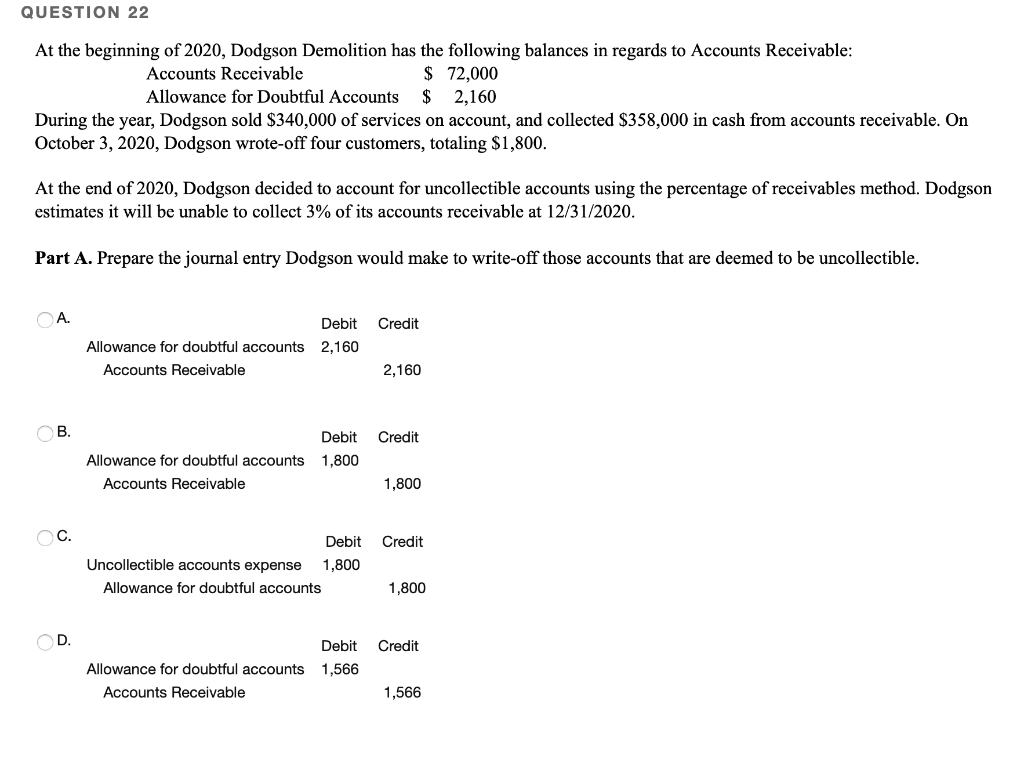

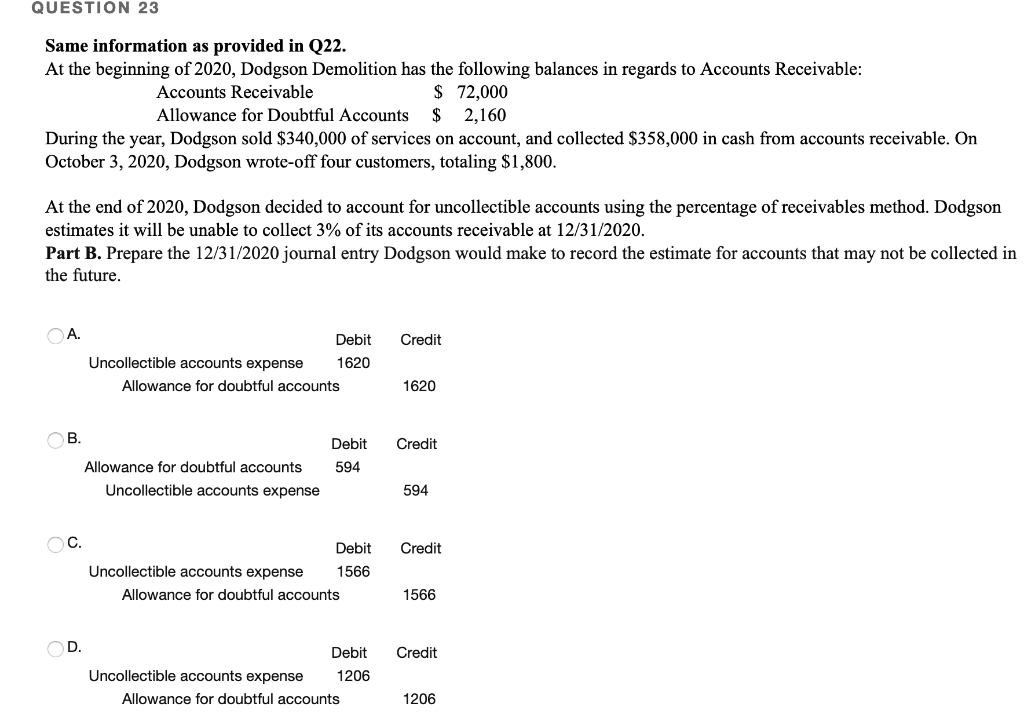

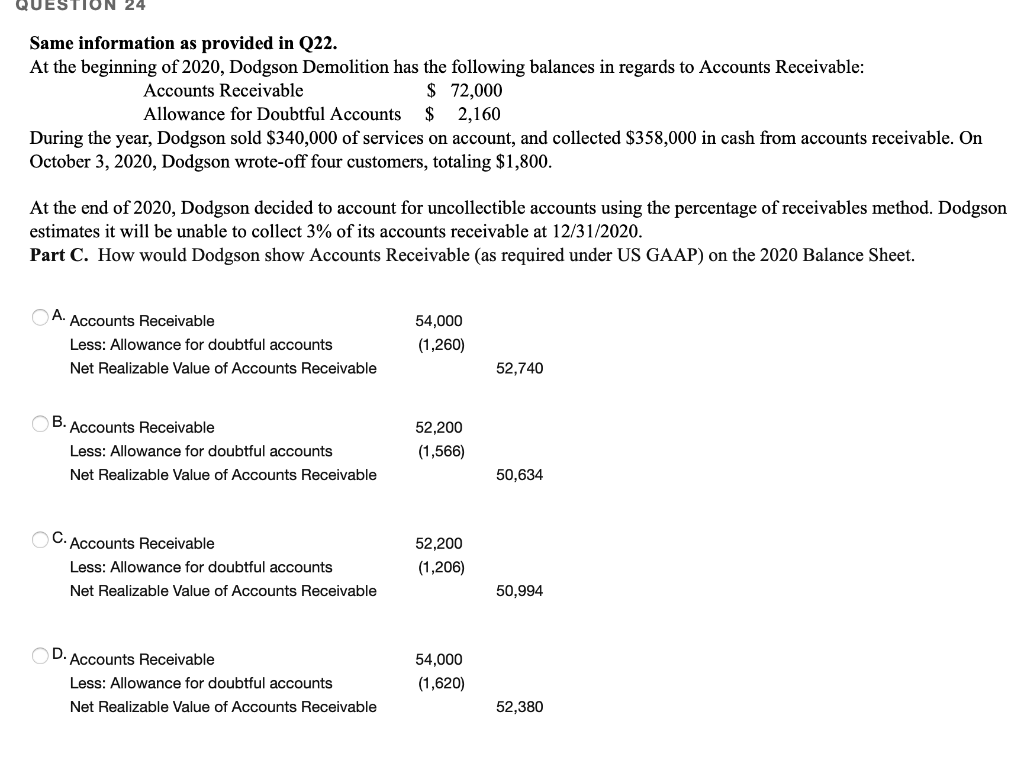

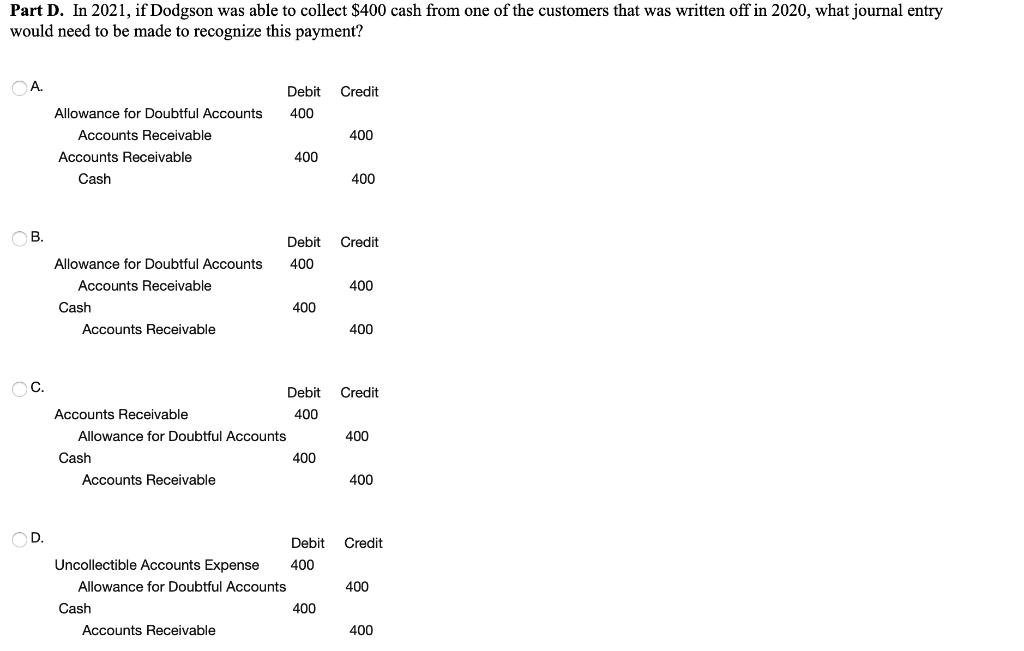

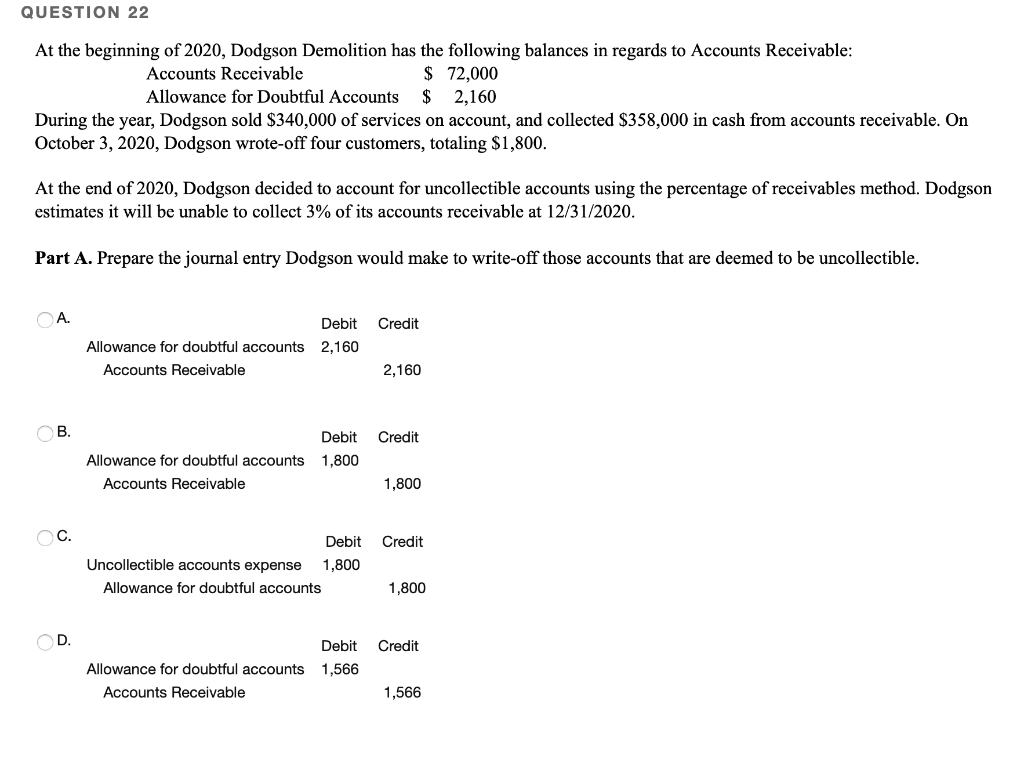

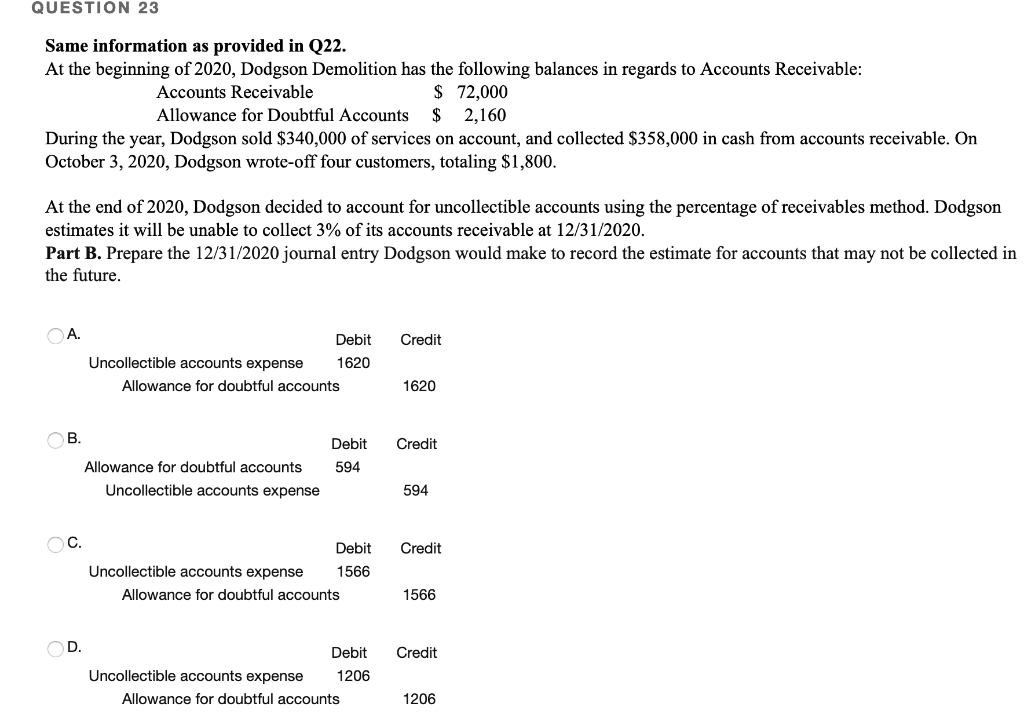

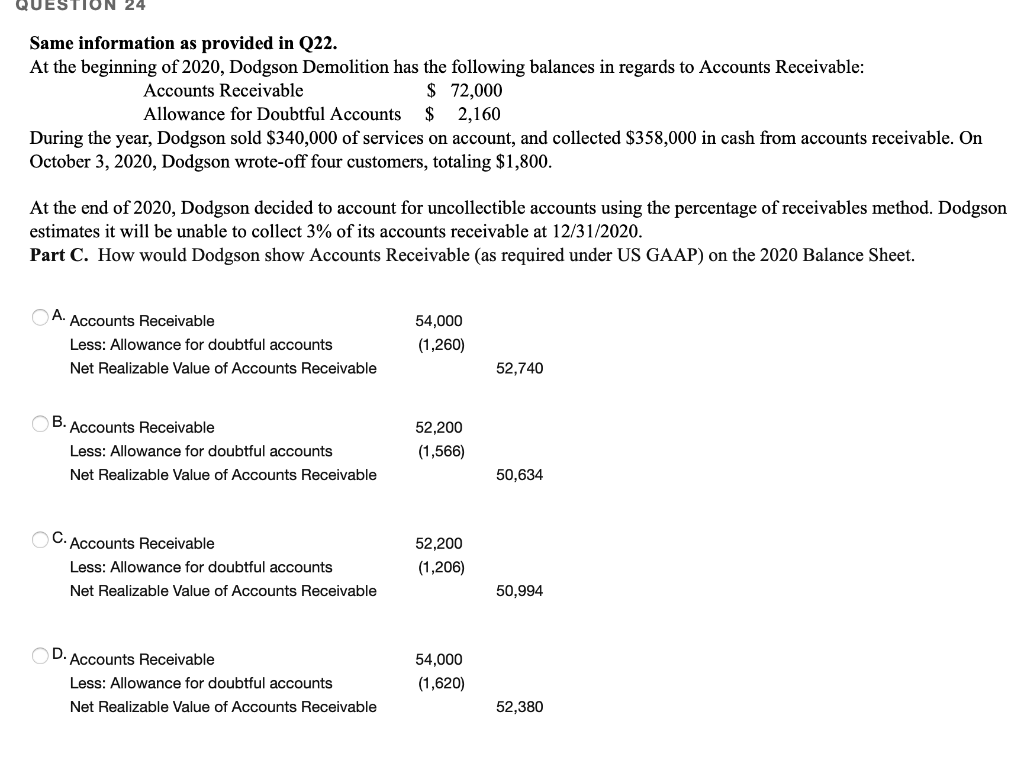

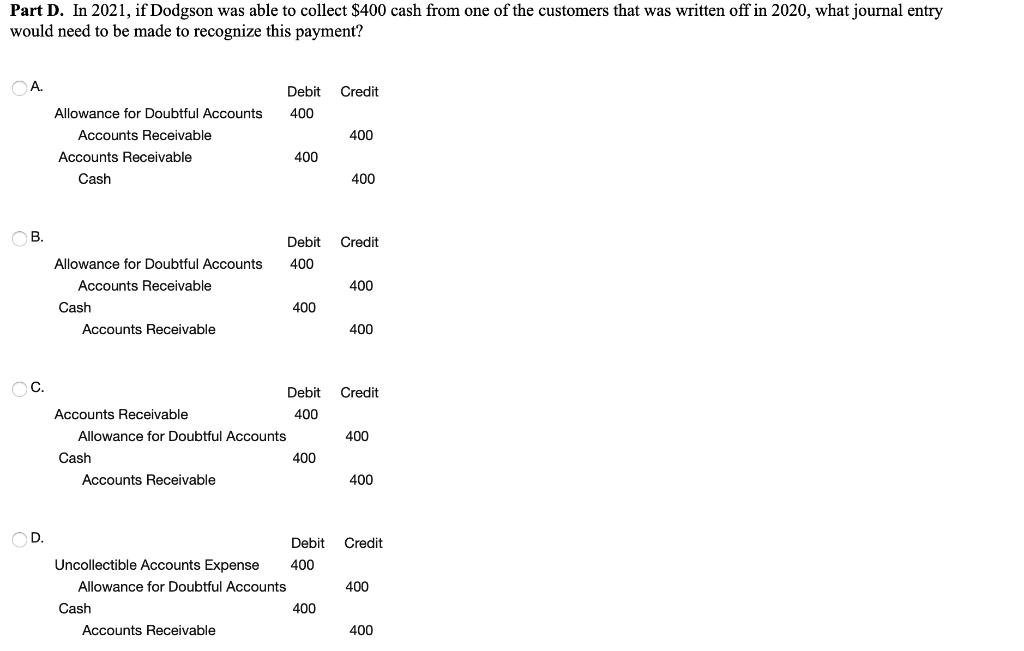

QUESTION 22 At the beginning of 2020, Dodgson Demolition has the following balances in regards to Accounts Receivable: Accounts Receivable $ 72,000 Allowance for Doubtful Accounts $ 2,160 During the year, Dodgson sold $340,000 of services on account, and collected $358,000 in cash from accounts receivable. On October 3, 2020, Dodgson wrote-off four customers, totaling $1,800. At the end of 2020, Dodgson decided to account for uncollectible accounts using the percentage of receivables method. Dodgson estimates it will be unable to collect 3% of its accounts receivable at 12/31/2020. Part A. Prepare the journal entry Dodgson would make to write-off those accounts that are deemed to be uncollectible. A. Credit Debit Allowance for doubtful accounts 2,160 Accounts Receivable 2,160 B. Credit Debit 1,800 Allowance for doubtful accounts Accounts Receivable 1,800 C. Credit Debit Uncollectible accounts expense 1,800 Allowance for doubtful accounts 1,800 D Debit Credit 1,566 Allowance for doubtful accounts Accounts Receivable 1,566 QUESTION 23 Same information as provided in Q22. At the beginning of 2020, Dodgson Demolition has the following balances in regards to Accounts Receivable: Accounts Receivable $ 72,000 Allowance for Doubtful Accounts $ 2,160 During the year, Dodgson sold $340,000 of services on account, and collected $358,000 in cash from accounts receivable. On October 3, 2020, Dodgson wrote-off four customers, totaling $1,800. At the end of 2020, Dodgson decided to account for uncollectible accounts using the percentage of receivables method. Dodgson estimates it will be unable to collect 3% of its accounts receivable at 12/31/2020. Part B. Prepare the 12/31/2020 journal entry Dodgson would make to record the estimate for accounts that may not be collected in the future. A. Credit Debit Uncollectible accounts expense 1620 Allowance for doubtful accounts 1620 B. Debit Credit 594 Allowance for doubtful accounts Uncollectible accounts expense 594 C. Credit Debit Uncollectible accounts expense 1566 Allowance for doubtful accounts 1566 D. Credit Debit Uncollectible accounts expense 1206 Allowance for doubtful accounts 1206 QUESTION 24 Same information as provided in Q22. At the beginning of 2020, Dodgson Demolition has the following balances in regards to Accounts Receivable: Accounts Receivable $ 72,000 Allowance for Doubtful Accounts $ 2,160 During the year, Dodgson sold $340,000 of services on account, and collected $358,000 in cash from accounts receivable. On October 3, 2020, Dodgson wrote-off four customers, totaling $1,800. At the end of 2020, Dodgson decided to account for uncollectible accounts using the percentage of receivables method. Dodgson estimates it will be unable to collect 3% of its accounts receivable at 12/31/2020. Part C. How would Dodgson show Accounts Receivable (as required under US GAAP) on the 2020 Balance Sheet. A. Accounts Receivable Less: Allowance for doubtful accounts Net Realizable Value of Accounts Receivable 54,000 (1,260) 52,740 B. Accounts Receivable Less: Allowance for doubtful accounts Net Realizable Value of Accounts Receivable 52,200 (1,566) 50,634 C. Accounts Receivable Less: Allowance for doubtful accounts Net Realizable Value of Accounts Receivable 52,200 (1,206) 50,994 D. Accounts Receivable Less: Allowance for doubtful accounts Net Realizable Value of Accounts Receivable 54,000 (1,620) 52,380 Part D. In 2021, if Dodgson was able to collect $400 cash from one of the customers that was written off in 2020, what journal entry would need to be made to recognize this payment? A. Credit Debit 400 400 Allowance for Doubtful Accounts Accounts Receivable Accounts Receivable Cash 400 400 B. Debit Credit 400 400 Allowance for Doubtful Accounts Accounts Receivable Cash Accounts Receivable 400 400 C. Credit Debit Accounts Receivable 400 Allowance for Doubtful Accounts Cash 400 Accounts Receivable 400 400 D. Credit Debit Uncollectible Accounts Expense 400 Allowance for Doubtful Accounts Cash 400 Accounts Receivable 400 400