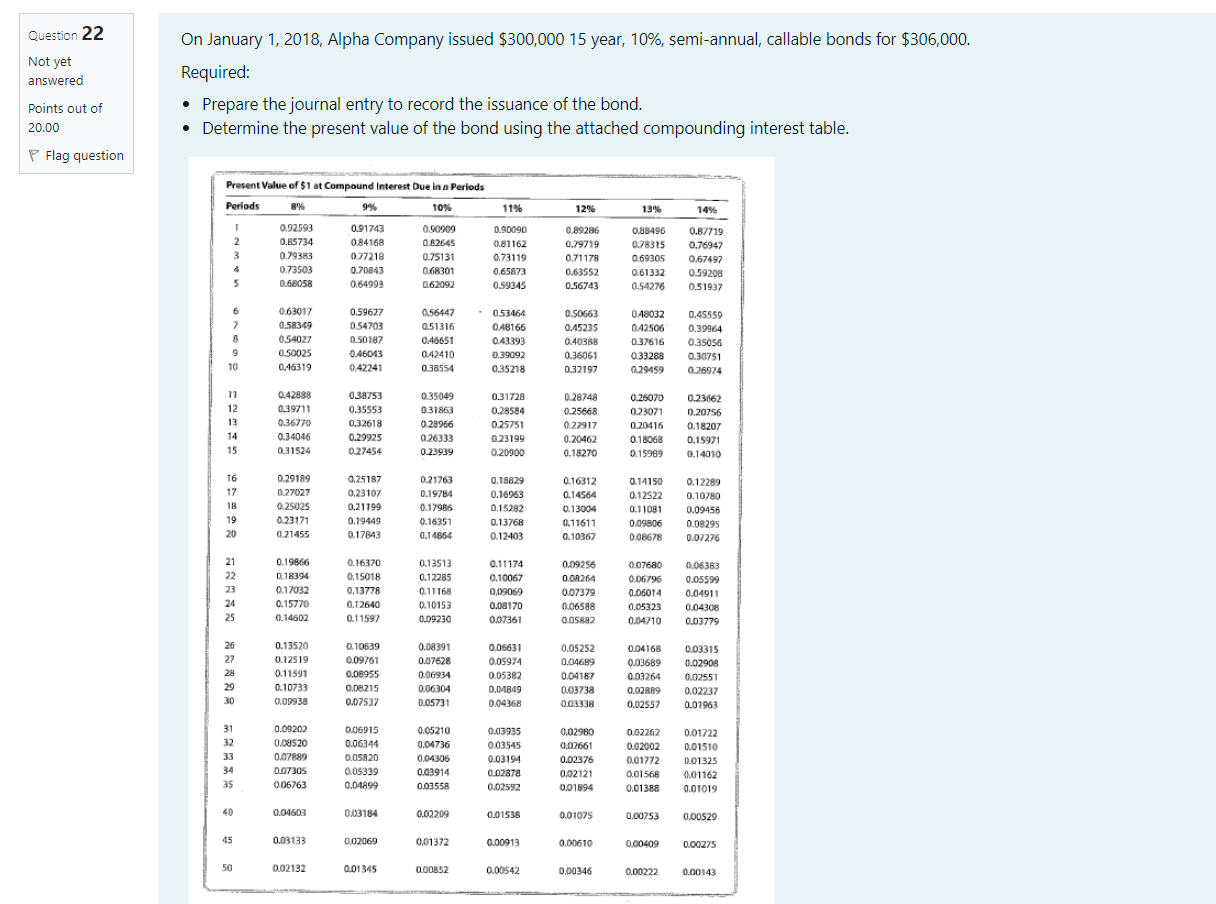

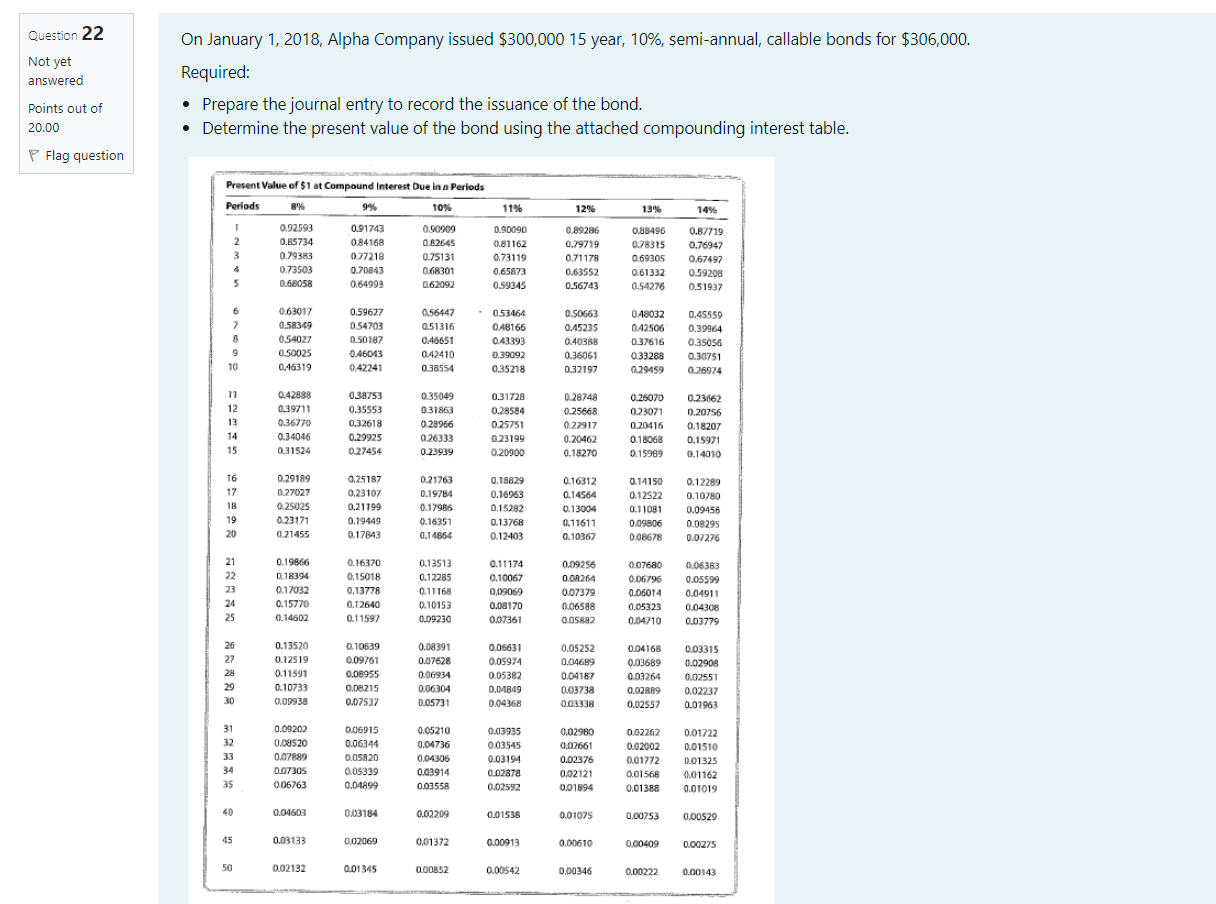

Question 22 Not yet answered On January 1, 2018, Alpha Company issued $300,000 15 year, 10%, semi-annual, callable bonds for $306,000. Required: Prepare the journal entry to record the issuance of the bond. Determine the present value of the bond using the attached compounding interest table. Points out of 20.00 Flag question 11% 12% 13% 1496 1 Present Value of $1 at Compound Interest Due in a Periods Periods B'M 10% 0.92593 0.91743 0.90909 2 0.85734 0.84168 0.82645 3 0.79383 0.77218 0.75131 4 4 0.73503 0.70843 0.68301 5 0,68058 0.64993 0.62092 0.90090 0.81162 0.73119 0.65873 0.59345 0.89286 0.79719 0.71178 0.63552 0.56743 0.88496 0.78315 0.69305 0.61332 0.54276 0.87719 0.76947 0.67497 0.59209 0.51937 6 7 8 9 10 063017 0.58369 0.54027 0.50025 0.46319 0.59627 0.54703 0.50187 0.46013 942241 0.56447 0.51316 0.46651 0.42410 0.38554 - 0.53464 0.48166 0.43393 0.39092 0.35218 0.50663 0.45235 0.40388 0.36061 0.32197 048032 042506 037616 033288 0.29459 0.45559 0.39964 0.35056 0.30751 0.26974 12 13 0.42988 0.39711 0.36770 0.34046 0.31524 0.38753 0.35553 0.32618 0.29925 0.27454 0.35049 0.31863 0.28966 0.26333 0.23939 0.31728 0.28584 0.25751 0.23199 0.20900 0.28748 0.25668 0.22917 0.20462 0.18270 0.26070 0.23071 0_20416 0.18068 0.15989 0.23662 0.20756 0.18207 14 0.15971 15 0.14010 16 17 18 19 20 0.29189 027027 0.25025 0.23171 0.21455 0.25187 0.23107 0.21199 0.19449 0.17843 0.21763 0.19784 0.17985 0.16351 0.14854 0.18629 0.16963 0.15282 0.13768 0.12403 0.16312 0.14564 0.13004 0.11611 0.10367 0.14150 0.12522 0.11081 0.09806 0.08678 0.12289 0.10780 0.09456 0.08295 0.07276 21 22 23 24 25 0.19866 0.18394 0.17032 0.15770 0.14602 0.16370 0.15018 0.13778 0.12640 0.11597 0.13513 0.12285 0.11168 0.10153 OLD9230 0.11174 0.10067 0,09069 0.08170 0.07361 0.09256 0.01264 0.07379 0.06588 0.05892 0.07680 0.06/96 0.06014 0.05323 0.04710 0.06383 0.05599 0.04911 0.04308 0.03779 26 27 28 29 30 0.13520 0.12519 0.11591 0.10733 0.09938 0.10639 0.09761 0.08955 0.00215 0.07537 0.08391 0.07628 0.06934 0.06304 0.05731 0.06631 0.05974 0.05382 0.01849 0.04368 0.05252 0.04689 0.04187 0,03738 0.03338 0,04168 0.03689 0.03264 0.02BR9 0.02557 0.03315 0.02908 0.02551 0.02237 0.01963 31 32 33 34 35 0.09202 0.09520 0.07889 0.07305 0.06763 0.06915 0.06344 0.05820 0.05339 0.04899 0.05210 0.04736 0.04306 0.03914 0.0355 0.03935 0.03545 0.03194 0.02878 0.02592 0.02980 0,02661 0.02376 0.0212 0.01894 0.02262 0.02002 0.01772 0.01568 0.01388 0.01722 0.01510 0.01325 0.01162 0.01019 40 0.04603 0.03184 0.02209 0.01536 0.01025 0.00753 0.00529 45 0.03133 002069 0,01372 0.00913 0.00610 0.00409 0.00275 50 0.02132 0.01345 0.00852 0.00542 0.00346 0.00222 0.00143