Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 21.3 (Company tax return) Elite Designs Pty Ltd, a resident Australian private company, specialising in Architectural designs and associated services. Its relevant details are:

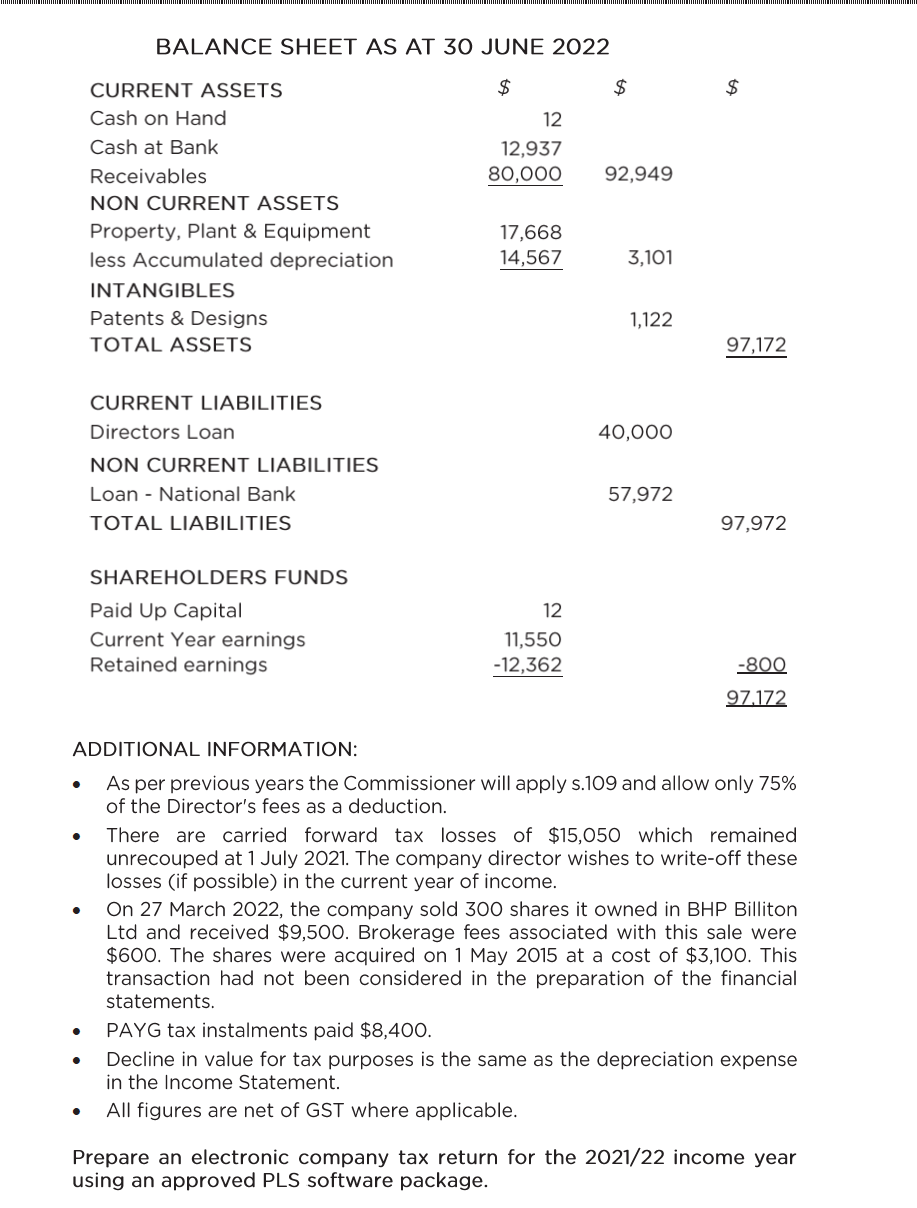

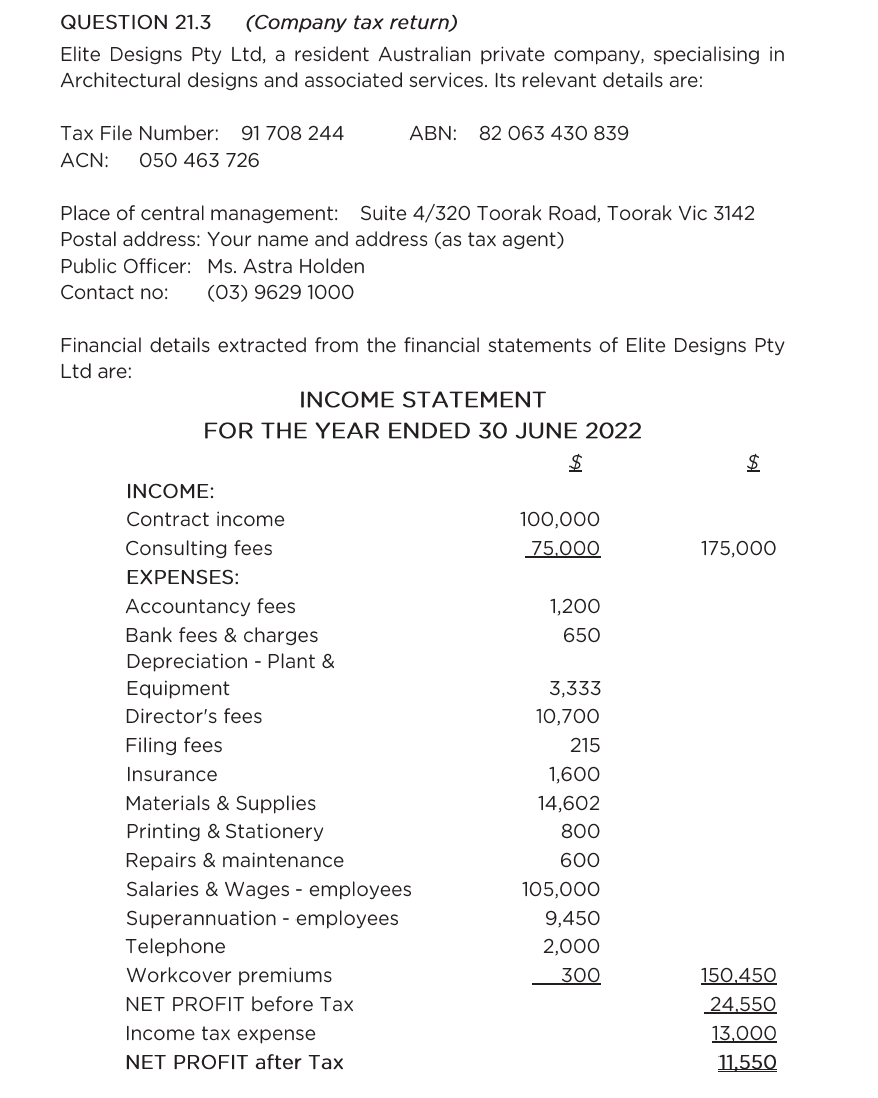

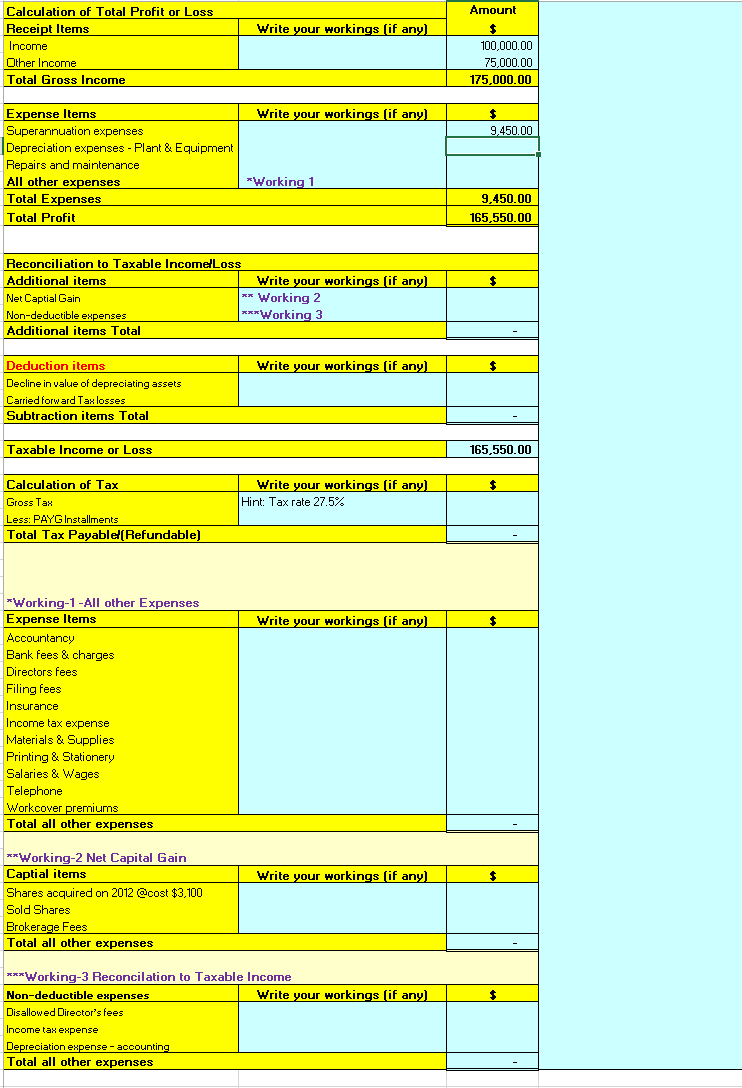

QUESTION 21.3 (Company tax return) Elite Designs Pty Ltd, a resident Australian private company, specialising in Architectural designs and associated services. Its relevant details are: Tax File Number: 91708244 ABN: 82063430839 ACN: 050463726 Place of central management: Suite 4/320 Toorak Road, Toorak Vic 3142 Postal address: Your name and address (as tax agent) Public Officer: Ms. Astra Holden Contact no: (03) 96291000 Financial details extracted from the financial statements of Elite Designs Pty Ltd are: BALANCE SHEET AS AT 30 JUNE 2022 ADDITIONAL INFORMATION: - As per previous years the Commissioner will apply s.109 and allow only 75% of the Director's fees as a deduction. - There are carried forward tax losses of \$15,050 which remained unrecouped at 1 July 2021. The company director wishes to write-off these losses (if possible) in the current year of income. - On 27 March 2022, the company sold 300 shares it owned in BHP Billiton Ltd and received $9,500. Brokerage fees associated with this sale were $600. The shares were acquired on 1 May 2015 at a cost of $3,100. This transaction had not been considered in the preparation of the financial statements. - PAYG tax instalments paid $8,400. - Decline in value for tax purposes is the same as the depreciation expense in the Income Statement. - All figures are net of GST where applicable. Prepare an electronic company tax return for the 2021/22 income year using an approved PLS software package

QUESTION 21.3 (Company tax return) Elite Designs Pty Ltd, a resident Australian private company, specialising in Architectural designs and associated services. Its relevant details are: Tax File Number: 91708244 ABN: 82063430839 ACN: 050463726 Place of central management: Suite 4/320 Toorak Road, Toorak Vic 3142 Postal address: Your name and address (as tax agent) Public Officer: Ms. Astra Holden Contact no: (03) 96291000 Financial details extracted from the financial statements of Elite Designs Pty Ltd are: BALANCE SHEET AS AT 30 JUNE 2022 ADDITIONAL INFORMATION: - As per previous years the Commissioner will apply s.109 and allow only 75% of the Director's fees as a deduction. - There are carried forward tax losses of \$15,050 which remained unrecouped at 1 July 2021. The company director wishes to write-off these losses (if possible) in the current year of income. - On 27 March 2022, the company sold 300 shares it owned in BHP Billiton Ltd and received $9,500. Brokerage fees associated with this sale were $600. The shares were acquired on 1 May 2015 at a cost of $3,100. This transaction had not been considered in the preparation of the financial statements. - PAYG tax instalments paid $8,400. - Decline in value for tax purposes is the same as the depreciation expense in the Income Statement. - All figures are net of GST where applicable. Prepare an electronic company tax return for the 2021/22 income year using an approved PLS software package Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started