Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 You won the jackpot in the lottery, the win rises to $100,000, several banks offer you fund portfolios. By browsing the banks' prospectuses,

QUESTION 2

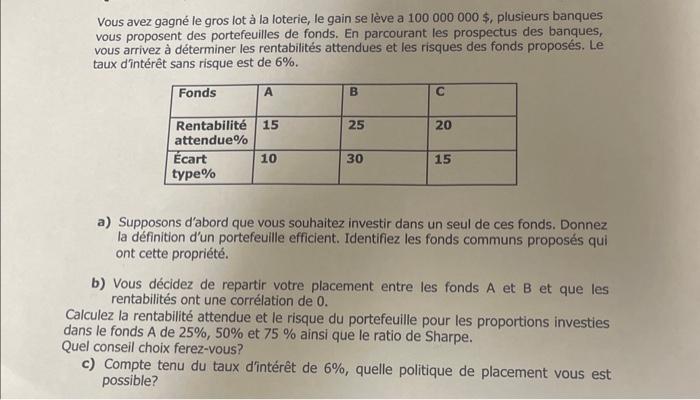

You won the jackpot in the lottery, the win rises to $100,000, several banks offer you fund portfolios. By browsing the banks' prospectuses, you can determine the expected profitability and risks of the proposed funds. The risk-free interest rate is 6%.

See table

A) Let's first assume that you want to invest in only one of these funds. Give the definition of an efficient portfolio. Identify the proposed common funds that have this property.

B) You decide to split your investment between funds A and B and that the returns have a correlation of 0.

Calculate the expected profitability and risk of the portfolio for the proportions invested in the A fund of 25%, 50% and 75% as well as the Sharpe ratio.

What advice will you choose?

C) Given the 6% interest rate, what investment policy is possible for you?

Photo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started