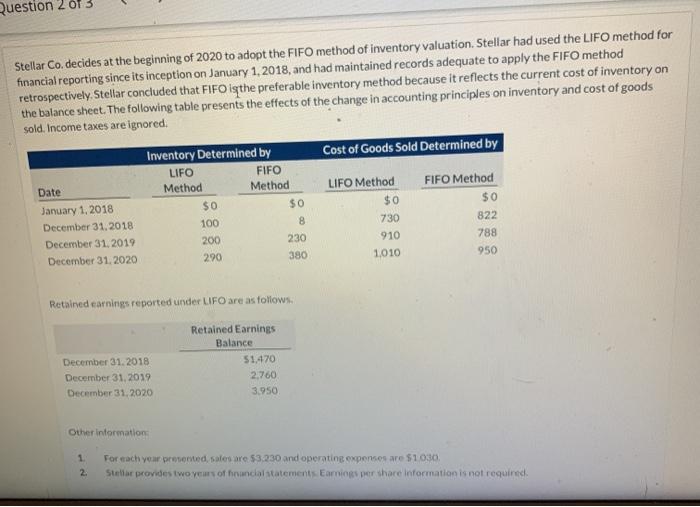

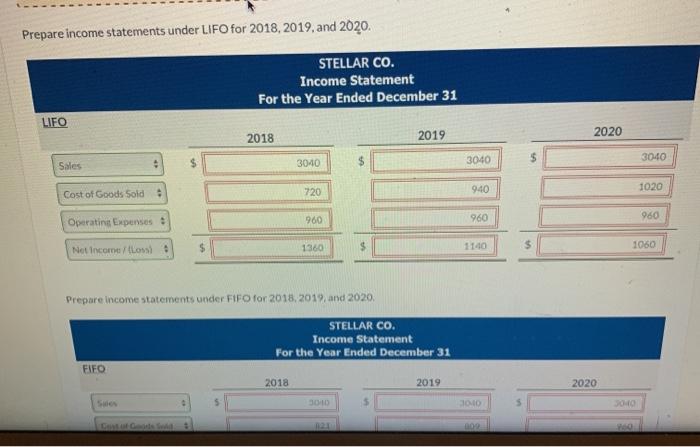

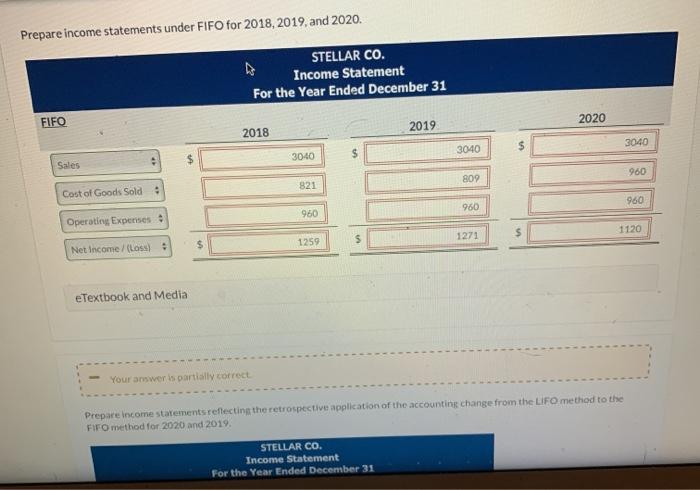

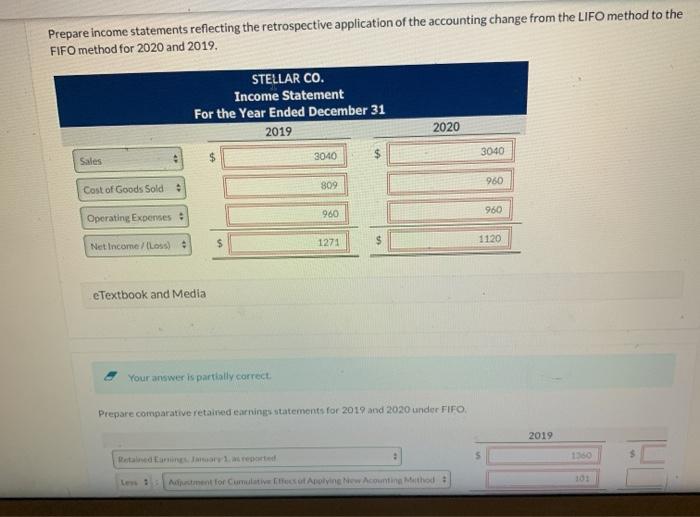

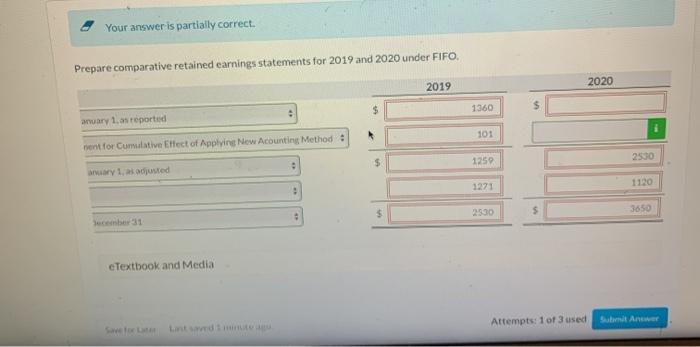

Question 2013 Stellar Co. decides at the beginning of 2020 to adopt the FIFO method of inventory valuation. Stellar had used the LIFO method for financial reporting since its inception on January 1, 2018, and had maintained records adequate to apply the FIFO method retrospectively, Stellar concluded that FIFO isthe preferable inventory method because it reflects the current cost of inventory on the balance sheet. The following table presents the effects of the change in accounting principles on inventory and cost of goods sold. Income taxes are ignored. Cost of Goods Sold Determined by Date January 1, 2018 December 31, 2018 December 31, 2019 December 31, 2020 Inventory Determined by LIFO FIFO Method Method $0 $0 100 8 200 290 380 LIFO Method $0 730 910 1010 FIFO Method $0 822 788 950 230 Retained earnings reported under LIFO are as follows. December 31, 2018 December 31, 2019 December 31, 2020 Retained Earnings Balance 51.470 2.760 3.950 Other information 1 2. For each year presented, sales are 53.230 and operating expenses are $1030, Stellar provides two years of ancial statements Earnings per share information is not required. Prepare income statements under LIFO for 2018, 2019, and 2020. STELLAR CO. Income Statement For the Year Ended December 31 LIFO 2018 2019 2020 $ Sales 3040 $ 3040 3040 720 940 1020 Cost of Goods Sold 960 960 Operating Expenses 960 $ 1360 $ 1140 $ Net Income / Loss 1060 Prepare income statements under FIFO for 2018, 2019 and 2020 STELLAR CO. Income Statement For the Year Ended December 31 FIFO 2018 2019 2020 3010 30.10 3040 002 Prepare income statements under FIFO for 2018, 2019 and 2020. STELLAR CO. Income Statement For the Year Ended December 31 FIFO 2020 2019 2018 $ 3040 3040 3040 $ Sales 960 809 821 Cost of Goods Sold 960 960 960 Operating Expenses $ 1120 1259 1271 Net Income/(Loss) e Textbook and Media Your amwer is partially correct Prepare income statements reflecting the retrospective application of the accounting change from the LIFO method to the FIFO method for 2020 and 2019. STELLAR CO. Income Statement For the Year Ended December 31 Prepare income statements reflecting the retrospective application of the accounting change from the LIFO method to the FIFO method for 2020 and 2019. STELLAR CO. Income Statement For the Year Ended December 31 2019 2020 $ 3040 3040 Sales 809 960 Cost of Goods Sold 4 960 960 Operating Expenses : $ 1271 1120 Net Income (Loss) eTextbook and Media Your answer is partially correct Prepare comparative retained earnings statements for 2019 and 2020 under FIFO. 2019 1380 101 Lewment for Cumulative tout Anline New Acount Method: Your answer is partially correct. Prepare comparative retained earnings statements for 2019 and 2020 under FIFO. 2019 2020 $ 1360 anuary 1. an reported 101 bent for Cumulative Effect of Applying Now Acounting Method : $ 125 2530 anuary 1, adjusted 1271 1120 $ 3650 Secember 31 e Textbook and Media Attempts: 1 of 3 used Sud Ant