Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Zulkifli sells goods on credit to customers, he had the following trade receivables at the end of the past five years: Bad Debts

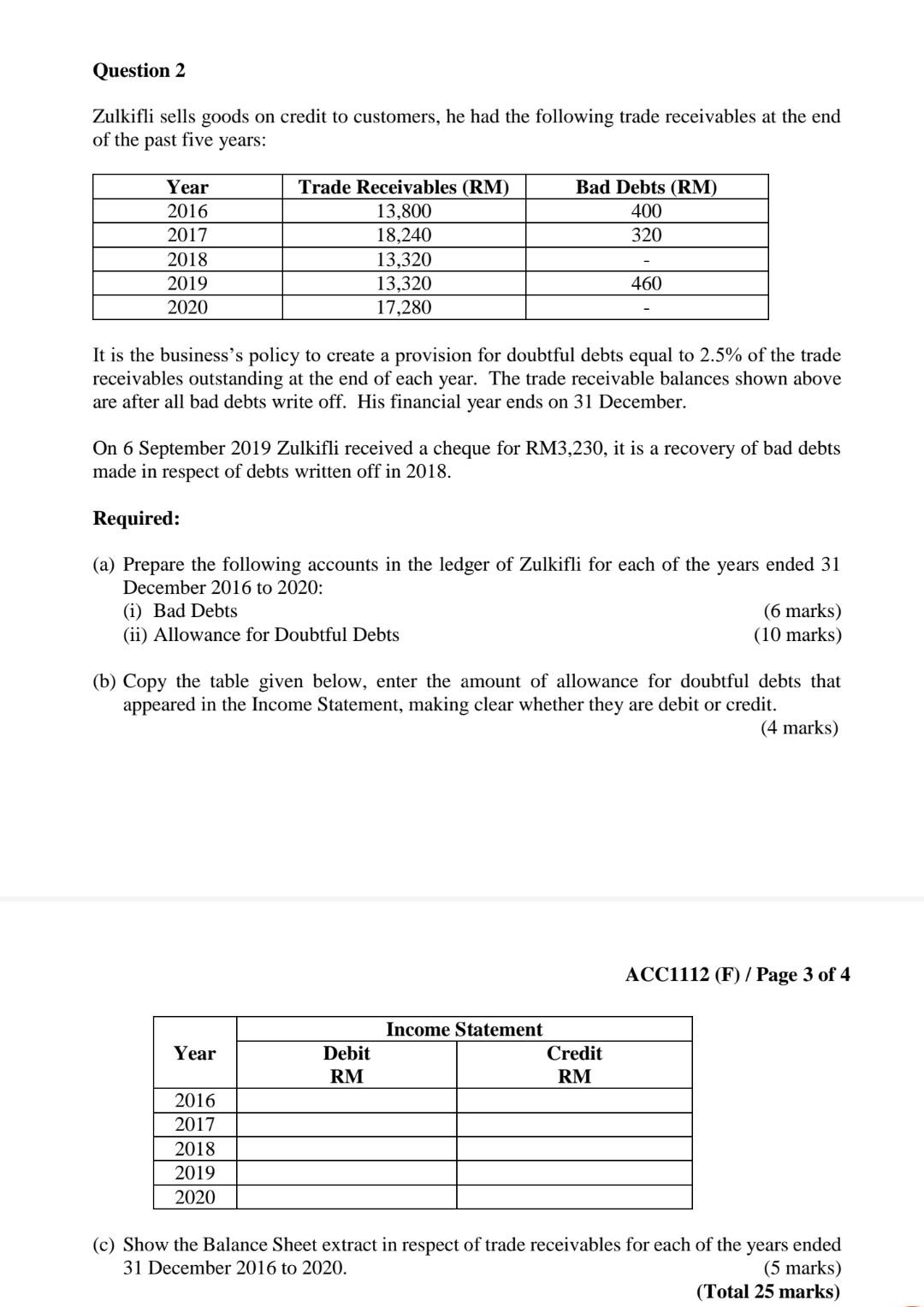

Question 2 Zulkifli sells goods on credit to customers, he had the following trade receivables at the end of the past five years: Bad Debts (RM) 400 320 Year 2016 2017 2018 2019 2020 Trade Receivables (RM) 13,800 18,240 13,320 13,320 17,280 460 It is the business's policy to create a provision for doubtful debts equal to 2.5% of the trade receivables outstanding at the end of each year. The trade receivable balances shown above are after all bad debts write off. His financial year ends on 31 December. On 6 September 2019 Zulkifli received a cheque for RM3,230, it is a recovery of bad debts made in respect of debts written off in 2018. Required: (a) Prepare the following accounts in the ledger of Zulkifli for each of the years ended 31 December 2016 to 2020: (i) Bad Debts (6 marks) (ii) Allowance for Doubtful Debts (10 marks) (b) Copy the table given below, enter the amount of allowance for doubtful debts that appeared in the Income Statement, making clear whether they are debit or credit. (4 marks) ACC1112 (F) / Page 3 of 4 Year Debit RM Income Statement Credit RM 2016 2017 2018 2019 2020 (c) Show the Balance Sheet extract in respect of trade receivables for each of the years ended 31 December 2016 to 2020. (5 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started