Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 21 If a 20 year bond has an annual coupon of $11.25 and its market price is $1,010 the yield to maturity is less

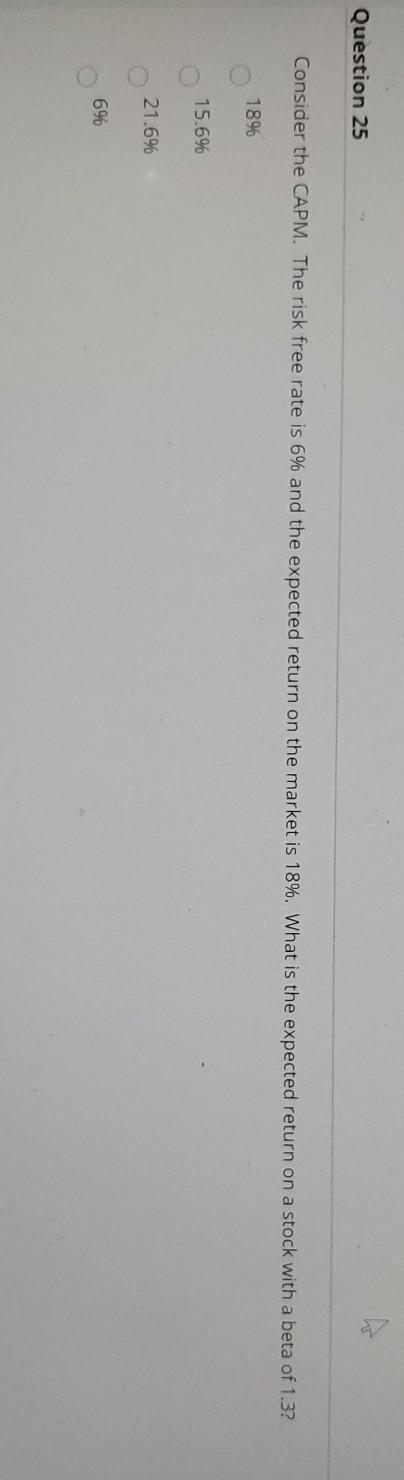

Question 21 If a 20 year bond has an annual coupon of $11.25 and its market price is $1,010 the yield to maturity is less than 1.2%. True False Question 22 The margin to buy a stock is set by the Federal Reserve. Margin is the percentage that you can borrow to buy a stock. True False Consider the liquidity preference theory of yield curves. on average one would expect investors to require a higher yield on long term bonds than short term bonds A higher yield on on AA bonds than on BB bonds higher yield on short term bonds because they mature quickly. the same yield on short and long term bonds as long as they are at least AA. Question 24 Question 24 of 36 The Chair of the Federal Reserve, Jerome Powell, announced this year that the Fed will let inflation go above 2% and will keep rates very low for a long period of time to help the economy recover. 10 points Save Answe True False Question 25 Consider the CAPM. The risk free rate is 6% and the expected return on the market is 18%. What is the expected return on a stock with a beta of 1.3? 18% 15.6% 21.6% 6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started