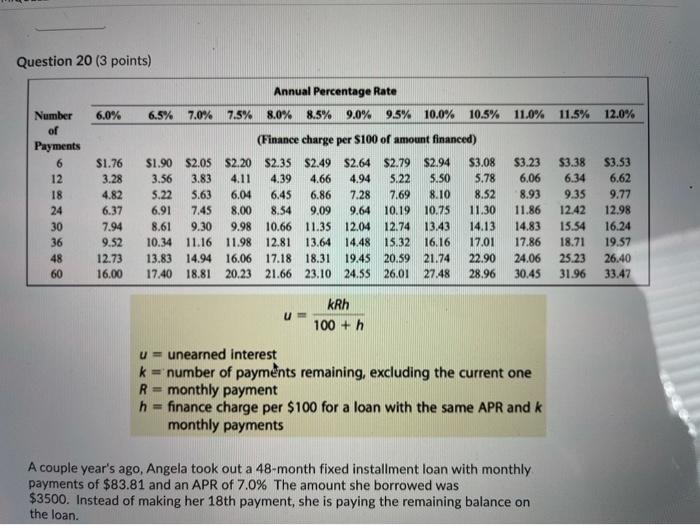

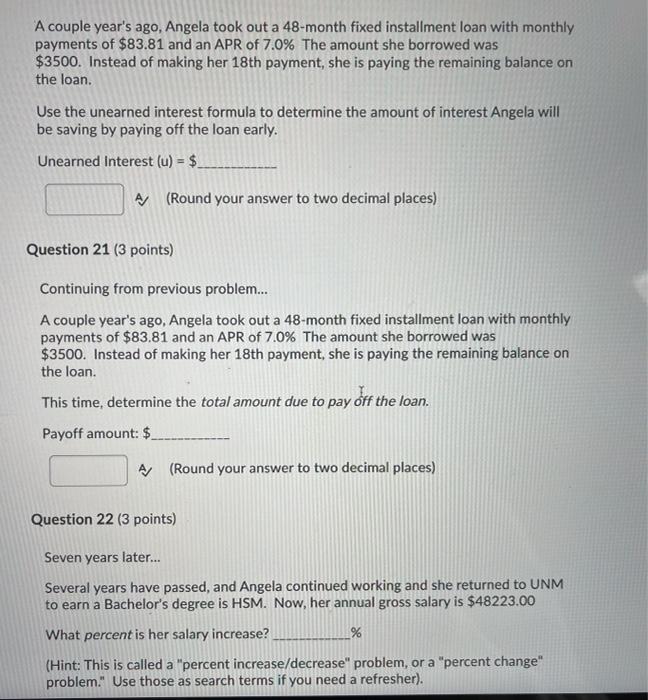

Question 20 (3 points) Annual Percentage Rate 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 11.5% 12.0% Number of Payments 6 12 18 24 30 36 48 60 S1.76 3.28 4.82 6.37 7.94 9.52 12.73 16.00 (Finance charge per $100 of amount financed) $1.90 $2.05 S2.20 $2.35 $2.49 $2.64 $2.79 $2.94 $3.08 3.56 3.83 4.11 4.39 4.66 4.94 5.22 5.50 5.78 5.22 5.63 6.04 6.45 6.86 7.28 7.69 8.10 8.52 6.91 7.45 8.00 8.54 9.09 9.64 10.19 10.75 11.30 8.61 9.30 9.98 10.66 11.35 12.04 12.74 13.43 14.13 10.34 11.16 11.98 12.81 13.64 14.48 15.32 16.16 17.01 13.83 14.94 16.06 17.18 18.31 19.45 20.59 21.74 22.90 17.40 18.81 20.23 21.66 23.10 24.35 26.01 27.48 28.96 $3.23 6.06 8.93 11.86 14.83 17.86 24.06 30.45 $3.38 6.34 9.35 12.42 15.54 18.71 25.23 31.96 $3.53 6.62 9.77 12.98 16.24 19.57 26.40 33.47 kRh 100 + h u = unearned interest K number of payments remaining, excluding the current one R = monthly payment h = finance charge per $100 for a loan with the same APR and k monthly payments A couple year's ago, Angela took out a 48-month fixed installment loan with monthly payments of $83.81 and an APR of 7.0% The amount she borrowed was $3500. Instead of making her 18th payment, she is paying the remaining balance on the loan. A couple year's ago, Angela took out a 48-month fixed installment loan with monthly payments of $83.81 and an APR of 7.0% The amount she borrowed was $3500. Instead of making her 18th payment, she is paying the remaining balance on the loan. Use the unearned interest formula to determine the amount of interest Angela will be saving by paying off the loan early. Unearned Interest (u) = $ (Round your answer to two decimal places) Question 21 (3 points) Continuing from previous problem... A couple year's ago, Angela took out a 48-month fixed installment loan with monthly payments of $83.81 and an APR of 7.0% The amount she borrowed was $3500. Instead of making her 18th payment, she is paying the remaining balance on the loan. This time, determine the total amount due to pay off the loan. Payoff amount: $ A (Round your answer to two decimal places) Question 22 (3 points) Seven years later... Several years have passed, and Angela continued working and she returned to UNM to earn a Bachelor's degree is HSM. Now, her annual gross salary is $48223.00 What percent is her salary increase? % (Hint: This is called a "percent increase/decrease" problem, or a "percent change" problem." Use those as search terms if you need a refresher). With her new salary, Angela can afford to pay more for some things in her life. For instance, she may decide to purchase a house and make monthly mortgage payments. Maybe she has decided to buy a new car. Figure out the amount of money she can allocate to each category. Before you start this problem, know that after deductions her new annual net salary ($48223 X.66) is $31827.00 (rounded to the nearest dollar). Think about why .66 was used in the calculation. Next, determine her new monthly net salary, and use this amount to complete the questions below (round to two decimal places): New monthly net salary: $ A (Round your answer to two decimal places) Question 24 (3 points) Originally, Angela's rent was $650. If she decides to increase her housing expenditure to 35% of her new monthly net salary, how much would that be? $_ A (Round your answer to two decimal places) Question 25 (3 points) Originally, Angela's Car Payment was $132.00. If she decides to buy a new car and and her monthly car payments increase to 10% of her new monthly net salary, how much is the new monthly car payment? $ A) (Round your answer to two decimal places)