Answered step by step

Verified Expert Solution

Question

1 Approved Answer

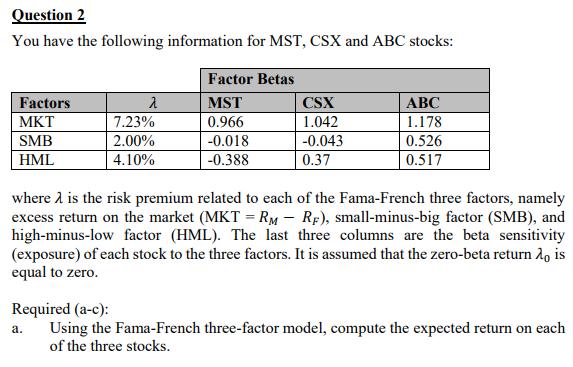

Question 2 You have the following information for MST, CSX and ABC stocks: Factor Betas Factors MST CSX ABC MKT 7.23% 0.966 1.042 1.178

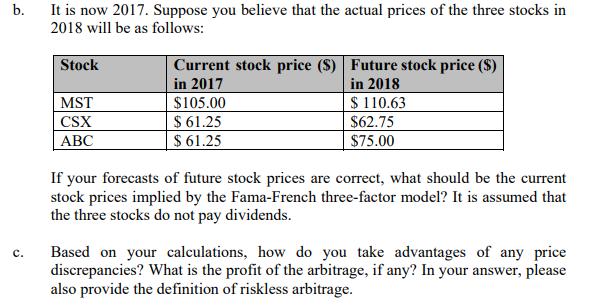

Question 2 You have the following information for MST, CSX and ABC stocks: Factor Betas Factors MST CSX ABC MKT 7.23% 0.966 1.042 1.178 SMB 2.00% -0.018 -0.043 0.526 HML 4.10% -0.388 0.37 0.517 where is the risk premium related to each of the Fama-French three factors, namely excess return on the market (MKT = RM - RF), small-minus-big factor (SMB), and high-minus-low factor (HML). The last three columns are the beta sensitivity (exposure) of each stock to the three factors. It is assumed that the zero-beta return o is equal to zero. Required (a-c): a. Using the Fama-French three-factor model, compute the expected return on each of the three stocks. b. It is now 2017. Suppose you believe that the actual prices of the three stocks in 2018 will be as follows: c. Stock MST CSX ABC Current stock price ($) | Future stock price ($) in 2017 $105.00 $ 61.25 $ 61.25 in 2018 $ 110.63 $62.75 $75.00 If your forecasts of future stock prices are correct, what should be the current stock prices implied by the Fama-French three-factor model? It is assumed that the three stocks do not pay dividends. Based on your calculations, how do you take advantages of any price discrepancies? What is the profit of the arbitrage, if any? In your answer, please also provide the definition of riskless arbitrage.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Using the FamaFrench threefactor model we can compute the expected return on each of the three stocks by multiplying the factor betas of each stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started