Answered step by step

Verified Expert Solution

Question

1 Approved Answer

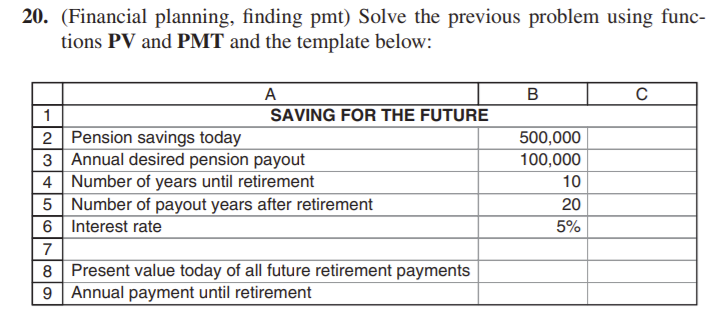

Question 20 uses Question 19 information to solve. The answer is Present Value today of all future retirement payments is $803,325,19 Annual Payment until retirement

Question 20 uses Question 19 information to solve.

The answer is "Present Value today of all future retirement payments is $803,325,19 Annual Payment until retirement is $37,411.13"

What is the Excel function written out fully used to acquire this answer? "Present Value today of all future retirement payments is $803,325,19 Annual Payment until retirement is $37,411.13 "

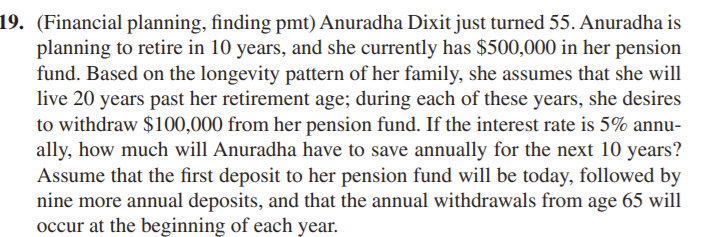

19. (Financial planning, finding pmt) Anuradha Dixit just turned 55. Anuradha is planning to retire in 10 years, and she currently has $500,000 in her pension fund. Based on the longevity pattern of her family, she assumes that she will live 20 years past her retirement age; during each of these years, she desires to withdraw $100,000 from her pension fund. If the interest rate is 5% annu- ally, how much will Anuradha have to save annually for the next 10 years? Assume that the first deposit to her pension fund will be today, followed by nine more annual deposits, and that the annual withdrawals from age 65 will occur at the beginning of each year. 20. (Financial planning, finding pmt) Solve the previous problem using func- tions PV and PMT and the template below: B A 1 SAVING FOR THE FUTURE 2 Pension savings today 3 Annual desired pension payout 4 Number of years until retirement 5 Number of payout years after retirement 6 Interest rate 7 8 Present value today of all future retirement payments 9 Annual payment until retirement 500,000 100,000 10 20 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started