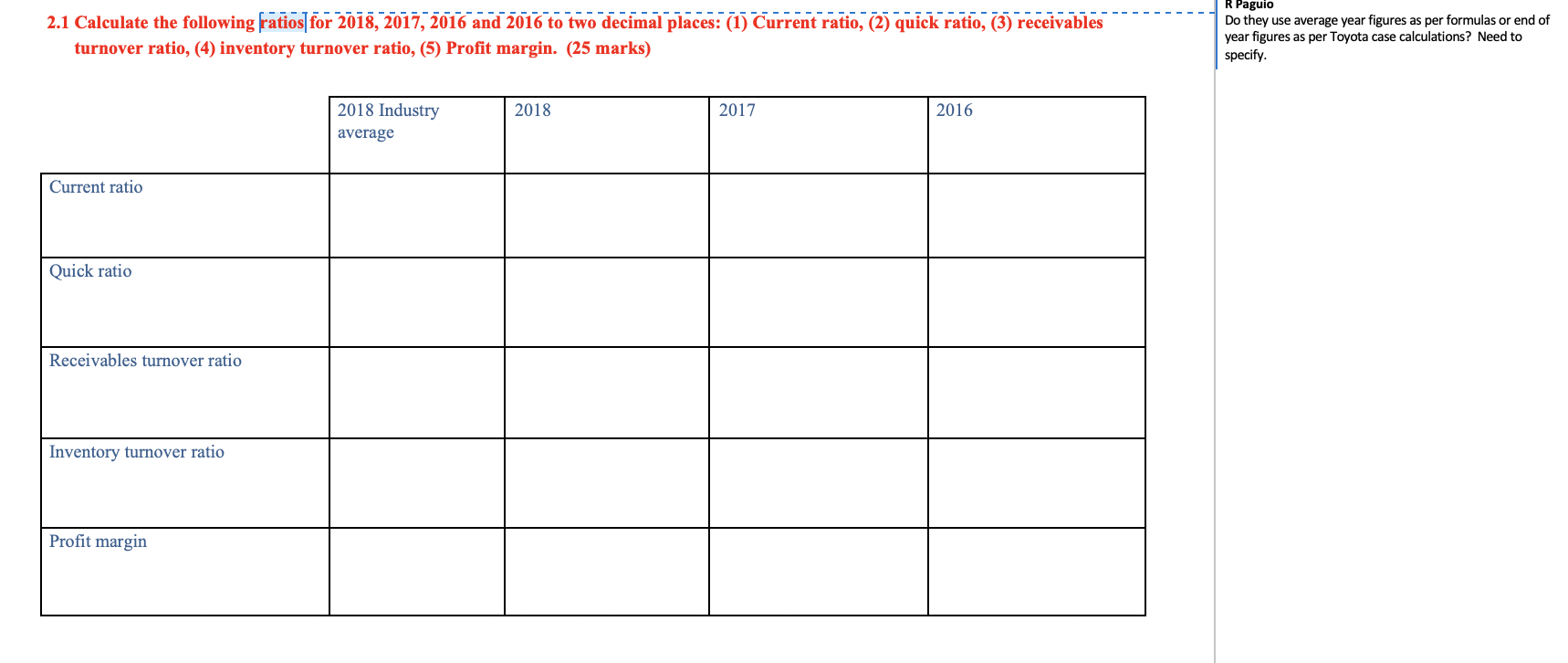

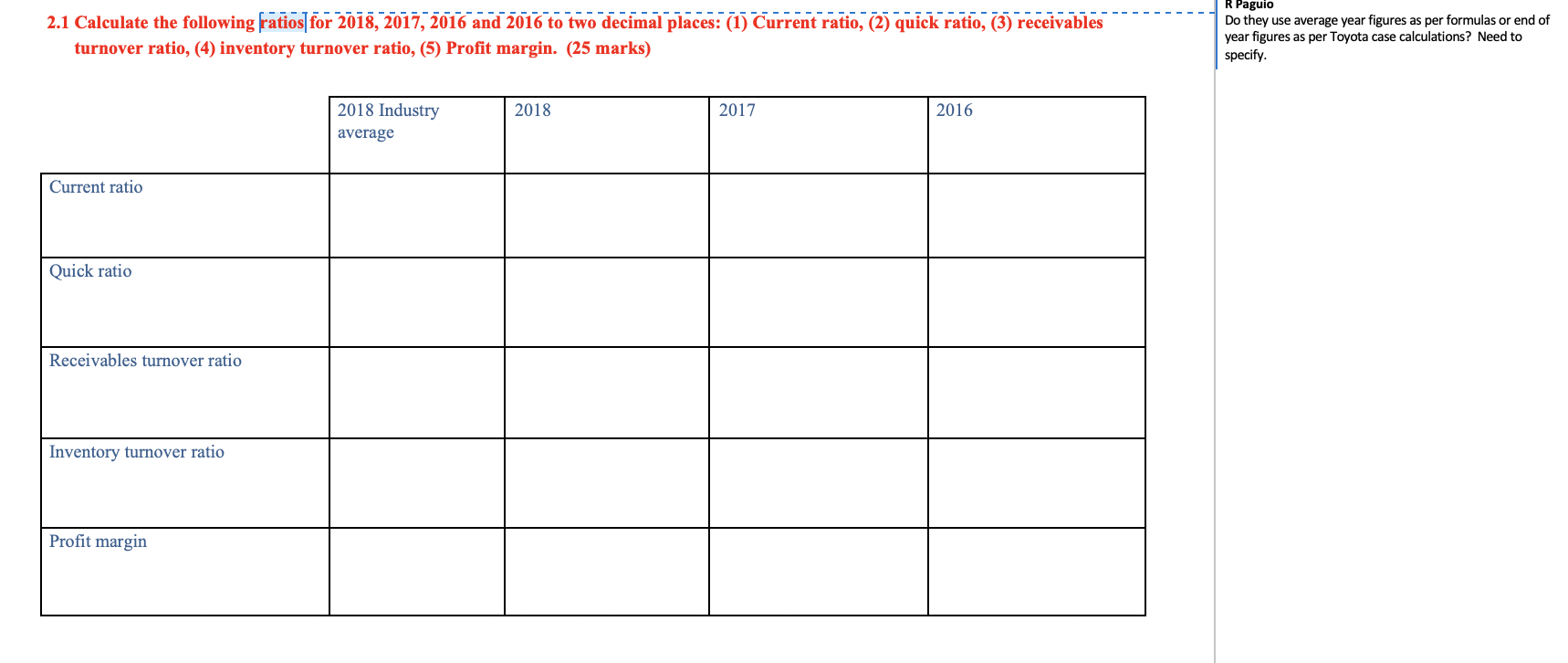

Question: 2.1

2.2: Both the current ratio and quick ratio are used to measure the liquidity of company. Explain how the quick ratio overcomes some of the limitations of the current ratio. (10 Marks)

2.3: Critically evaluate the liquidity position of DAIR for 2018 and 2017 (10 Marks)

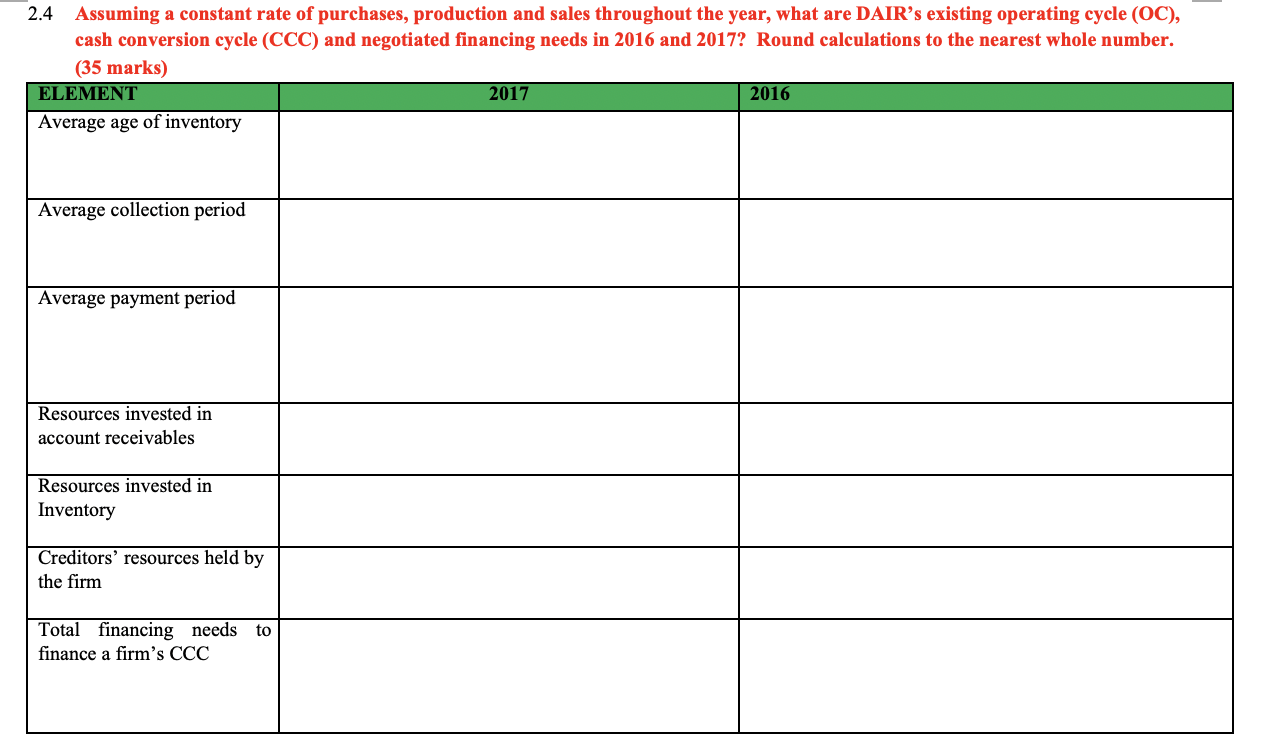

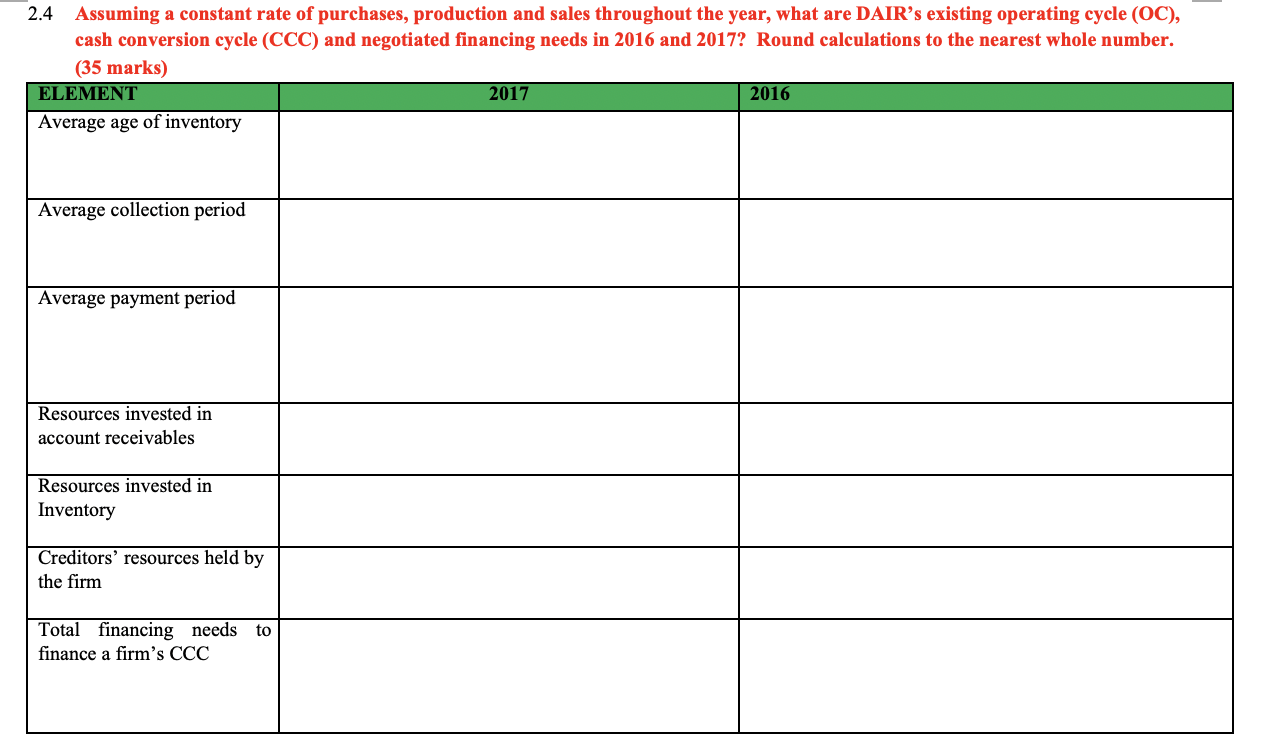

2.4:

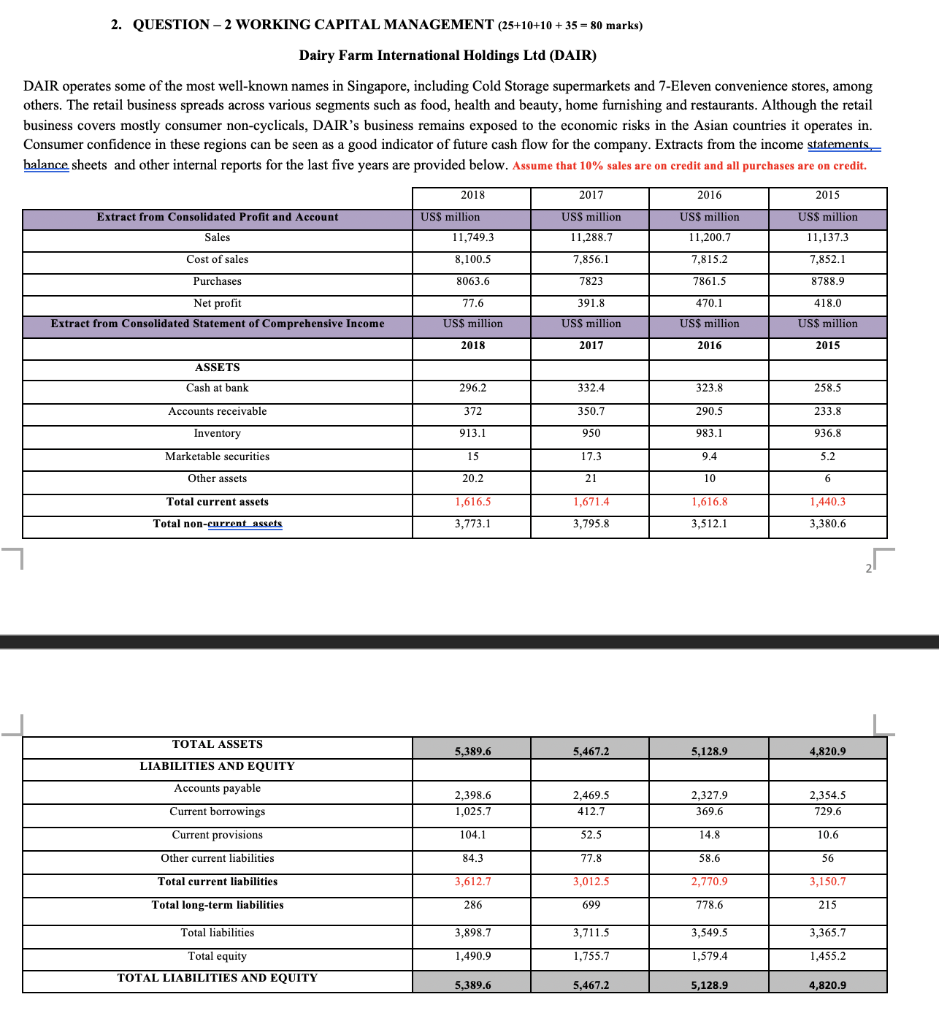

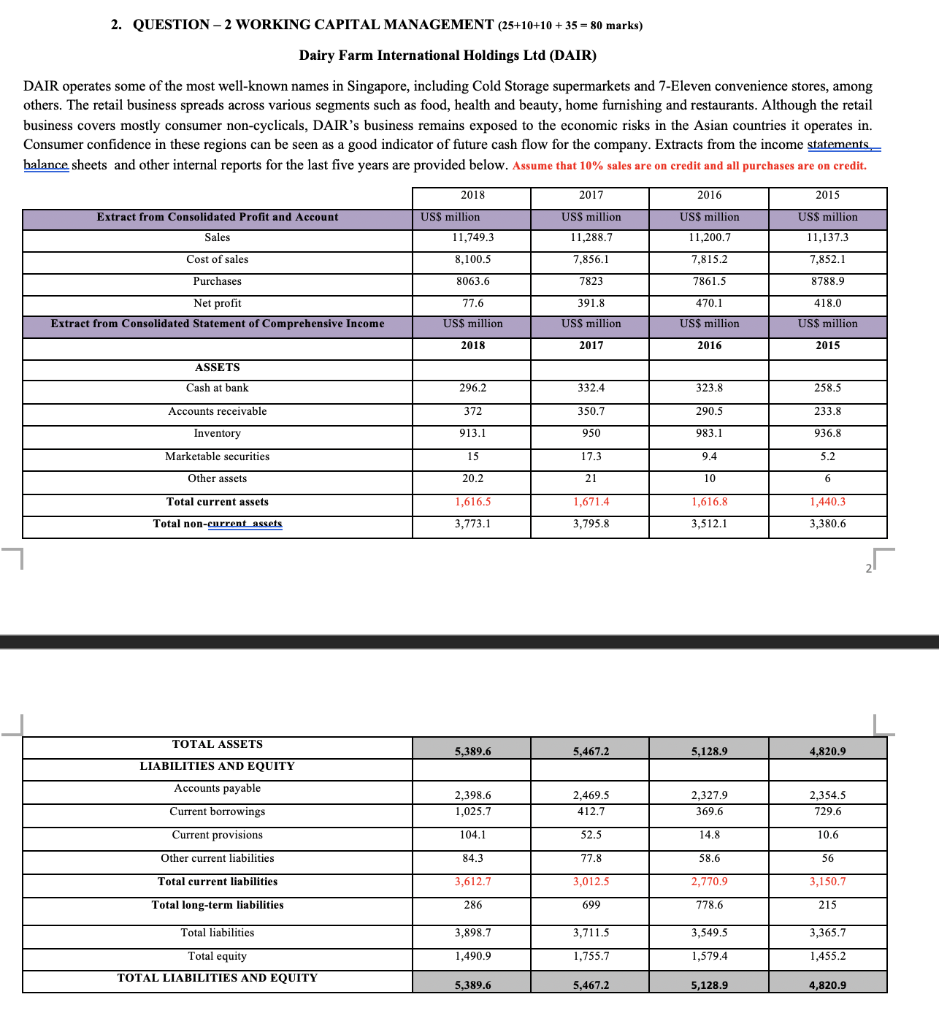

2. QUESTION - 2 WORKING CAPITAL MANAGEMENT (25+10+10 + 35 - 80 marks) Dairy Farm International Holdings Ltd (DAIR) DAIR operates some of the most well-known names in Singapore, including Cold Storage supermarkets and 7-Eleven convenience stores, among others. The retail business spreads across various segments such as food, health and beauty, home furnishing and restaurants. Although the retail business covers mostly consumer non-cyclicals, DAIR's business remains exposed to the economic risks in the Asian countries it operates in. Consumer confidence in these regions can be seen as a good indicator of future cash flow for the company. Extracts from the income statements. balance sheets and other internal reports for the last five years are provided below. Assume that 10% sales are on credit and all purchases are on credit. Extract from Consolidated Profit and Account Sales Cost of sales 2016 US$ million 11,200.7 2018 US$ million 11,749.3 8,100.5 8063.6 77.6 US$ million 7,815.2 2017 USS million 11,288.7 7,856.1 7823 391.8 US$ million 2017 2015 US$ million 11,137.3 7,852.1 8788.9 418.0 US$ million 2015 Purchases 7861.5 470.1 Net profit Extract from Consolidated Statement of Comprehensive Income | US$ million 2018 2016 ASSETS Cash at bank 296.2 332.4 323.8 258.5 Accounts receivable 1 233.8 350. 7 950 17.3 290.5 983.1 Inventory Marketable securities Other assets 936.8 9.4 5.2 913.1 15 20.2 1,616.5 3,773.1 21 10 Total current assets 1,440.3 1,671.4 3,795.8 1,616.8 3,512.1 Total non-current assets 3,380,6 TOTAL ASSETS 5,389.6 5,467.2 5,128.9 4,820.9 LIABILITIES AND EQUITY Accounts payable 2,398.6 1,025.7 2,469.5 412.7 2,327.9 369.6 2,354.5 729.6 Current borrowings Current provisions 104.1 52. 51 14.8 10.6 Other current liabilities 84.3 77.8 56 58.6 2,770. 9 Total current liabilities 3,612.7 3,012. 5 3,150.7 Total long-term liabilities 286 699 778.6 215 Total liabilities 3,549.5 3,898.7 1,490.9 3,711.5 1,755.7 3,365.7 1,455.2 1,579.4 Total equity TOTAL LIABILITIES AND EQUITY 5,389.6 5,467.2 9 5,128. 4 ,820.9 - - - - - - - - - - - 2.1 Calculate the following ratios for 2018, 2017, 2016 and 2016 to two decimal places: (1) Current ratio, (2) quick ratio, (3) receivables turnover ratio, (4) inventory turnover ratio, (5) Profit margin. (25 marks) R Paguio Do they use average year figures as per formulas or end of year figures as per Toyota case calculations? Need to specify. 2018 2017 2016 2018 Industry average Current ratio Quick ratio Receivables turnover ratio Inventory turnover ratio Profit margin 2.4 Assuming a constant rate of purchases, production and sales throughout the year, what are DAIR's existing operating cycle (OC), cash conversion cycle (CCC) and negotiated financing needs in 2016 and 2017? Round calculations to the nearest whole number. (35 marks) ELEMENT 2017 2016 Average age of inventory Average collection period Average payment period Resources invested in account receivables Resources invested in Inventory Creditors' resources held by the firm Total financing needs to finance a firm's CCC