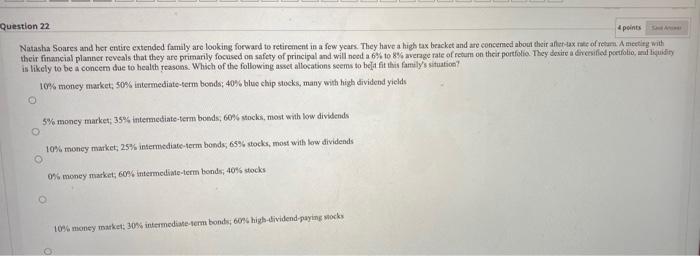

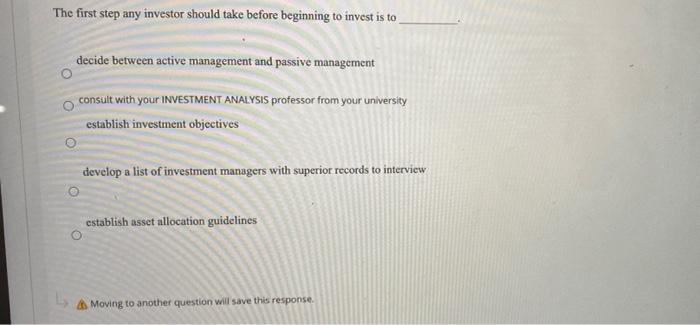

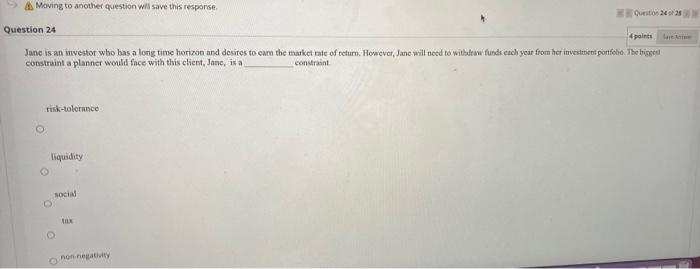

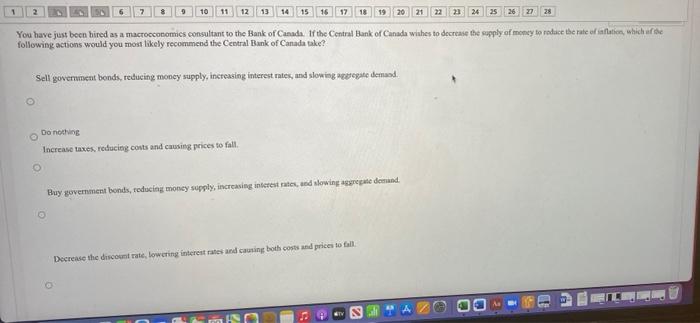

Question 22 4 points Natasha Soares and her entire extended family are looking forward to retirement in a few years. They have a high tax bracket and are concemed about their after-tax rate of retum. A meeting with their financial planner reveals that they are primarily focused on safety of principal and will need a 6% to 8% average rate of return on their portfolio They desire a diversified portfolio, liquidity is likely to be a concem doc to health reasons. Which of the following asset allocations seems to be fit this family's situation 10% money market 50% intermediate-term bonds: 40% blue chip stocks, many with high dividend yields O 5% mocy market: 35% intermediate-term bonds, 60% stocks, most with low dividends 10% money market, 25% intermediate-term bonds, 65% stocks, most with low dividends 0% money market: 60% intermediate-term bonds; 40% stocks 10% money market: 30% intermediate-term bond, high-dividend paying socks O The first step any investor should take before beginning to invest is to decide between active management and passive management consult with your INVESTMENT ANALYSIS professor from your university establish investment objectives develop a list of investment managers with superior records to interview establish asset allocation guidelines Moving to another question will save this response. Moving to another question will save this response Question 24/24 Question 24 points Junc is an investor who has a long time horizon and desires to earn the market rate of return. However, Jane will need to withdraw funds each year from her investitsient portfolio The hippet constraint a planner would face with this client, Jane, is a constraint lures risk-tolerance O liquidity social non negativity 7 8 9 10 11 12 13 14 15 16 17 21 22 23 24 25 22 28 You have just been hired as a macroccatomes consultant to the Bank of Canada. If the Central Bank of Canada wishes to decrease the supply of money to reduce the rate of inflation, which i the following actions would you most likely recommend the Central Bank of Canada take? Sell government bonds, reducing money supply, increasing interest rates, and slowing repregate demand. Do nothing Increase taxes, reducing costs and causing prices to fall. Buy government bonds, reducing money supply, increasing interest rates, and slowing aggregate demand. Decrease the discount rate, lowering interest rates and causing both costs and prices to fall