Answered step by step

Verified Expert Solution

Question

1 Approved Answer

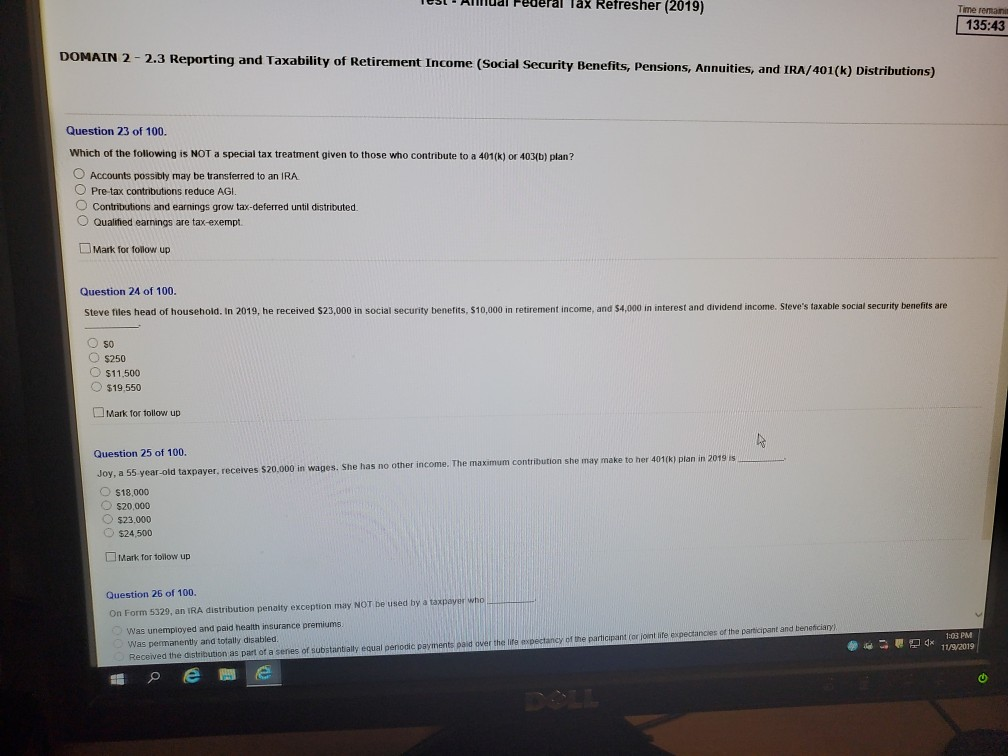

question #23 15. Aldi Federal Tax Refresher (2019) Time remaini 135:43 DOMAIN 2-2.3 Reporting and Taxability of Retirement Income (Social Security Benefits, Pensions, Annuities, and

question #23

15. Aldi Federal Tax Refresher (2019) Time remaini 135:43 DOMAIN 2-2.3 Reporting and Taxability of Retirement Income (Social Security Benefits, Pensions, Annuities, and IRA/401(k) Distributions) Question 23 of 100. Which of the following is NOT a special tax treatment given to those who contribute to a 401(k) or 403b) plan? Accounts possibly may be transferred to an IRA O Pre tax contributions reduce AGI. O Contributions and earnings grow tax-deferred until distributed O Qualified earnings are tax-exempt Mark for follow up Question 24 of 100. Steve files head of household. In 2019, he received $23,000 in social security benefits, $10,000 in retirement income, and $4,000 in interest and dividend income. Steve's taxable social security benefits are OSO O $250 O $11,500 $19,550 Mark for follow up Question 25 of 100. Joy, a 55 year-old taxpayer, receives $20,000 in wages. She has no other income. The maximum contribution she may make to her 401(k) plan in 2019 O $18,000 $20.000 $23.000 $24.500 Mark for follow up Question 26 of 100. On Form 5329, an IRA distribution penalty exception may NOT be used by a taxpayer who Was unemployed and paid health insurance premiums. Was permanently and totally disabled. Received the distribution as part of a senes of substantially equal penodic payments paid over the life expectancy of the participant (or joint are expectances of the participant and benefician) 21 1:03 PM 11/9/2019 e eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started