch company called 'Stadsvervoer NV' and; an Italian company called 'Trasporto locale S.p.A' Stadsvervoer NV Key financial information: Company Last dividend per share paid Expected future growth rate Required rate of return Trasporto locale S.p.A 2.50 6.20 5.1% 4.25% 12.5% 9.5% Industry information: Company UKbus Pic EuroRail S.A. Eyjaflutningar Hf. SWE Connect AB Moderne Verkehrsmittel AG Location U.K. France Iceland Sweden Germany Latest dividend N/A 1.50 100 kr. 5 Kr. 2.00 Share price 12.50 14.55 7133 kr. 312 kr. 35.52 REQUIRED: Q2.1 Using an appropriate model, calculate the expected share price of Stadsvervoer NV. (5%) Q2.2 Using an appropriate model, calculate the expected share price of Trasporto locale S.p.A (5%) Q2.3 Outline the assumptions that you made in Q2.1. and 2.2 Maximum word limit: 100 (5%) Q2.4 If Stadsvervoer NV and Trasporto locale S.p.A had no growth, calculate their respective share prices? (5%) Q2.5 What is the present value of the growth opportunities for both firms? (10%) 6 Continued Overleaf Q2.6 In your role at the investment bank, you've been asked to recommend a stock on the basis of the information provided to a client who is nearing retirement. Your client wishes to avoid investing in Dutch or Italian firms, as their portfolios already are significantly exposed to these markets. Therefore looking at the other firms in the transport industry above, which of the stocks would you select and why? Maximum word limit: 200 (excluding any calculations) (12%) Q2.7 Another client has invested in Trasporto locale S.p.A. If the client invests in the company today and the client holds the stock for three years, where it is expected sold for 56.25, what is the total return experienced by this client? For the purposes of this calculation you should assume the client owns one share and there are no trading costs. (8%) (QUESTION TOTAL 50%)