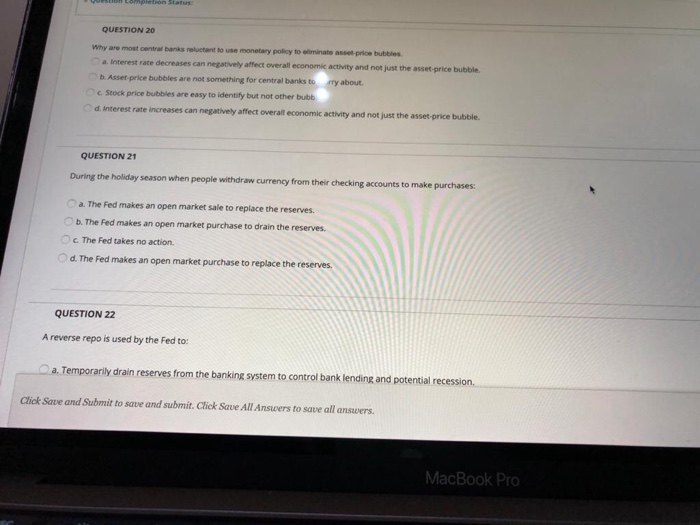

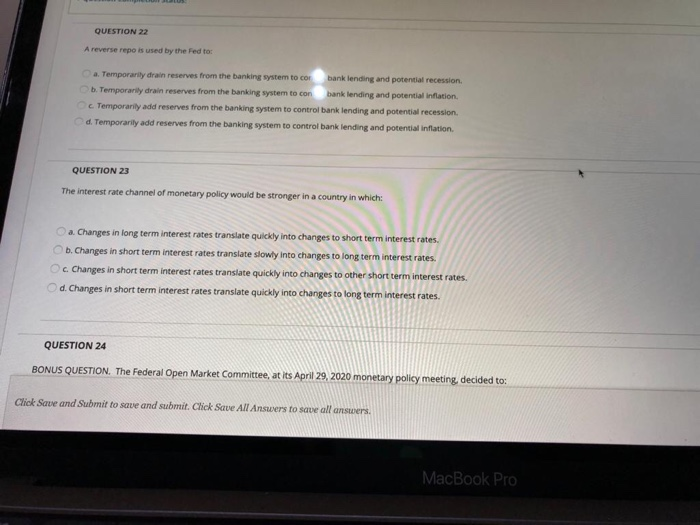

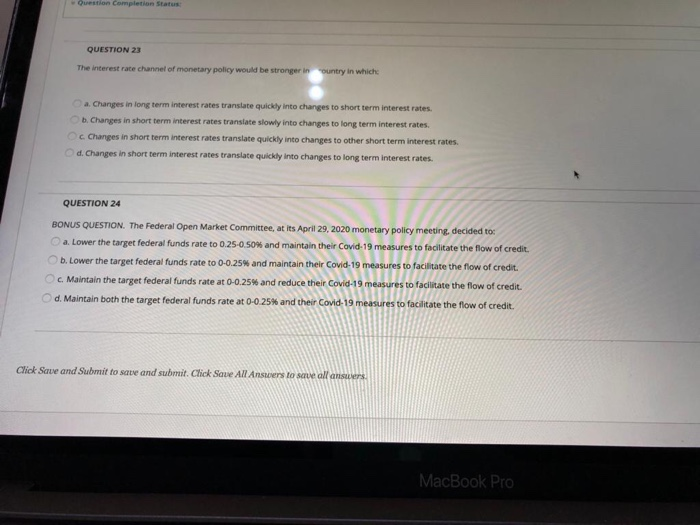

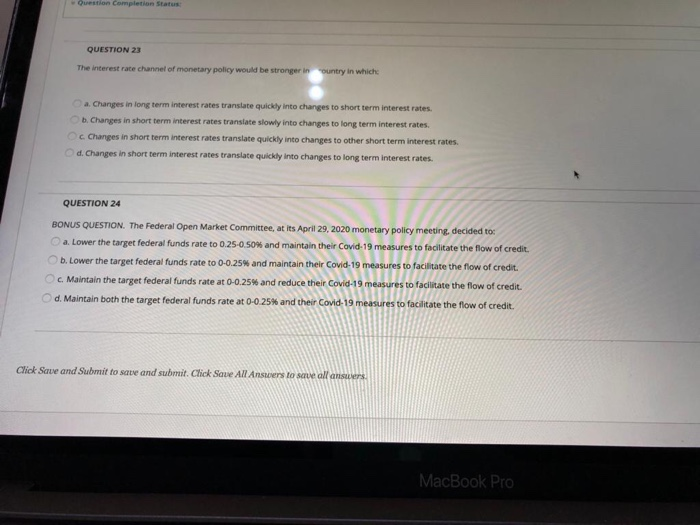

QUESTION 20 Why are most contrabankructant to use monetary policy to imate price bubbles a. Interest rate decreases can negatively affect overall economic activity and not just the asset price bubble b. Asset price bubbles are not something for central banks torry about Stock price bubbles are easy to identify but not other bubb di interest rate increases can negatively affect overall economic activity and not just the asset price bubble QUESTION 21 During the holiday season when people withdraw currency from their checking accounts to make purchases a. The Fed makes an open market sale to replace the reserves. b. The Fed makes an open market purchase to drain the reserves. The Fed takes no action d. The Fed makes an open market purchase to replace the reserves QUESTION 22 A reverse repo is used by the Fed to: a. Temporarily drain reserves from the banking system to control bank lending and potential recession Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro QUESTION 22 A reverse reposed by the Fed to a. Temporarily drain reserves from the banking system to co bank lending and potential recession b. Temporarily drain reserves from the banking system to con bank lending and potential inflation Temporarily add reserves from the banking system to control bank lending and potential recession d. Temporarily add reserves from the banking system to control bank lending and potential inflation QUESTION 23 The interest rate channel of monetary policy would be stronger in a country in which a. Changes in long term interest rates translate quickly into changes to short term interest rates. b. Changes in short term interest rates translate slowly into changes to long term interest rates. c. Changes in short term interest rates translate quickly into changes to other short term interest rates. d. Changes in short term interest rates translate quickly into changes to long term interest rates. QUESTION 24 BONUS QUESTION. The Federal Open Market Committee, at its April 29, 2020 monetary policy meeting, decided to: Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro QUESTION 23 The interest rate channel of monetary policy would be stronger in n try in which a. Changes in long term interest rates translate quickly into changes to short term interest rates. b. Changes in short term interest rates translate slowly into changes to long term interest rates. Changes in short term interest rates translate quickly into changes to other short term interest rates. d. Changes in short term interest rates translate quickly into changes to long term interest rates QUESTION 24 BONUS QUESTION. The Federal Open Market Committee, at its April 29, 2020 monetary policy meeting decided to a Lower the target federal funds rate to 0.25-0.50% and maintain their Covid: 19 measures to facilitate the flow of credit. b. Lower the target federal funds rate to 0-0.25% and maintain their Covid-19 measures to facilitate the flow of credit. Maintain the target federal funds rate at 0-0.25% and reduce their Covid-19 measures to facilitate the flow of credit. d. Maintain both the target federal funds rate at 0-0.25% and their Covid-19 measures to facilitate the flow of credit. Click Save and Submit to save and submit. Click Save All Answers to save al MacBook Pro