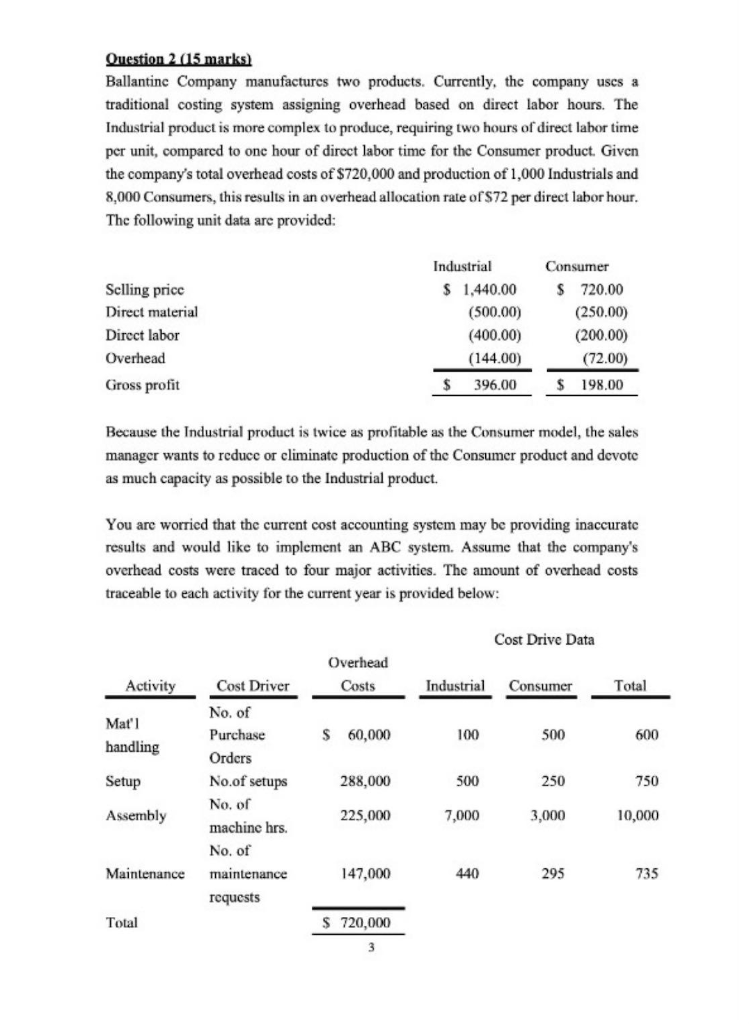

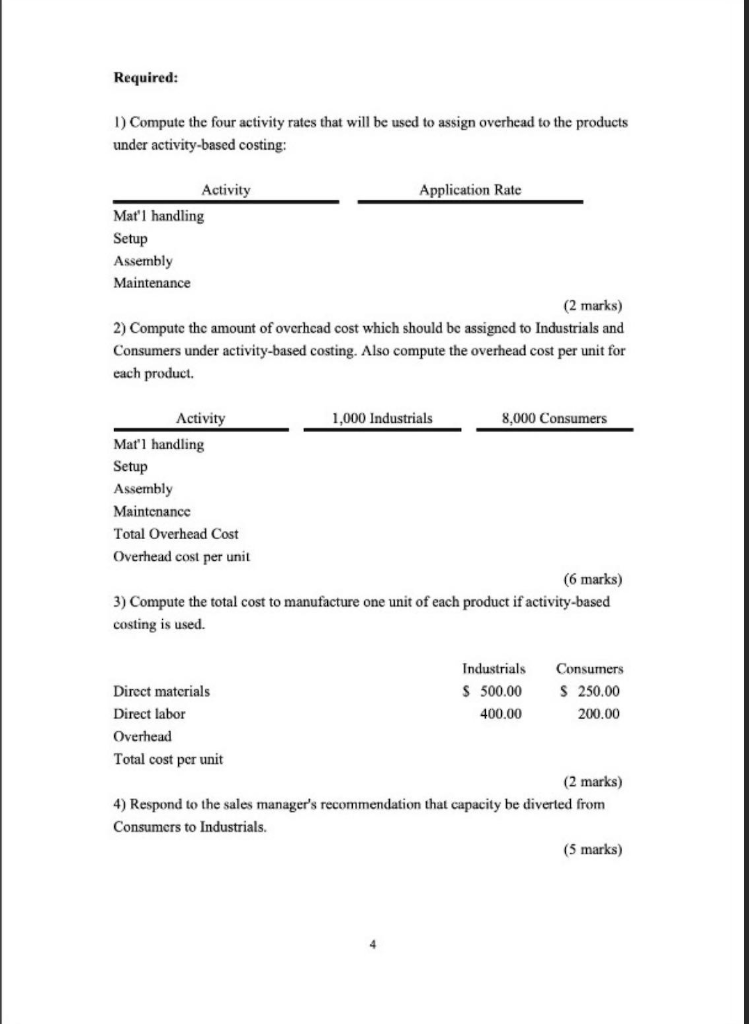

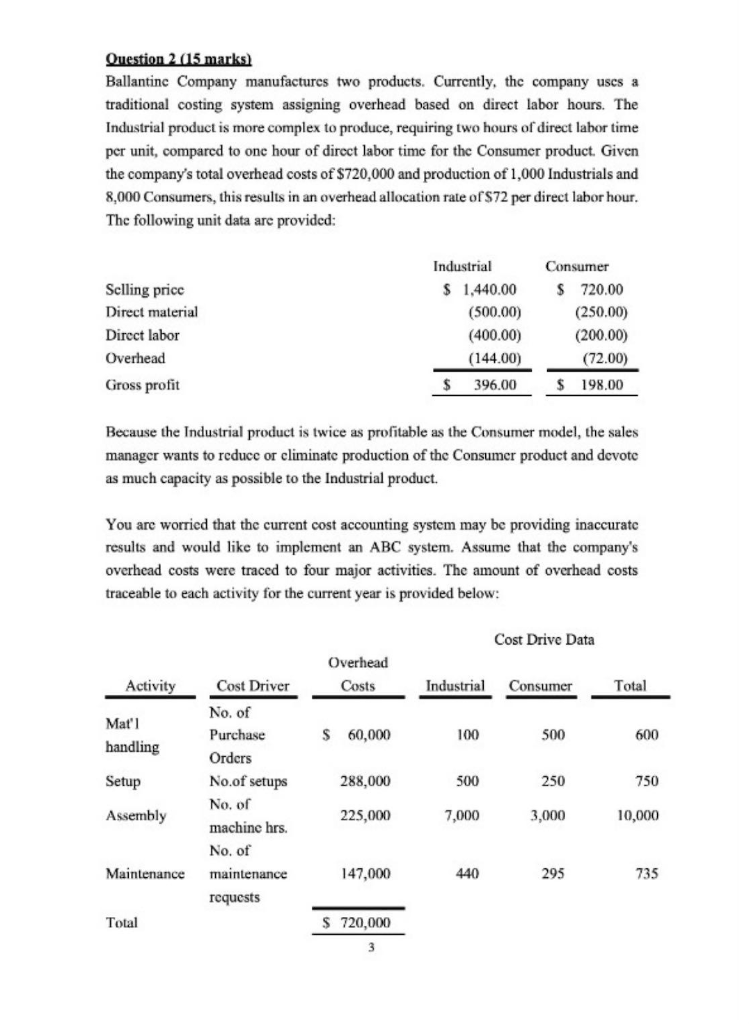

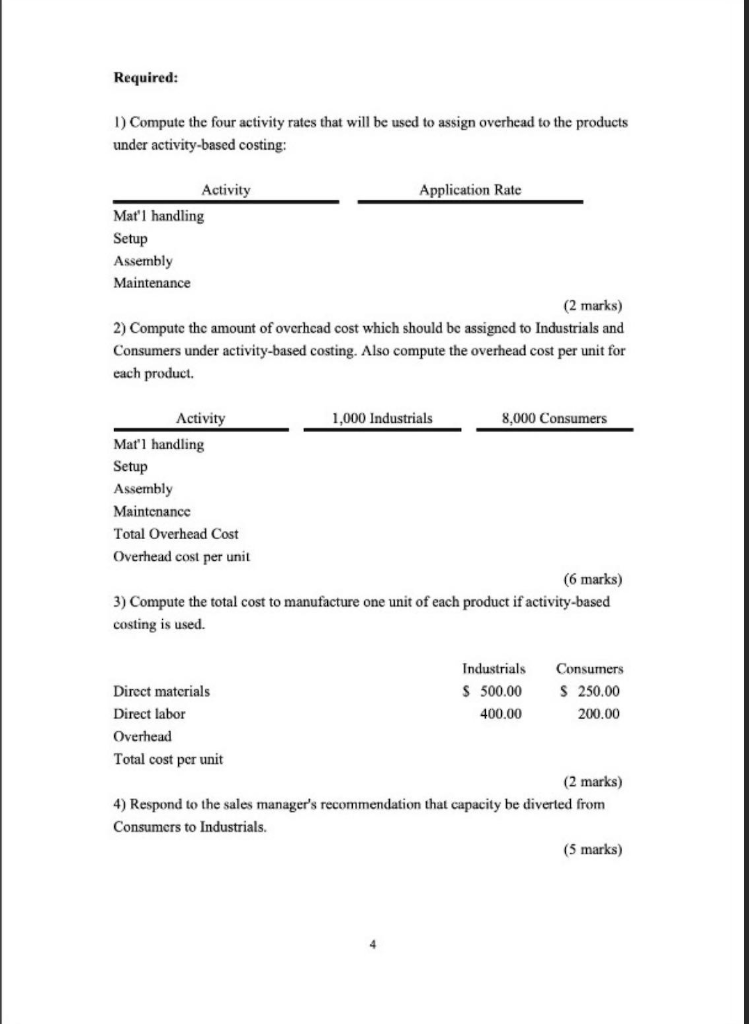

Question 2015 marks) Ballantinc Company manufactures two products. Currently, the company uses a traditional costing system assigning overhead based on direct labor hours. The Industrial product is more complex to produce, requiring two hours of direct labor time per unit, compared to one hour of direct labor time for the Consumer product. Given the company's total overhead costs of $720,000 and production of 1,000 Industrials and 8,000 Consumers, this results in an overhead allocation rate of $72 per direct labor hour. The following unit data are provided: Selling price Direct material Direct labor Industrial $ 1,440.00 (500.00) (400.00) (144.00) $ 396.00 Consumer $ 720.00 (250.00) (200.00) (72.00) Overhead Gross profit $198.00 Because the Industrial product is twice as profitable as the Consumer model, the sales manager wants to reduce or climinate production of the Consumer product and devote as much capacity as possible to the Industrial product. You are worried that the current cost accounting system may be providing inaccurate results and would like to implement an ABC system. Assume that the company's overhead costs were traced to four major activities. The amount of overhead costs traceable to each activity for the current year is provided below: Cost Drive Data Overhead Costs Activity Industrial Consumer Total Mat'l handling $ 60,000 100 500 600 Setup Cost Driver No. of Purchase Orders No.of setups No. of machine hrs. No. of maintenanc 288,000 500 250 750 Assembly 225,000 7,000 3,000 10,000 Maintenance 147,000 440 295 735 requests Total $ 720,000 3 Required: 1) Compute the four activity rates that will be used to assign overhead to the products under activity-based costing: Activity Application Rate Mat'l handling Setup Assembly Maintenance (2 marks) 2) Compute the amount of overhead cost which should be assigned to Industrials and Consumers under activity-based costing. Also compute the overhead cost per unit for each product 1,000 Industrials 8,000 Consumers Activity Mat'l handling Setup Assembly Maintenance Total Overhead Cost Overhead cost per unit (6 marks) 3) Compute the total cost to manufacture one unit of each product if activity-based costing is used. Industrials Consumers Direct materials $ 500.00 $ 250.00 Direct labor 400.00 200.00 Overhead Total cost per unit (2 marks) 4) Respond to the sales manager's recommendation that capacity be diverted from Consumers to Industrials