Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 2&3 inyour own words me 1 Portfolio management draws on insig variance correlation. In assU e and each of these statistical concepts may give

question 2&3

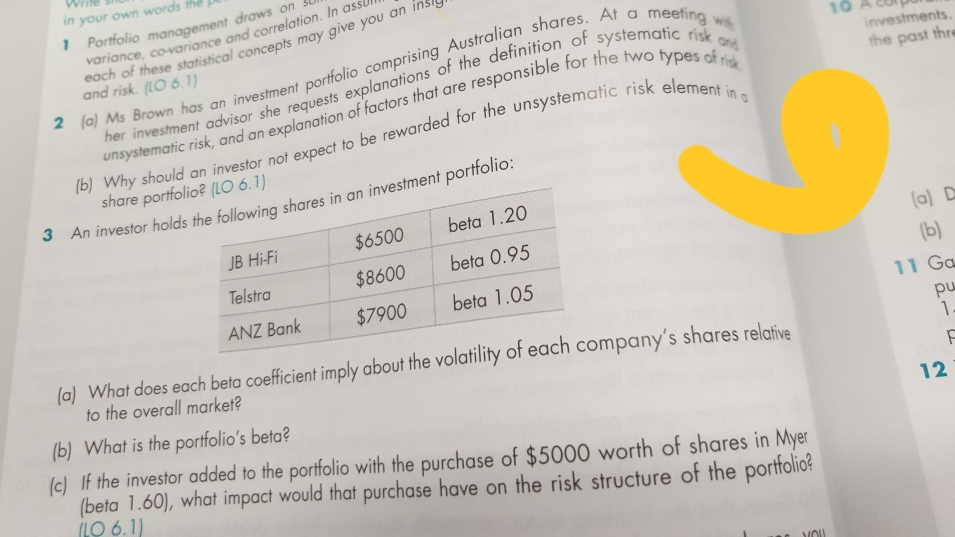

inyour own words me 1 Portfolio management draws on insig variance correlation. In assU e and each of these statistical concepts may give and risk lO 6.1) hs an investment portfolio comprising Australian shares. A her investment advisor s meeting w unsystematic rrequests explanations of the definition fm share portfolio (LO 6.1) ion of systematic 0 A8urpu 2 (al Ms Brown has an investment porfolio comprising the past thr k, and an explanation of factors that are responsible for the Ib) Why should an investor not expect to be rewarded for the unsystematic risk ele An investor holds the following shares in an investment portfolio: JB Hi-Fi $6500 beta 1.20 $8600 beta 0.95 ANZ Bank $7900 beta 1.05 Telstra 11 Ga a What does each beta coeficient imply about the volatlity of each company's shares relahie to the overall market? b) What is the portfolio's beta? (c) If the investor added to the porfolio with the purchase of $5000 worth of shares in Myer 12 beta 1.60), what impact would that purchase have on the risk structure of the portfolio? LO 6.1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started