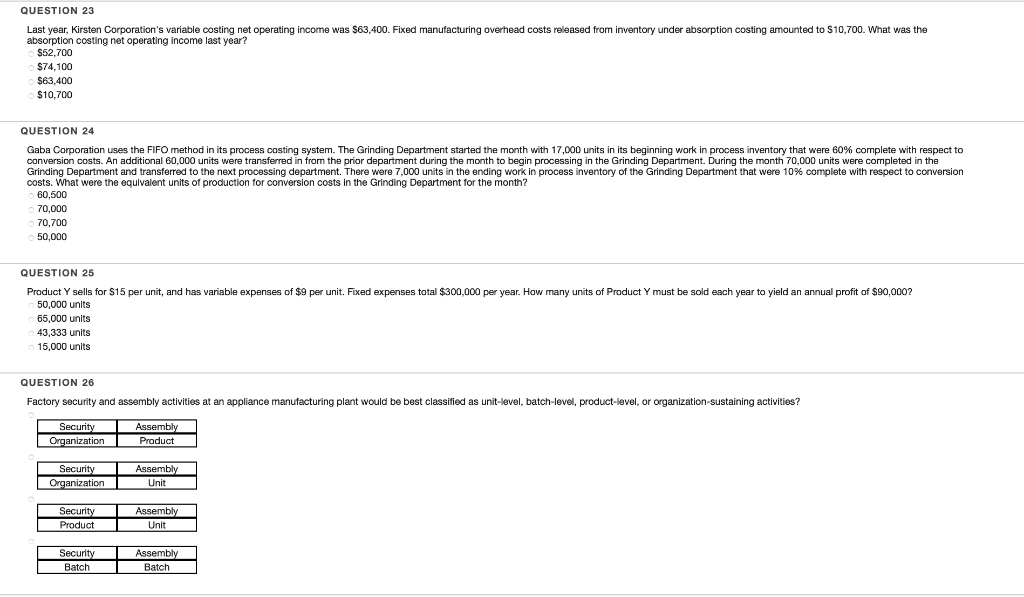

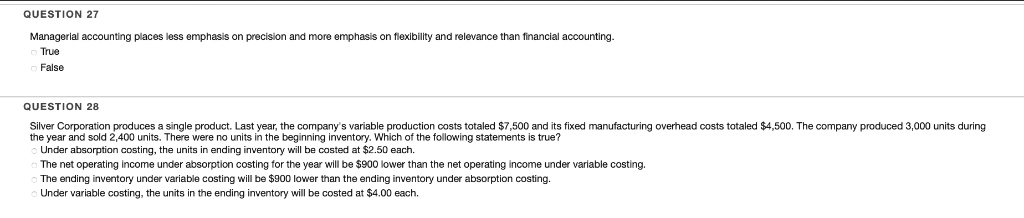

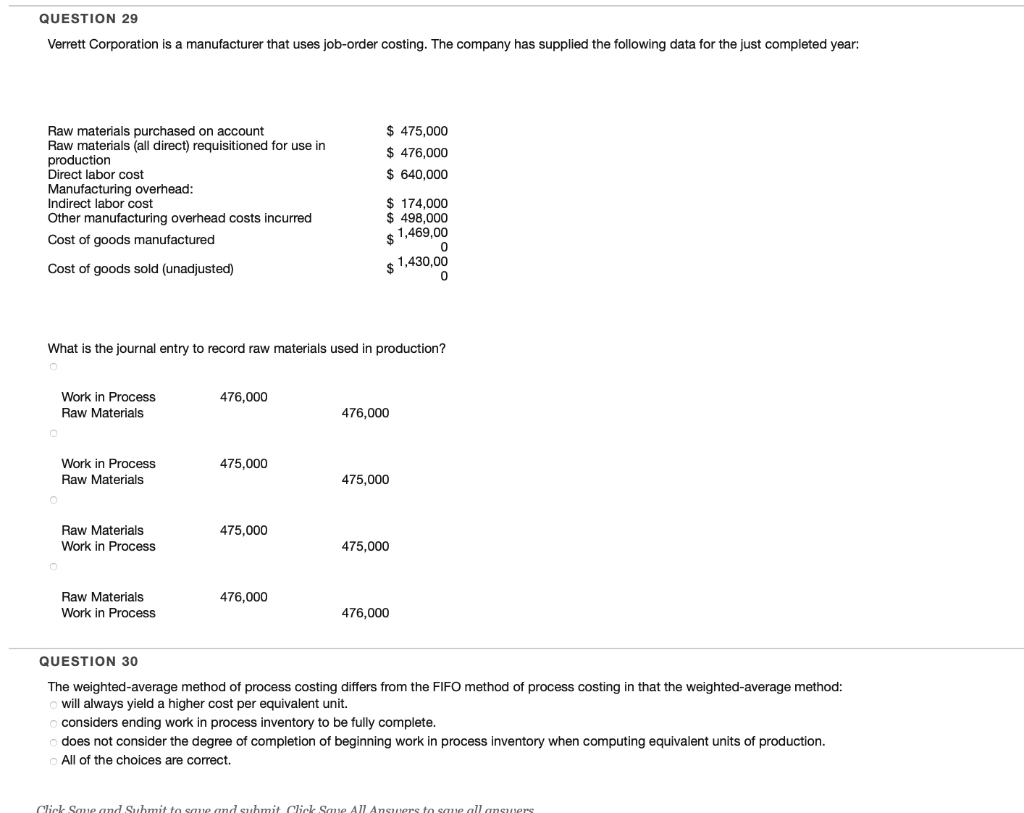

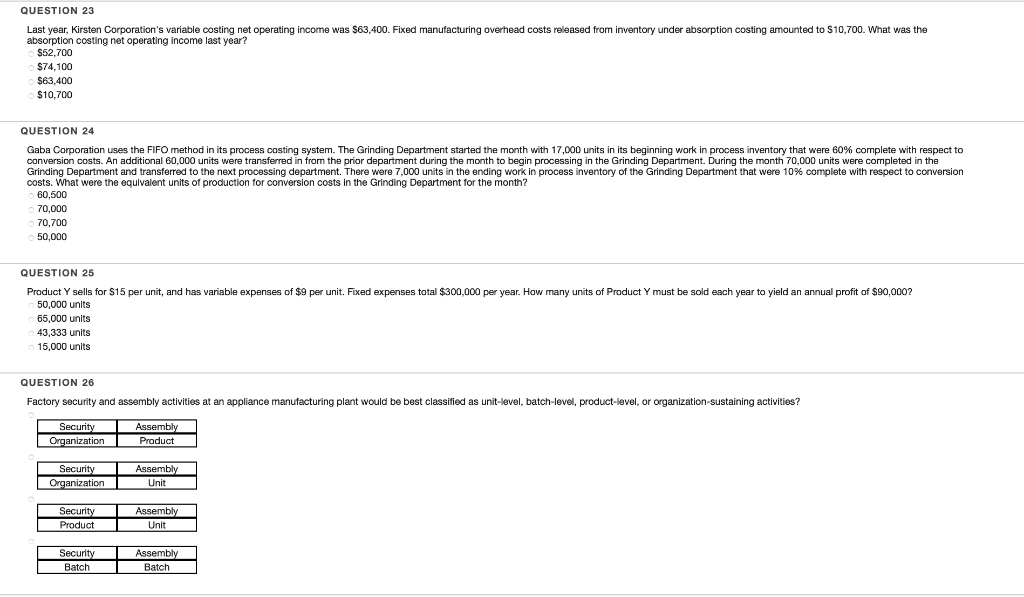

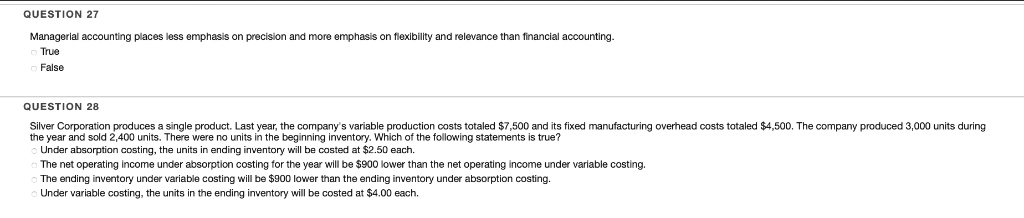

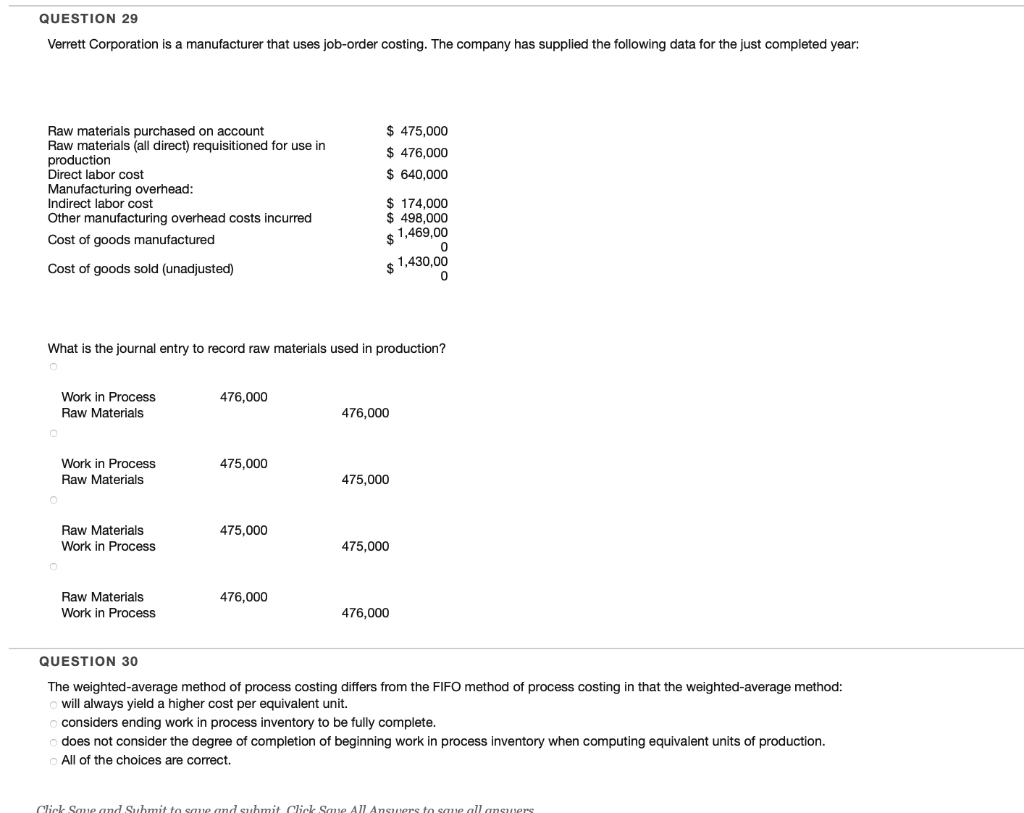

QUESTION 23 Last year, Kirsten Corporation's variable costing net operating income was $63,400. Fixed manufacturing overhead costs released from inventory under absorption costing amounted to S10,700. What was the absorption costing net operating income last year? $52,700 $74,100 $63,400 $10,700 QUESTION 24 Gaba Corporation uses the FIFO method in its process costing system. The Grinding Department started the month with 17,000 units in its beginning work in process inventory that were 60% complete with respect to conversion costs. An additional 60,000 units were transferred in fron the prior department during the month to begin processing in the Grinding Department. During the month 70,000 units were completed in the Grinding Department and transferred to the next processing department. There were 7,000 units in the ending work in process inventory of the Grinding Department that were 10% complete with respect to conversion costs. What were the equivalent units of production for conversion costs in the Grinding Department for the month? 60,500 70,000 70,700 50,000 QUESTION 25 Product Y sells for $15 per unit, and has variable expenses of $9 per unit. Fixed expenses total $300,000 per year. How many units of Product Y must be sold each year to yield an annual profit of $90,000? 50,000 units 65,000 units 43,333 units 15,000 units QUESTION 26 Factory security and assembly activities at an appliance manufacturing plant would be best classified as unit-level, batch-level, product-level, or organization-sustaining activities? Assem anization Product Ass anization Unit Assemb Product Unit Secu Ass Batch Batch QUESTION 27 Managerial accounting places less emphasis on precision and more emphasis on flexibility and relevance than financial accounting True False QUESTION 28 a single product. Last year, the company's vanable production costs totaled $ 50 and ts ixed manufacturing overhead costs ta ed OThe com a produced 3 000 units r ng the year and sold 2,400 units. There were no units in the beginning inventory. Which of the following statements is true? Under absorption costing, the units in ending inventory will be costed at $2.50 each. The net operating income under absorption costing for the year will be $900 lower than the net operating income under variable costing. The ending inventory under variable costing will be $900 lower than the ending inventory under absorption costing. Under variable costing, the units in the ending inventory will be costed at $4.00 each. QUESTION 29 Verrett Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year: Raw materials purchased on account Raw production Direct labor cost Manufacturing overhead Indirect labor cost Other manufacturing overhead costs incurred $ 475,000 $ 476,000 $640,000 materials (all direct) requisitioned for use in $ 174,000 $ 498,000 1,469,00 0 1,430,00 0 Cost of goods manufactured Cost of goods sold (unadjusted) What is the journal entry to record raw materials used in production? Work in Process Raw Materials 476,000 476,000 475,000 Work in Process Raw Materials 475,000 Raw Materials Work in Process 475,000 475,000 Raw Materials Work in Process 476,000 476,000 QUESTION 30 The weighted-average method of process costing differs from the FIFO method of process costing in that the weighted-average method: will always yield a higher cost per equivalent unit. considers ending work in process inventory to be fully complete. does not consider the degree of completion of beginning work in process inventory when computing equivalent units of production. All of the choices are correct