Answered step by step

Verified Expert Solution

Question

1 Approved Answer

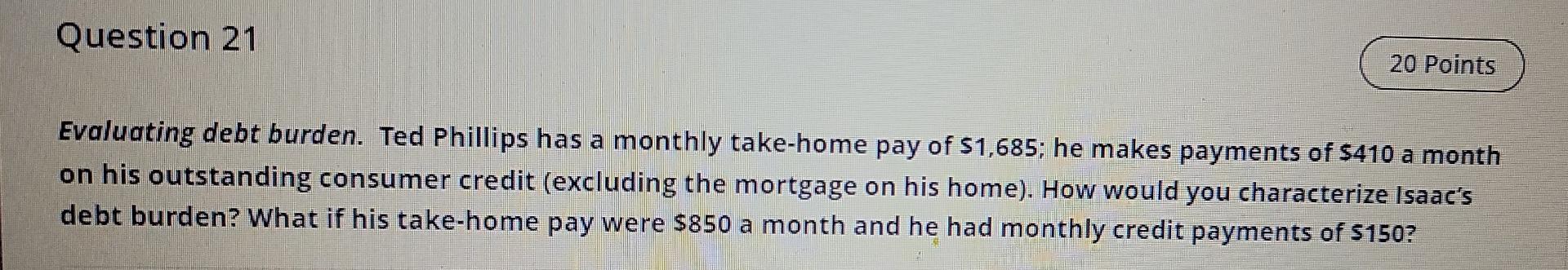

Question 21 20 Points Evaluating debt burden. Ted Phillips has a monthly take-home pay of $1,685; he makes payments of $410 a month on his

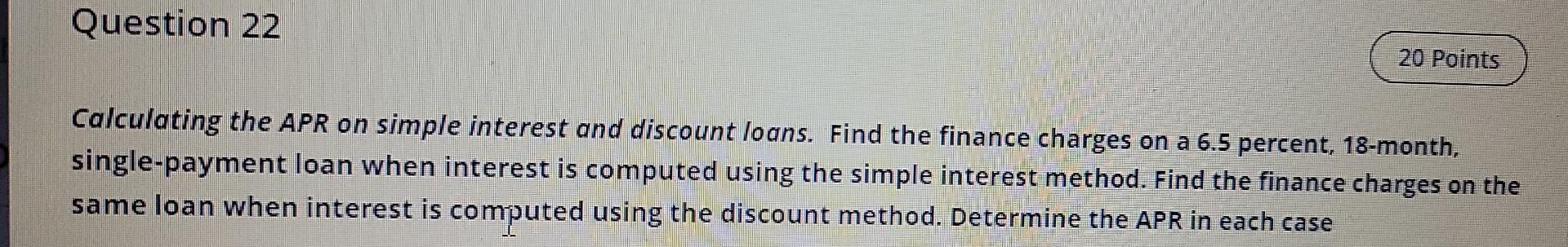

Question 21 20 Points Evaluating debt burden. Ted Phillips has a monthly take-home pay of $1,685; he makes payments of $410 a month on his outstanding consumer credit (excluding the mortgage on his home). How would you characterize Isaac's debt burden? What if his take-home pay were $850 a month and he had monthly credit payments of $150? Question 22 20 Points Calculating the APR on simple interest and discount loans. Find the finance charges on a 6.5 percent, 18-month, single-payment loan when interest is computed using the simple interest method. Find the finance charges on the same loan when interest is computed using the discount method. Determine the APR in each case

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started