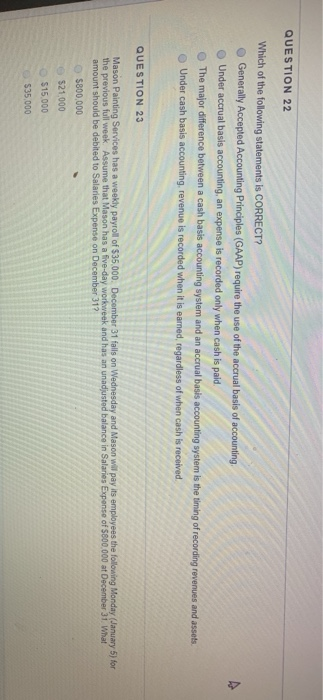

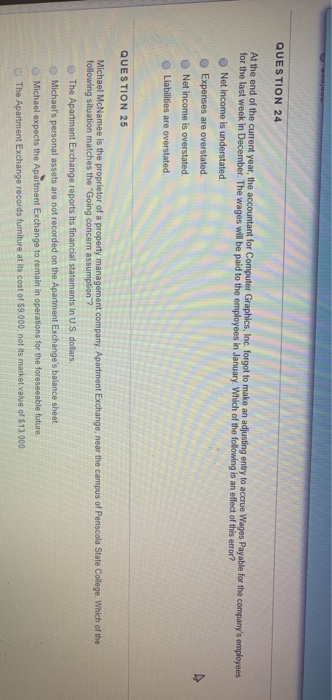

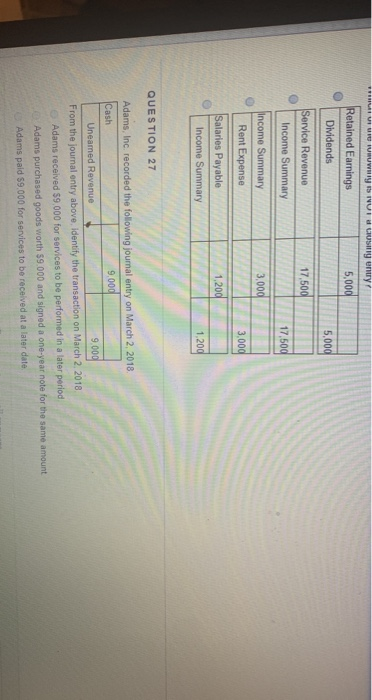

QUESTION 22 Which of the following statements is CORRECT? Generally Accepted Accounting Principles (GAAP) require the use of the accrual basis of accounting Under accrual basis accounting, an expense is recorded only when cash is paid. The major difference between a cash basis accounting system and an accrual basis accounting system is the timing of recording revenues and assets. Under cash basis accounting, revenue is recorded when it is earned, regardless of when cash is received. QUESTION 23 Mason Painting Services has a weekly payroll of $35.000. December 31 falls on Wednesday and Mason will pay its employees the following Monday (January 5) for the previous full week. Assume that Mason has a five-day workweek and has an unadjusted balance in Salaries Expense of 5800.000 at December 31 What amount should be debited to Salaries Expense on December 31? $800,000 $21,000 $15.000 $35.000 QUESTION 24 At the end of the current year, the accountant for Computer Graphics, Inc. forgot to make an adjusting entry to accrue Wages Payable for the company's employees for the last week in December. The wages will be paid to the employees in January. Which of the following is an effect of this error? Net Income is understated. Expenses are overstated Net income is overstated Liabilities are overstated. QUESTION 25 Michael McNamee is the proprietor of a property management company. Apartment Exchange, near the campus of Penscola State College. Which of the following situation matches the "Going concern assumption? The Apartment Exchange reports its financial statements in US dollars. Michael's personal assets are not recorded on the Apartment Exchange's balance sheet Michael expects the Apartment Exchange to remain in operations for the foreseeable future The Apartment Exchange records furniture at its cost of $9.000 not its market value of $13.000 I U UNUwy i Cusig eny Retained Earnings 5,000 Dividends 5,000 17,500 17,500 3.000 Service Revenue Income Summary Income Summary Rent Expense Salaries Payable Income Summary 3,000 1,200 1.200 QUESTION 27 Adams, Inc. recorded the following journal entry on March 2, 2018 Cash 9,000 Uneamed Revenue 9.000 From the journal entry above, identify the transaction on March 2. 2018 Adams received $9.000 for services to be performed in a later period Adams purchased goods worth $9.000 and signed a one-year note for the same amount Adams pald $9.000 for services to be received at a later date