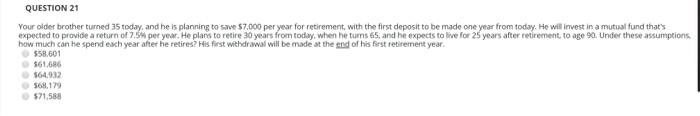

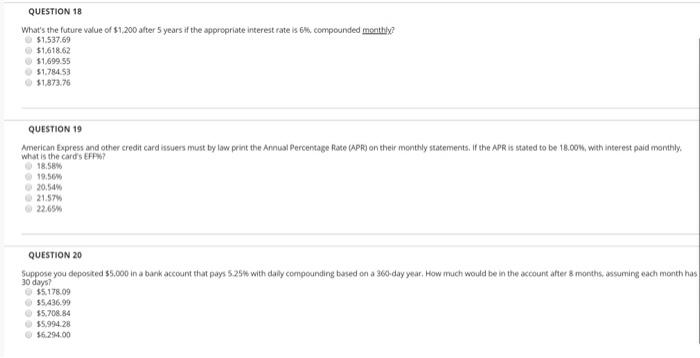

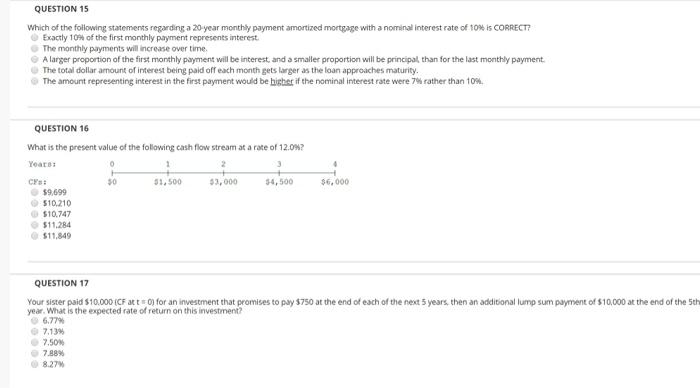

QUESTION 21 Your older brother turned 35 today, and he is planning to save $7.000 per year for retirement with the first deposit to be made one year from today. He will invest in a mutual fund that's expected to provide a return of 7.5 per year. He plans to retire 30 years from today, when he turns 65 and be expects to live for 25 years after retirement to age 90. Under these assumptions how much can he spend each year after he retires? His first withdrawal will be made at the end of his first retirement year. 558.601 561686 $64.92 568.179 571,588 QUESTION 18 What's the future value of $1.200 after 5 years if the appropriate interest rate is 68. compounded monthly $1.537.69 $1.618.62 $1,699.55 51.78453 $1,873.75 QUESTION 19 American Express and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 18.00w, with interest paid morthly, what is the cards EFPM? 18.58% 19.56% 20.54% 21.57% 22,65% QUESTION 20 Suppose you deposited 55.000 in a bank account that pays 5.254 with daily compounding based on a 360day wear, How much would be in the account after 8 months, assuming each month has 55.178.09 55.436.99 $5.708.84 $5.994.28 56.291.00 QUESTION 15 Which of the following statements regarding a 20-year monthly payment amortized mortgage with a nominal interest rate of 10% is CORRECT? Exactly 10% of the first monthly payment represents interest The monthly payments will increase over time A larger proportion of the first monthly payment will be interest and a smaller proportion will be principal, than for the last monthly payment. The total dollar amount of interest being paid off each month gets langer as the loan approaches maturity. The amount representing interest in the first payment would be bisher if the nominal interest rate were 7 rather than to QUESTION 16 What is the present value of the following cash flow stream at a rate of 12.092 Yoara CY: 51,500 53,000 34,500 59,699 510,210 510.747 $11.284 $11.849 $6,000 QUESTION 17 Your sister paid $10.000 CF att for an investment that promises to pay $750 at the end of each of the next 5 years, then an additional lump sum payment of $10,000 at the end of the Sth year. What is the expected rate of return on this investment? 6.77% 7.13 7.50 7.88% 8.27%