Answered step by step

Verified Expert Solution

Question

1 Approved Answer

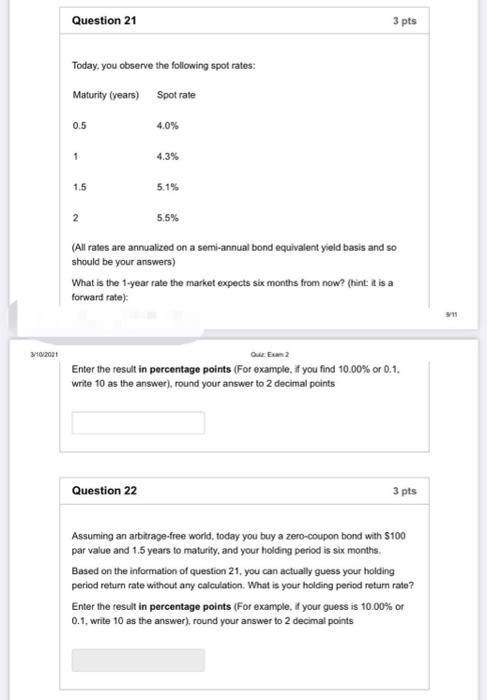

Question 21 3 pts Today, you observe the following spot rates: Maturity (years) Spot rate 0.5 4.0% 1 4.3% 1.5 5.1% 2 5.5% (All rates

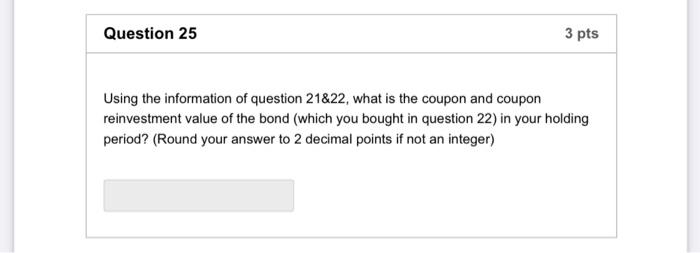

Question 21 3 pts Today, you observe the following spot rates: Maturity (years) Spot rate 0.5 4.0% 1 4.3% 1.5 5.1% 2 5.5% (All rates are annualized on a semi-annual bond equivalent yield basis and so should be your answers) What is the 1-year rate the market expects six months from now? (hint: it is a forward rate): 340/2001 Enter the result in percentage points (For example, if you find 10.00% or 0.1. write 10 as the answer), round your answer to 2 decimal points Question 22 3 pts Assuming an arbitrage-free world, today you buy a zero-coupon bond with $100 par value and 1.5 years to maturity, and your holding period is six months. Based on the information of question 21, you can actually guess your holding period return rate without any calculation. What is your holding period return rato? Enter the result in percentage points (For example. If your guess is 10.00% or 0.1, Write 10 as the answer), round your answer to 2 decimal points Question 25 3 pts Using the information of question 21&22, what is the coupon and coupon reinvestment value of the bond (which you bought in question 22) in your holding period? (Round your answer to 2 decimal points if not an integer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started