Answered step by step

Verified Expert Solution

Question

1 Approved Answer

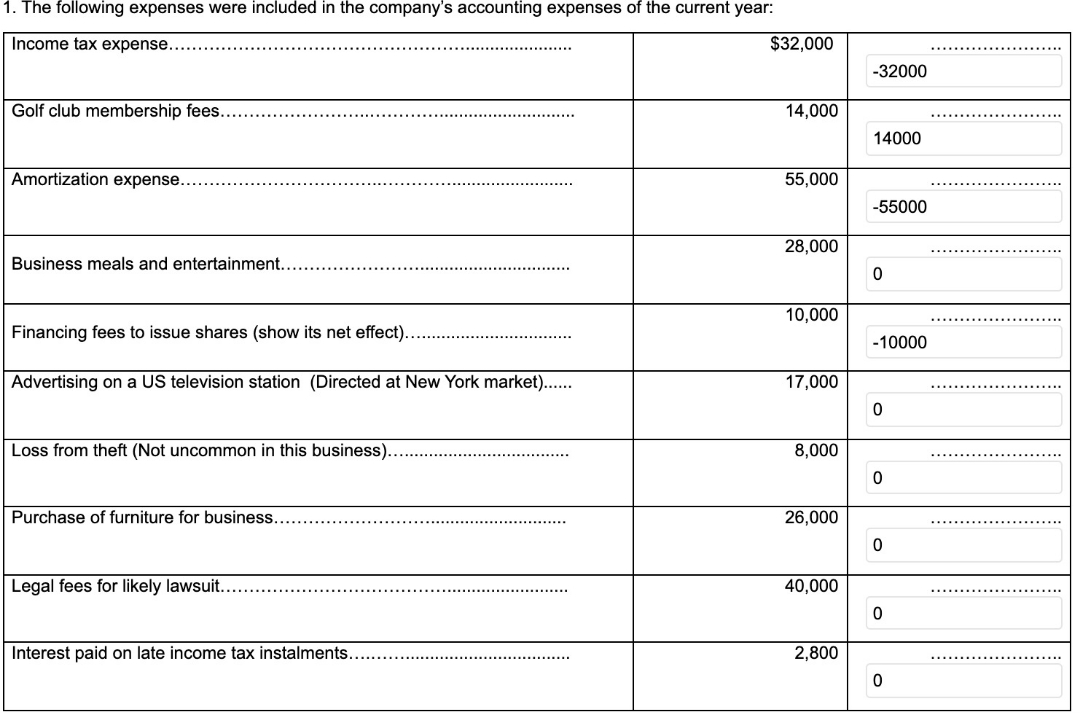

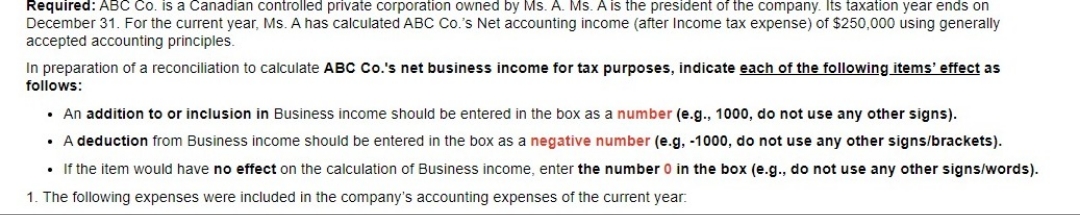

what are the inclusions and deductions for business income . 1. The following expenses were included in the company's accounting expenses of the current year:

what are the inclusions and deductions for business income .

1. The following expenses were included in the company's accounting expenses of the current year: Income tax expense...... Golf club membership fees. Amortization expense... Business meals and entertainment..... Financing fees to issue shares (show its net effect)... Advertising on a US television station (Directed at New York market)...... Loss from theft (Not uncommon in this business).. Purchase of furniture for business. Legal fees for likely lawsuit... Interest paid on late income tax instalments... $32,000 14,000 55,000 28,000 10,000 17,000 8,000 26,000 40,000 2,800 -32000 14000 -55000 0 -10000 0 0 0 0 0

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the reconciliation to calculate ABC Cos net business income for tax purposes we need to identify which expenses should be added to or deduc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started