Answered step by step

Verified Expert Solution

Question

1 Approved Answer

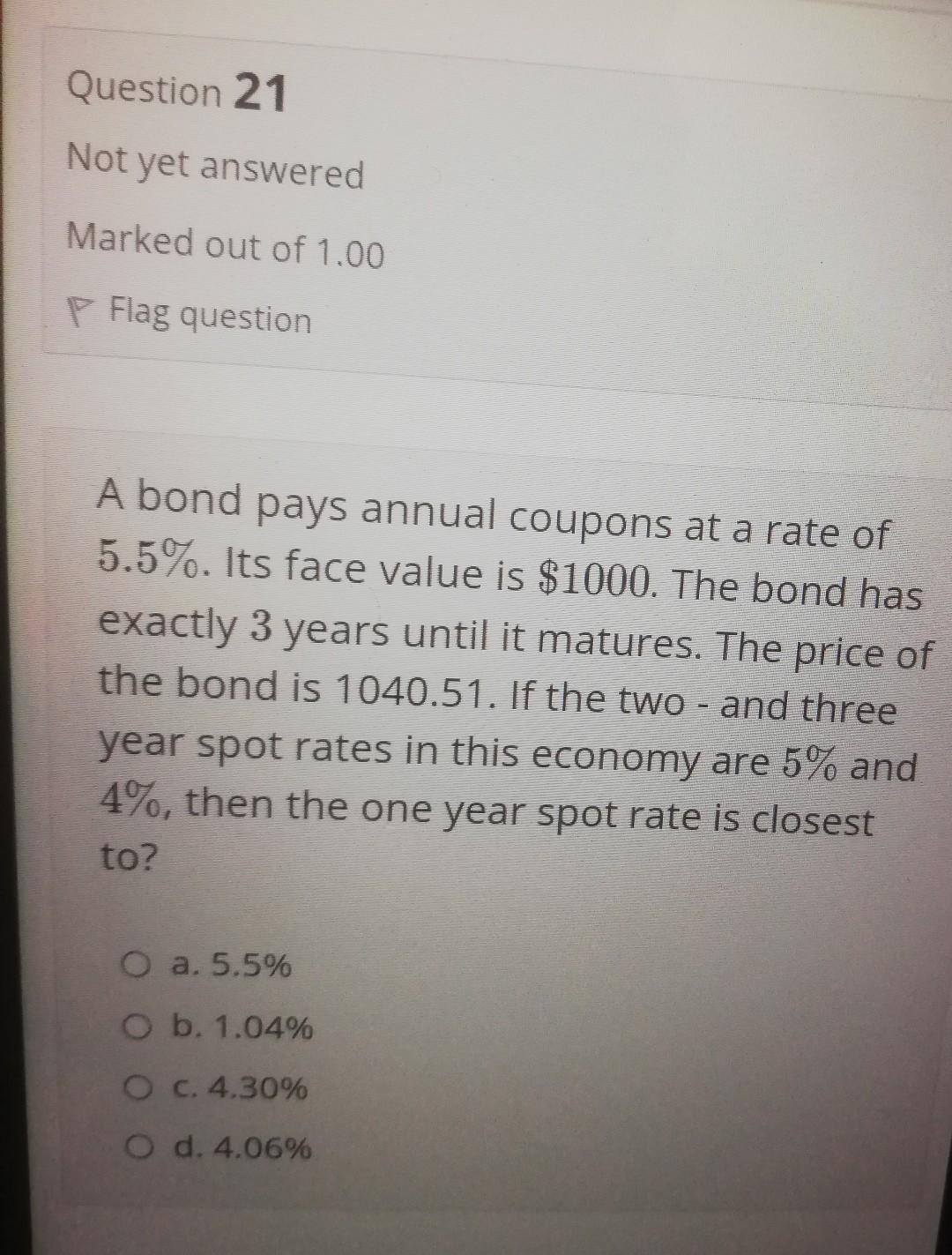

Question 21 Not yet answered Marked out of 1.00 P Flag question A bond pays annual coupons at a rate of 5.5%. Its face value

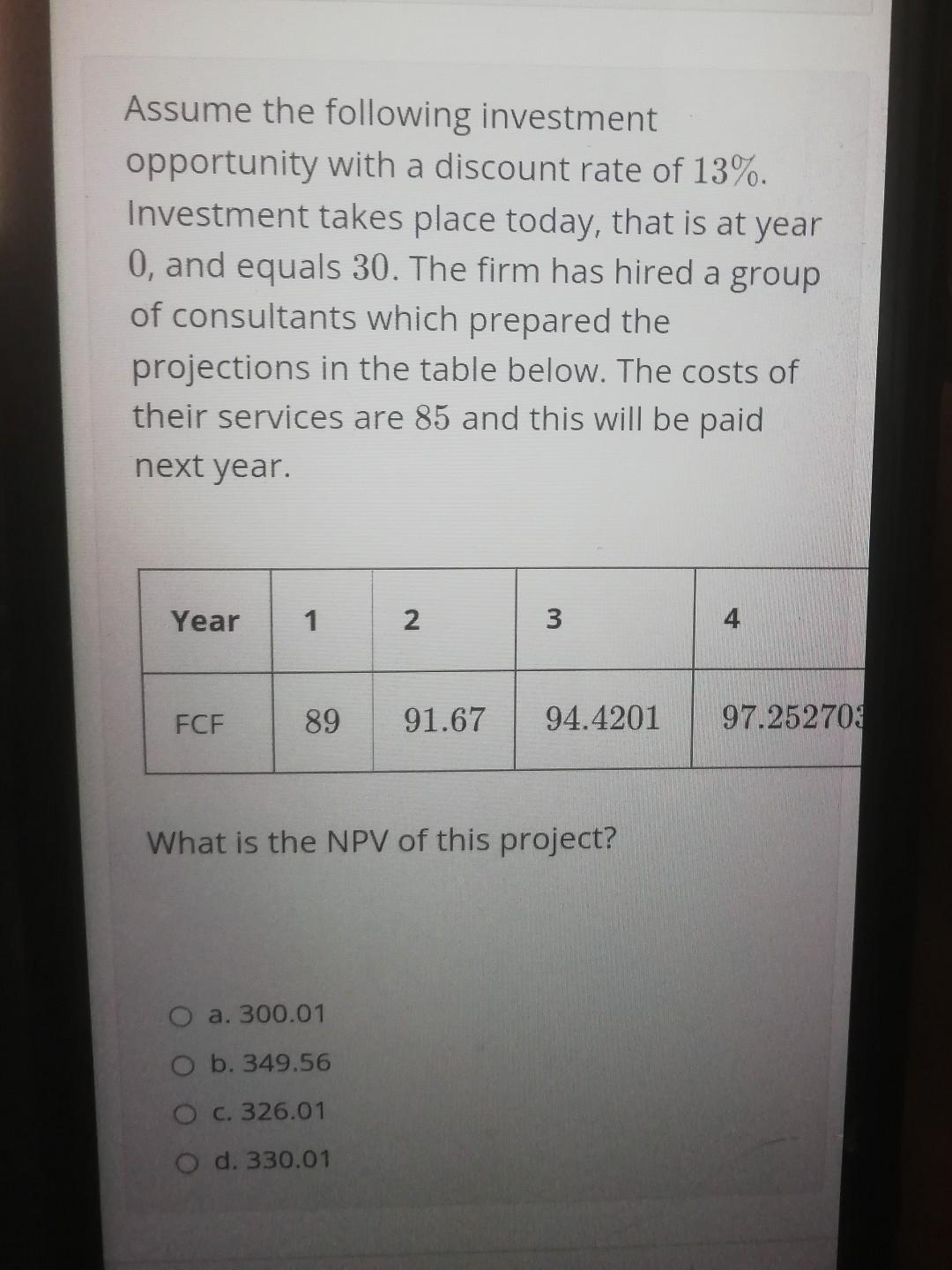

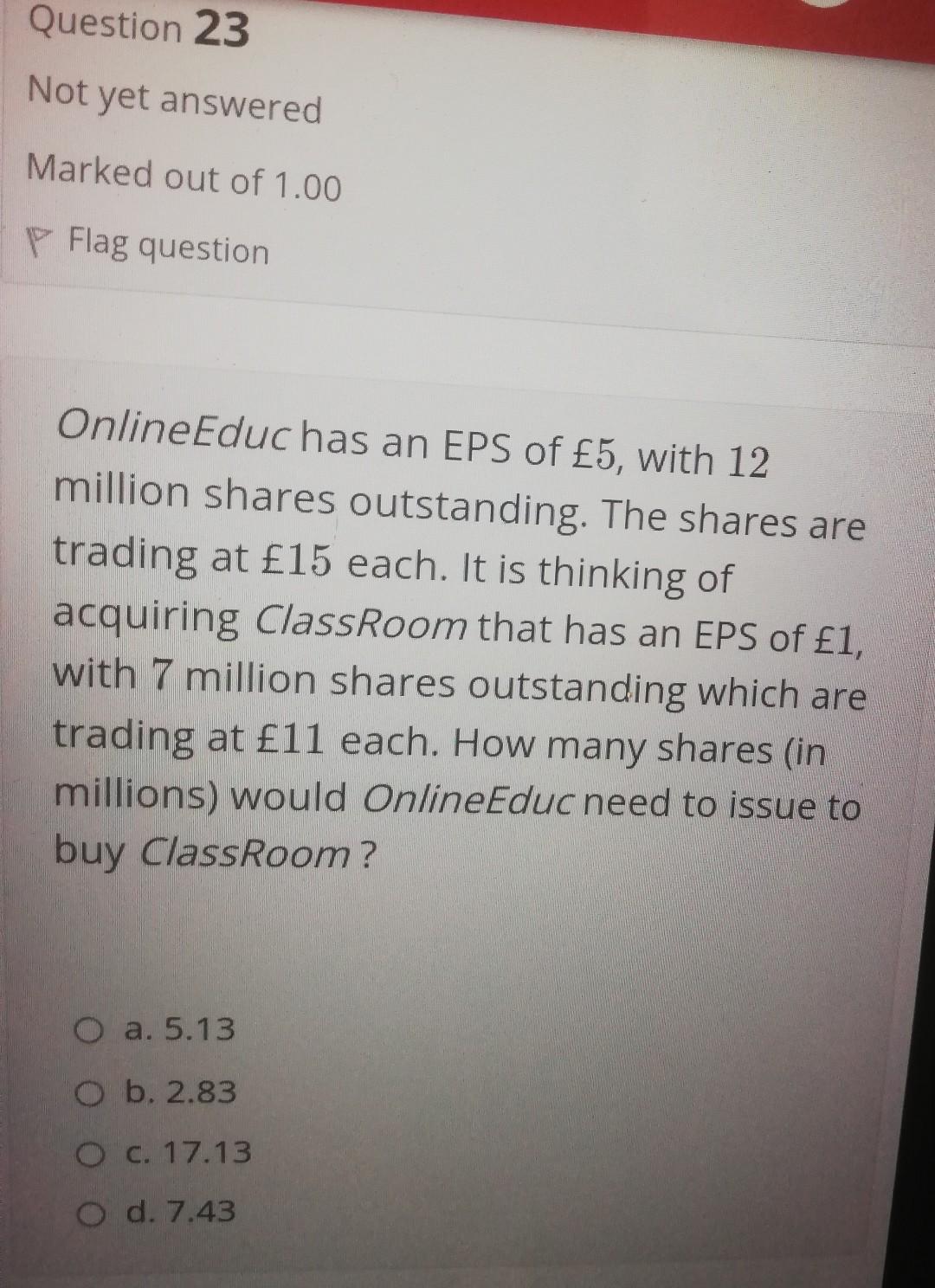

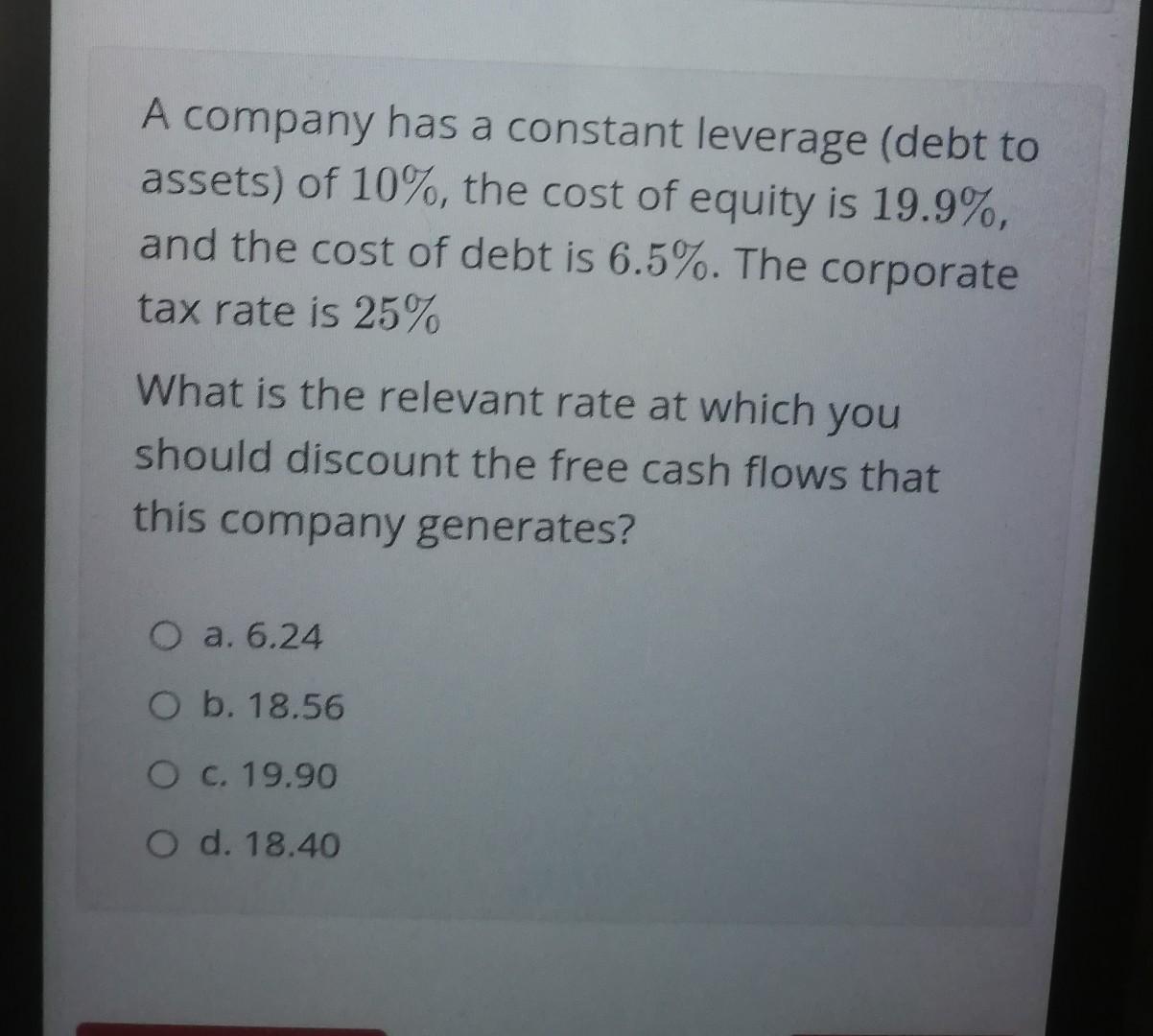

Question 21 Not yet answered Marked out of 1.00 P Flag question A bond pays annual coupons at a rate of 5.5%. Its face value is $1000. The bond has exactly 3 years until it matures. The price of the bond is 1040.51. If the two - and three year spot rates in this economy are 5% and 4%, then the one year spot rate is closest to? O a. 5.5% O b. 1.04% O c. 4.30% O d. 4.06% Assume the following investment opportunity with a discount rate of 13%. Investment takes place today, that is at year 0, and equals 30. The firm has hired a group of consultants which prepared the projections in the table below. The costs of their services are 85 and this will be paid next year. Year 1 2. 3 4 FCF 89 91.67 94.4201 97.25270 What is the NPV of this project? a. 300.01 O b. 349.56 O c. 326.01 O d. 330.01 Question 23 Not yet answered Marked out of 1.00 Flag question Online Educhas an EPS of 5, with 12 million shares outstanding. The shares are trading at 15 each. It is thinking of acquiring Classroom that has an EPS of 1, with 7 million shares outstanding which are trading at 11 each. How many shares in millions) would OnlineEduc need to issue to buy Classroom? O a. 5.13 O b. 2.83 O c. 17.13 O d. 7.43 A company has a constant leverage (debt to assets) of 10%, the cost of equity is 19.9%, and the cost of debt is 6.5%. The corporate tax rate is 25% What is the relevant rate at which you should discount the free cash flows that this company generates? O a. 6.24 O b. 18.56 O c. 19.90 O d. 18.40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started