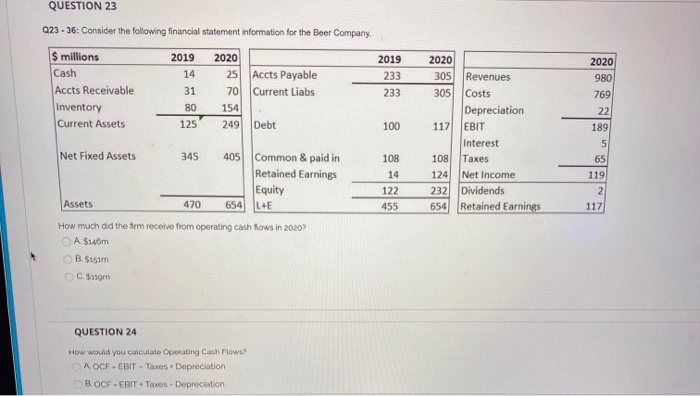

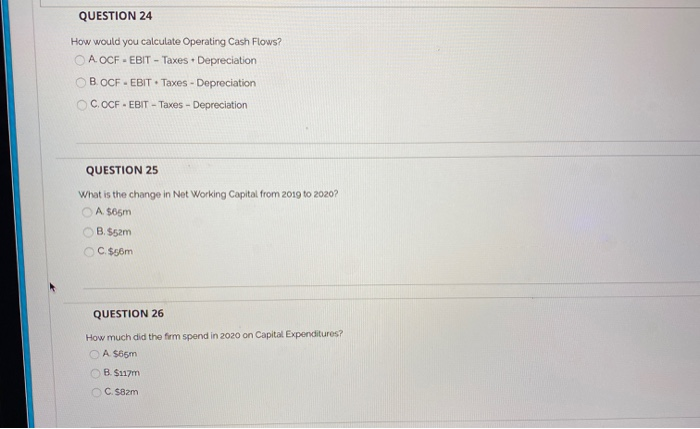

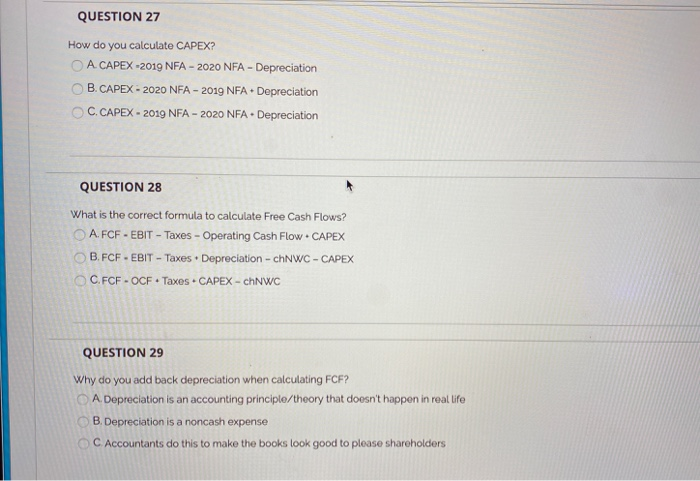

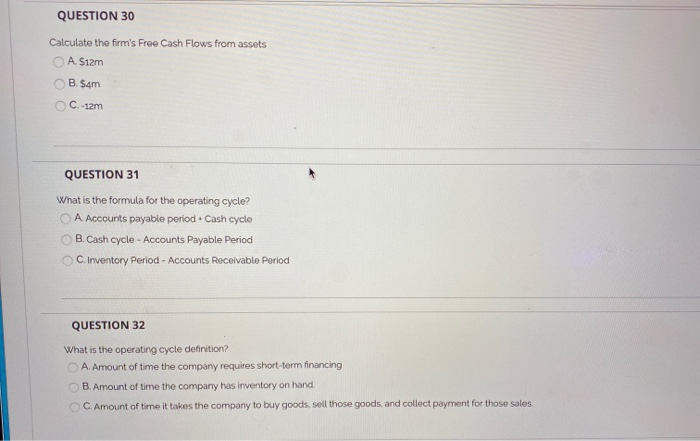

QUESTION 23 023-36: Consider the following financial statement information for the Beer Company $ millions Cash Accts Receivable Inventory Current Assets 2019 2020 25 70 80154 249 2020 980 2019 233 233 Accts Payable Current Liabs 2020 3 05 305 Debt 117 Revenues Costs Depreciation EBIT Interest Taxes Net Income Dividends Retained Earnings Net Fixed Assets 405 Common & paid in Retained Earnings Equity 654 LUE 108 124 232 Assets 470 654 How much did the firm receive from operating cash fows in 2020? A $146m B $150m C. Sum QUESTION 24 How would you calculate Operating Cash Flows A OCF - EBIT - Taxes. Depreciation BOCF-EBITTaxes - Depreciation QUESTION 24 How would you calculate Operating Cash Flows? A OCF - EBIT - Taxes . Depreciation B.OCF - EBIT. Taxes - Depreciation COCF. EBIT - Taxes - Depreciation QUESTION 25 What is the change in Net Working Capital from 2019 to 2020? A. $65m B. $52m C$56m QUESTION 26 How much did the firm spend in 2020 on Capital Expenditures? A $65m B. $117m C. $82m QUESTION 27 How do you calculate CAPEX? A. CAPEX -2019 NFA - 2020 NFA - Depreciation OB. CAPEX - 2020 NFA - 2019 NFA Depreciation C. CAPEX - 2019 NFA - 2020 NFA.Depreciation QUESTION 28 What is the correct formula to calculate Free Cash Flows? A. FCF - EBIT - Taxes - Operating Cash Flow. CAPEX B.FCF. EBIT - Taxes. Depreciation - chNWC - CAPEX C.FCF- OCF TaxesCAPEX - chNWC QUESTION 29 Why do you add back depreciation when calculating FCF? A Depreciation is an accounting principle/theory that doesn't happen in real life B. Depreciation is a noncash expense C Accountants do this to make the books look good to please shareholders QUESTION 30 Calculate the firm's Free Cash Flows from assets A. $12m B. $4m C.-12m QUESTION 31 What is the formula for the operating cycle? A Accounts payable period. Cash cycle B. Cash cycle - Accounts Payable Period C. Inventory Period - Accounts Receivable Period QUESTION 32 What is the operating cycle definition? A. Amount of time the company requires short-term financing B. Amount of time the company has inventory on hand C Amount of time it takes the company to buy goods, sell those goods, and collect payment for those sales QUESTION 33 What is the operating cycle calculation? A. 78.42 days B. 89 71 days C. 74 34 days QUESTION 34 N What is the formula for the cash cycle? A. Inventory Period Operating Cycle B . Inventory Period Accounts Receivable Period C. Operating Cycle - Accounts Payable Period QUESTION 35 What is the cash cycle definition? A Amount of time the company requires short-term financing for current assets B. Amount of time the company has inventory on hand. C Amount of time it takes the company to buy goods, sell those goods, and collect payment for those sales