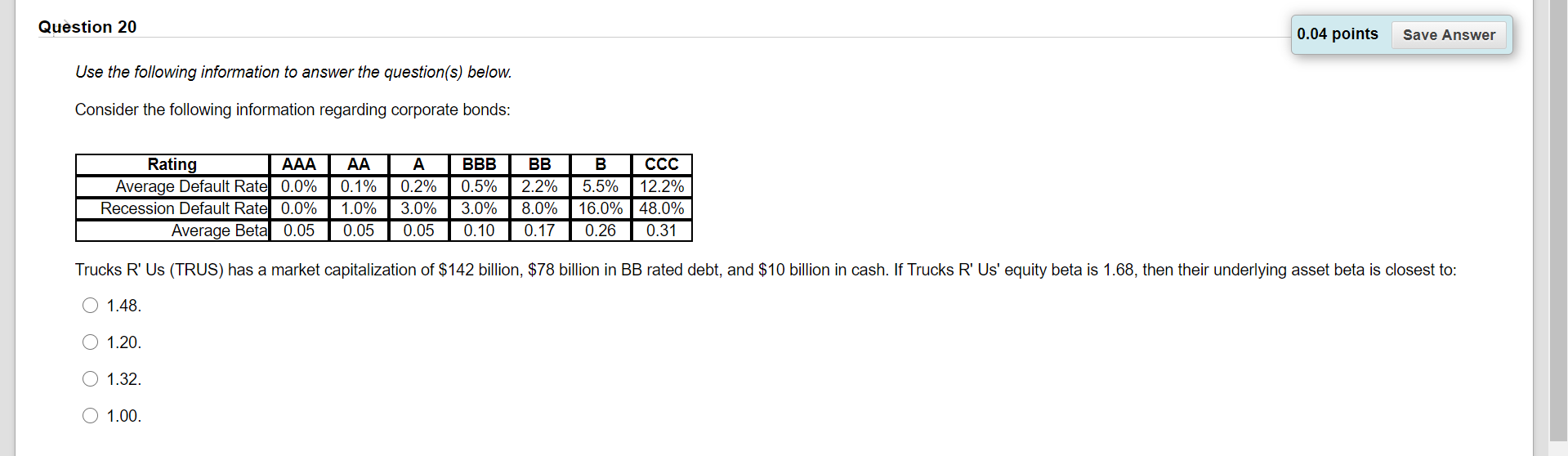

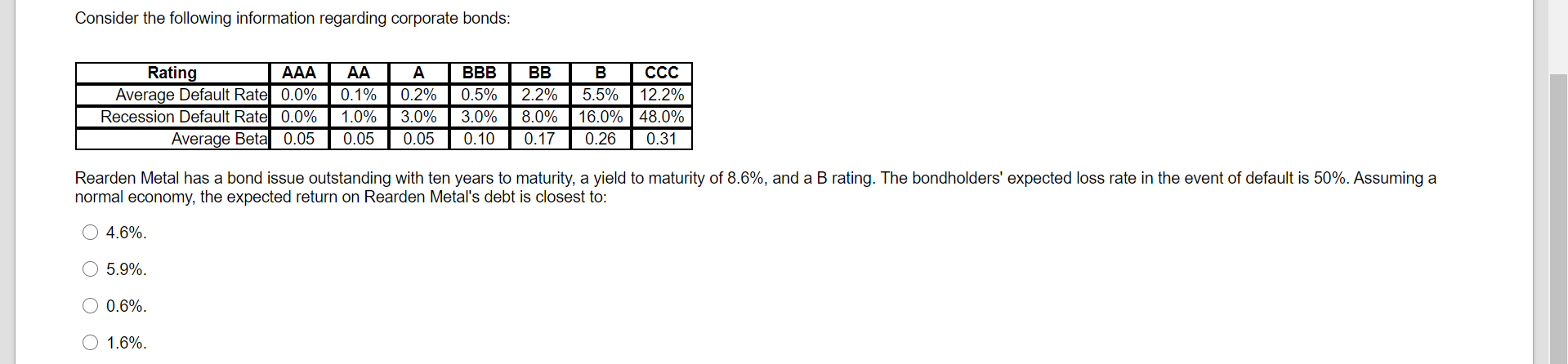

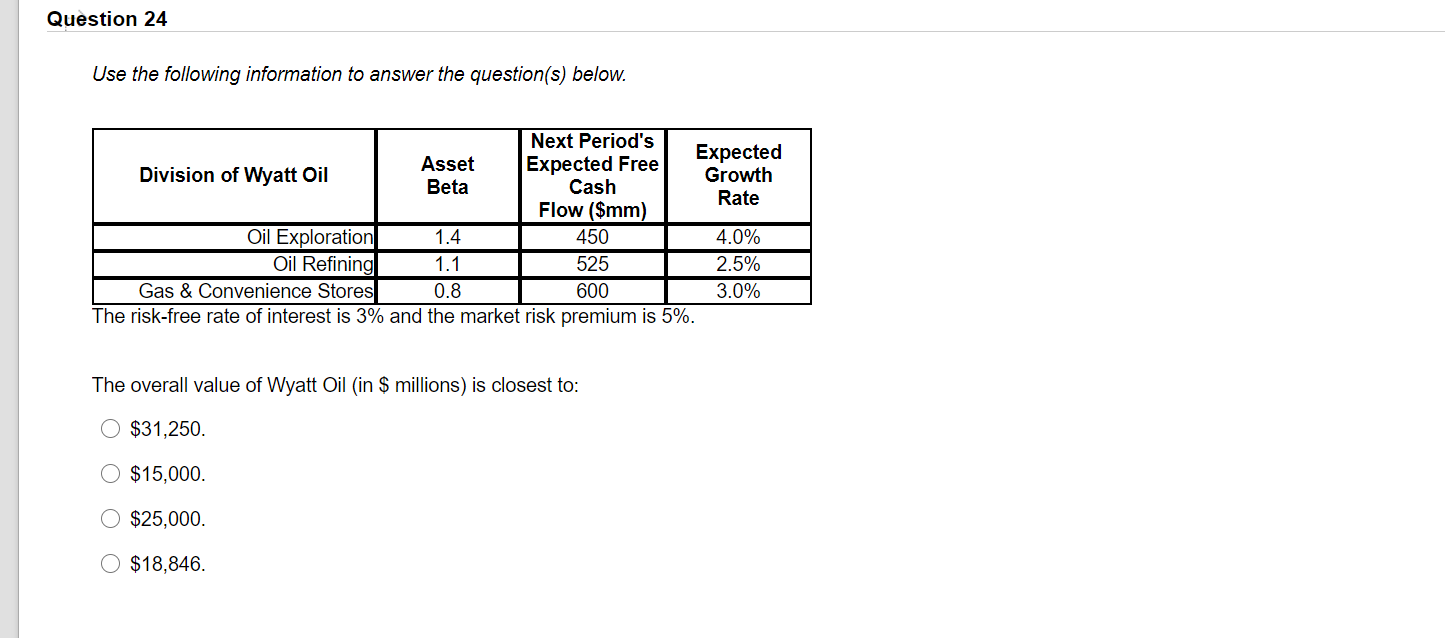

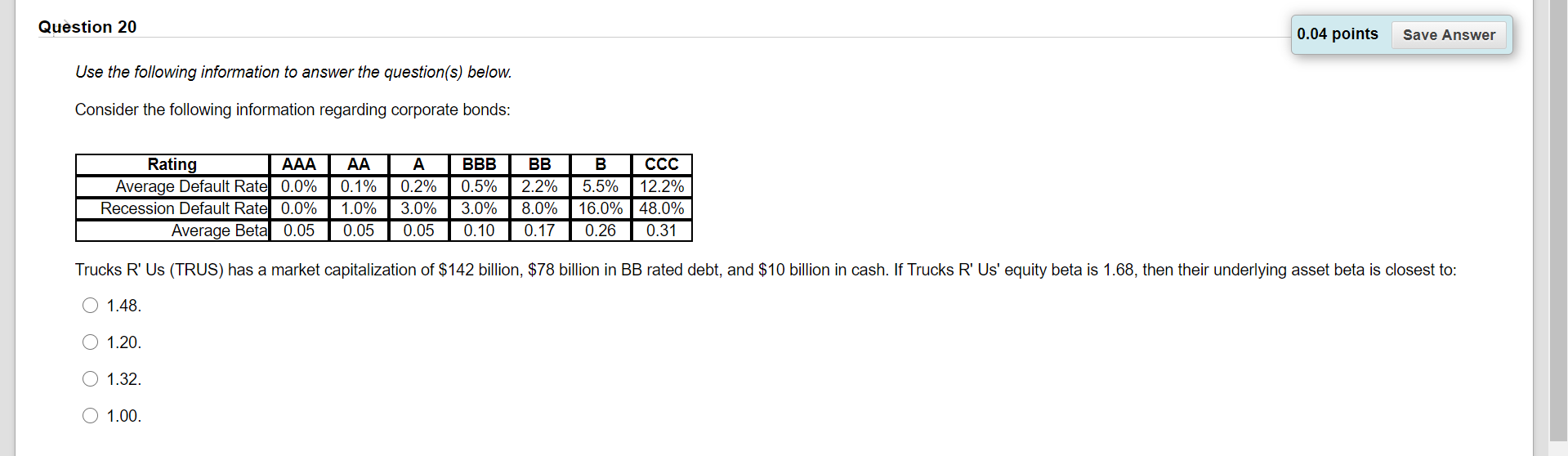

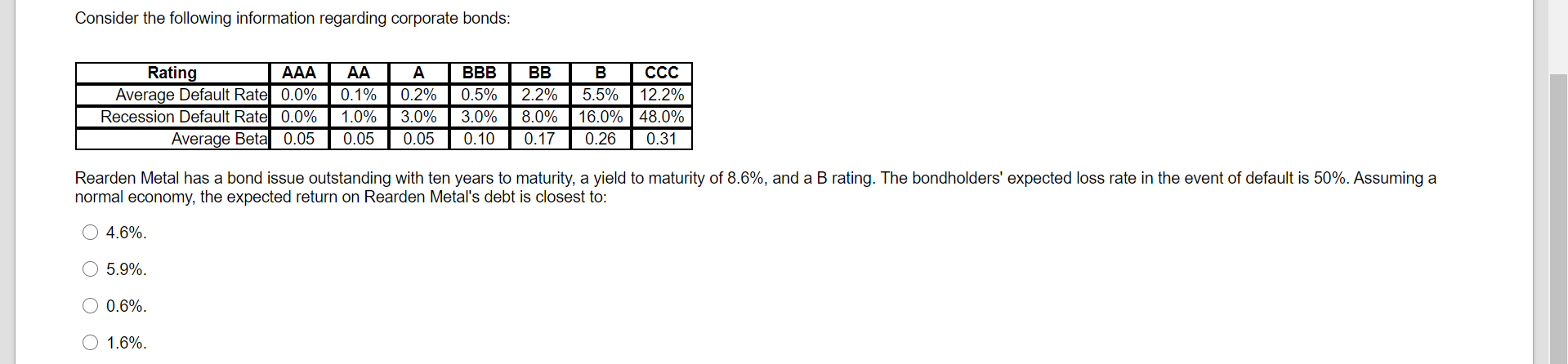

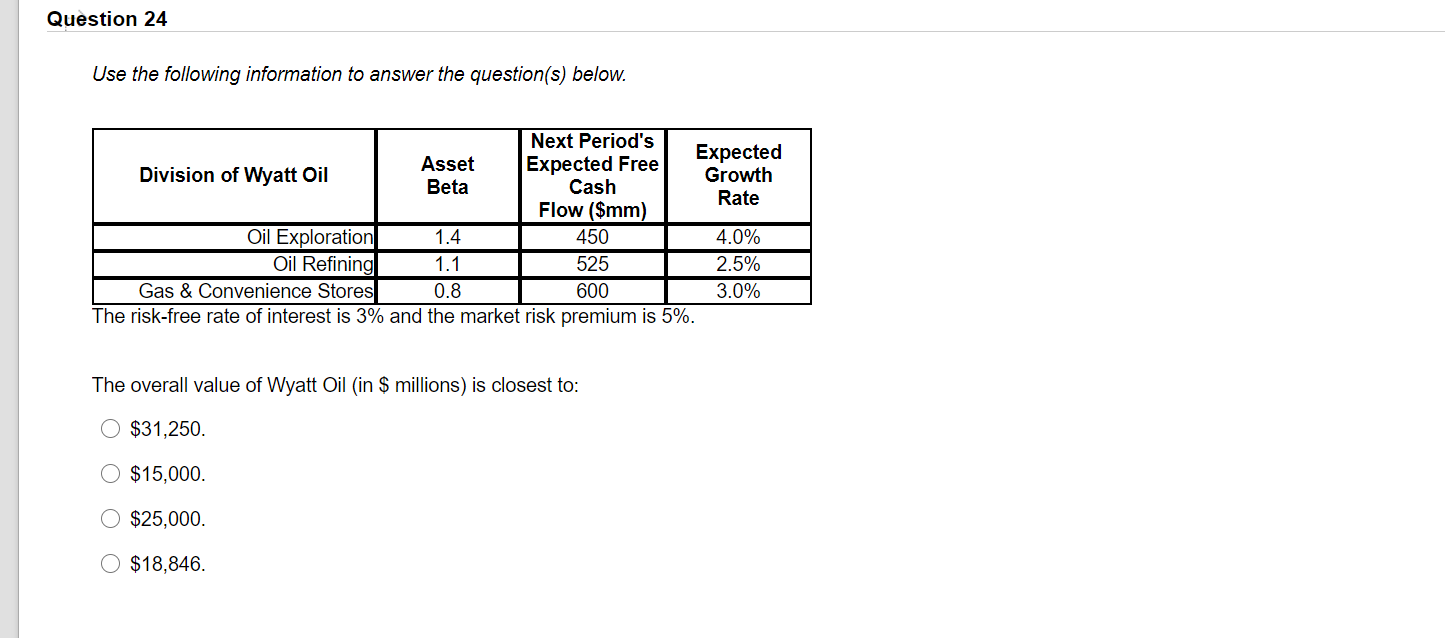

Question 20 0.04 points Save Answer Use the following information to answer the question(s) below. Consider the following information regarding corporate bonds: Rating AAA Average Default Rate 0.0% Recession Default Rate 0.0% Average Beta 0.05 AA 0.1% 1.0% 0.05 A 0.2% 3.0% 0.05 BBB 0.5% 3.0% 0.10 BB 2.2% 8.0% 0.17 B CCC 5.5% 12.2% 16.0% 48.0% 0.26 0.31 Trucks R' Us (TRUS) has a market capitalization of $142 billion, $78 billion in BB rated debt, and $10 billion in cash. If Trucks R' Us' equity beta is 1.68, then their underlying asset beta is closest to: O 1.48. O 1.20. O 1.32. 1.00. Consider the following information regarding corporate bonds: AA Rating AAA Average Default Rate 0.0% Recession Default Rate 0.0% Average Beta 0.05 0.1% 1.0% 0.05 A 0.2% 3.0% 0.05 BBB 0.5% 3.0% 0.10 BB 2.2% 8.0% 0.17 B CCC 5.5% 12.2% 16.0% 48.0% 0.26 0.31 Rearden Metal has a bond issue outstanding with ten years to maturity, a yield to maturity of 8.6%, and a B rating. The bondholders' expected loss rate in the event of default is 50%. Assuming a normal economy, the expected return on Rearden Metal's debt is closest to: O 4.6%. O 5.9%. O 0.6% O 1.6% Question 24 Use the following information to answer the question(s) below. Next Period's Expected Asset Division of Wyatt Oil Expected Free Growth Beta Cash Rate Flow ($mm) Oil Exploration 1.4 450 4.0% Oil Refining 1.1 525 2.5% Gas & Convenience Stores 0.8 600 3.0% The risk-free rate of interest is 3% and the market risk premium is 5%. The overall value of Wyatt Oil (in $ millions) is closest to: $31,250. O $15,000. O $25,000. O $18,846. Question 20 0.04 points Save Answer Use the following information to answer the question(s) below. Consider the following information regarding corporate bonds: Rating AAA Average Default Rate 0.0% Recession Default Rate 0.0% Average Beta 0.05 AA 0.1% 1.0% 0.05 A 0.2% 3.0% 0.05 BBB 0.5% 3.0% 0.10 BB 2.2% 8.0% 0.17 B CCC 5.5% 12.2% 16.0% 48.0% 0.26 0.31 Trucks R' Us (TRUS) has a market capitalization of $142 billion, $78 billion in BB rated debt, and $10 billion in cash. If Trucks R' Us' equity beta is 1.68, then their underlying asset beta is closest to: O 1.48. O 1.20. O 1.32. 1.00. Consider the following information regarding corporate bonds: AA Rating AAA Average Default Rate 0.0% Recession Default Rate 0.0% Average Beta 0.05 0.1% 1.0% 0.05 A 0.2% 3.0% 0.05 BBB 0.5% 3.0% 0.10 BB 2.2% 8.0% 0.17 B CCC 5.5% 12.2% 16.0% 48.0% 0.26 0.31 Rearden Metal has a bond issue outstanding with ten years to maturity, a yield to maturity of 8.6%, and a B rating. The bondholders' expected loss rate in the event of default is 50%. Assuming a normal economy, the expected return on Rearden Metal's debt is closest to: O 4.6%. O 5.9%. O 0.6% O 1.6% Question 24 Use the following information to answer the question(s) below. Next Period's Expected Asset Division of Wyatt Oil Expected Free Growth Beta Cash Rate Flow ($mm) Oil Exploration 1.4 450 4.0% Oil Refining 1.1 525 2.5% Gas & Convenience Stores 0.8 600 3.0% The risk-free rate of interest is 3% and the market risk premium is 5%. The overall value of Wyatt Oil (in $ millions) is closest to: $31,250. O $15,000. O $25,000. O $18,846