Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Your company is in the process of restructuring the company's capital structure. As the company's Head of Finance, you have been given

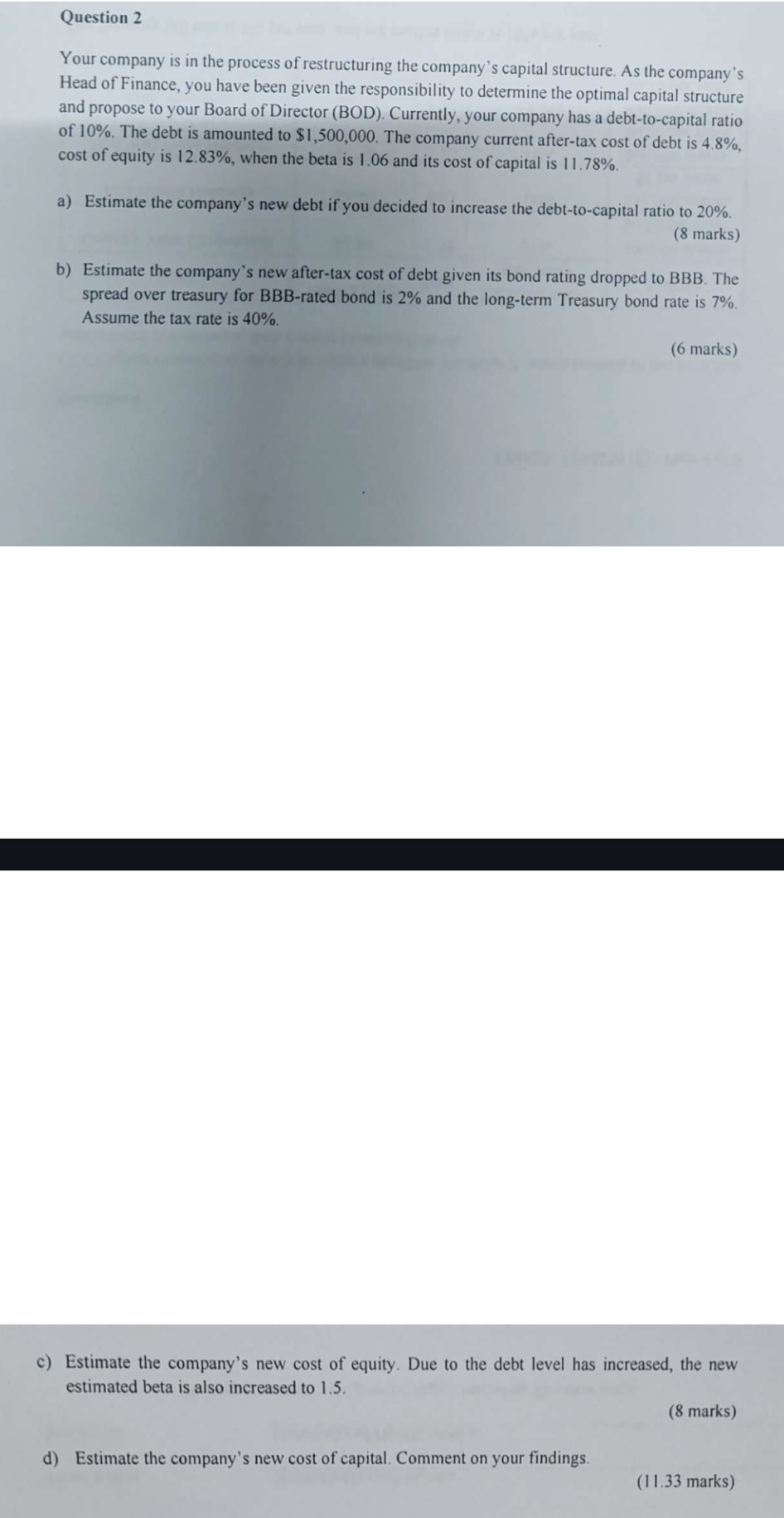

Question 2 Your company is in the process of restructuring the company's capital structure. As the company's Head of Finance, you have been given the responsibility to determine the optimal capital structure and propose to your Board of Director (BOD). Currently, your company has a debt-to-capital ratio of 10%. The debt is amounted to $1,500,000. The company current after-tax cost of debt is 4.8%, cost of equity is 12.83%, when the beta is 1.06 and its cost of capital is 11.78%. a) Estimate the company's new debt if you decided to increase the debt-to-capital ratio to 20%. (8 marks) b) Estimate the company's new after-tax cost of debt given its bond rating dropped to BBB. The spread over treasury for BBB-rated bond is 2% and the long-term Treasury bond rate is 7%. Assume the tax rate is 40%. (6 marks) c) Estimate the company's new cost of equity. Due to the debt level has increased, the new estimated beta is also increased to 1.5. (8 marks) d) Estimate the company's new cost of capital. Comment on your findings. (11.33 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To estimate the companys new debt if the debttocapital ratio is increased to 20 you can use the fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started