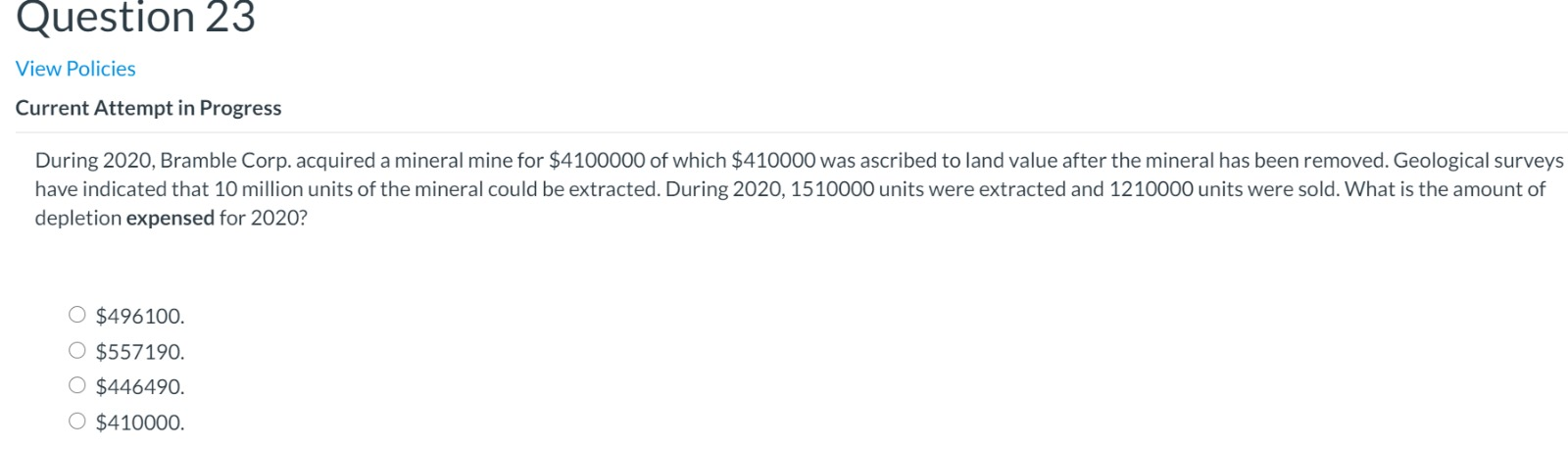

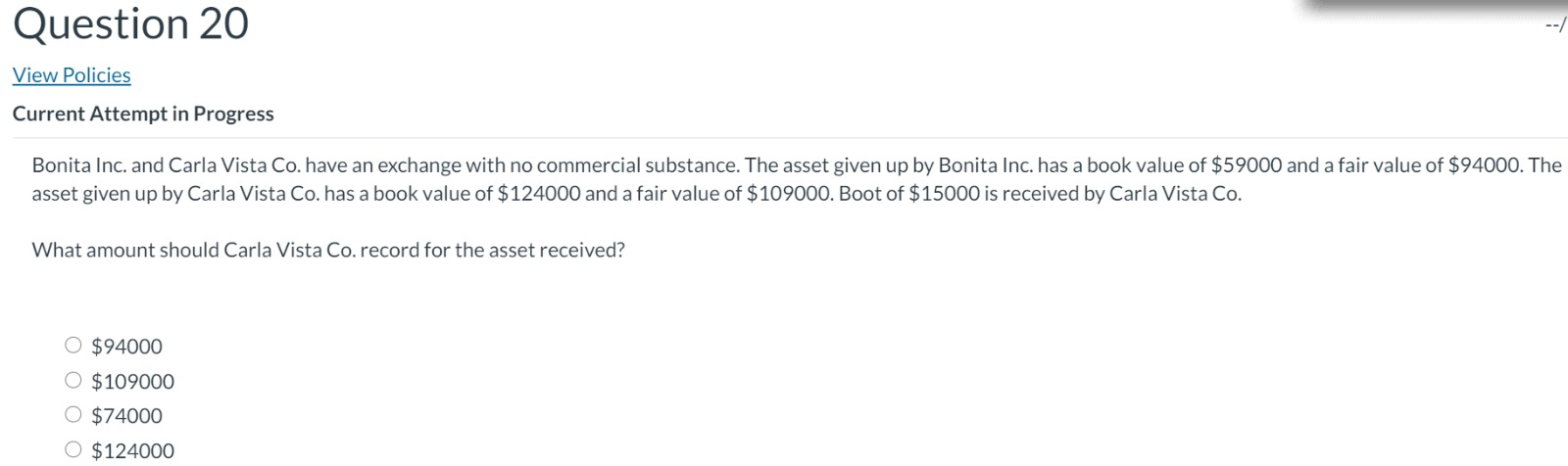

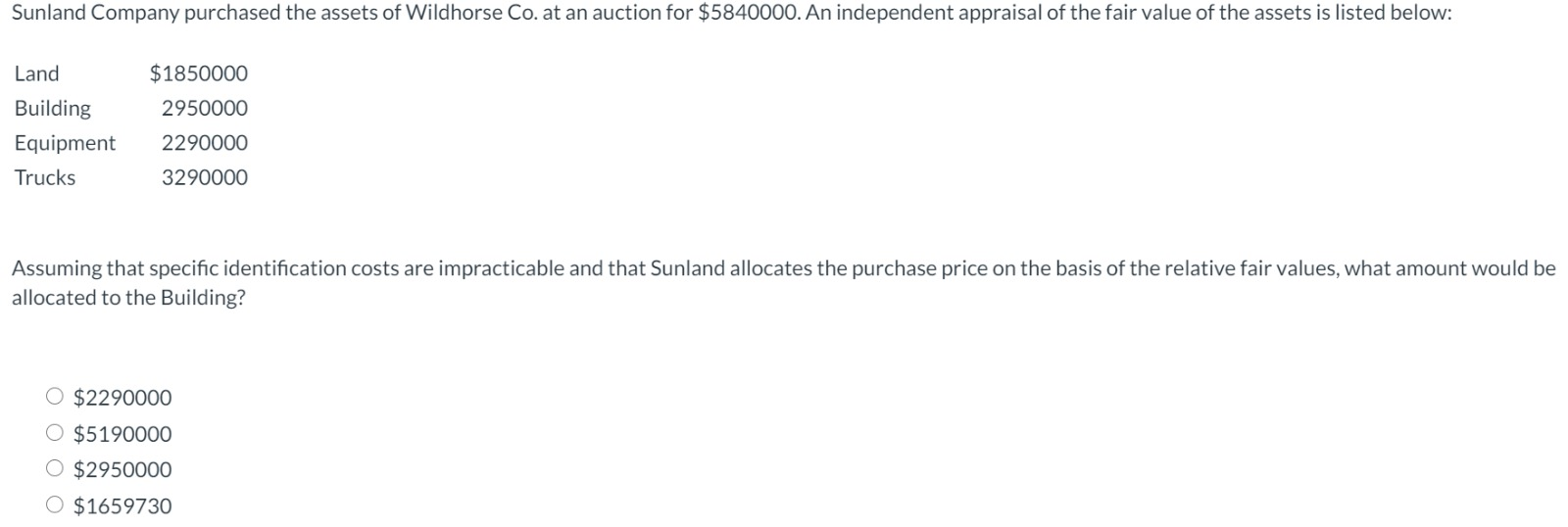

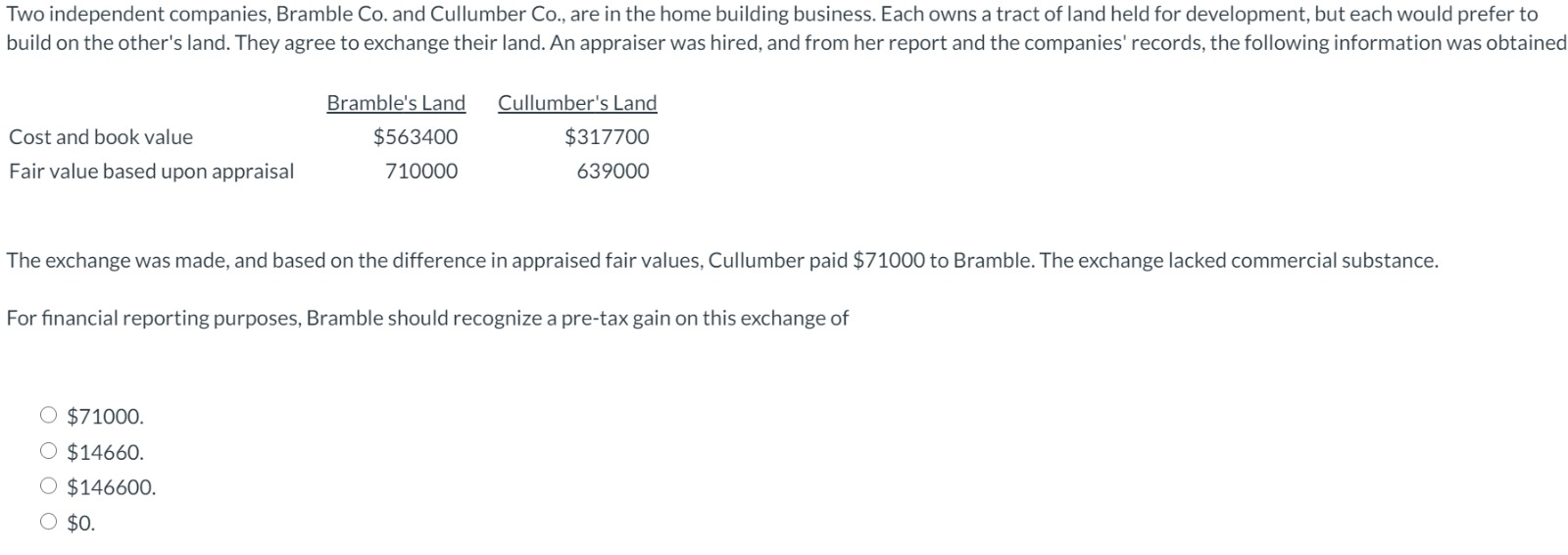

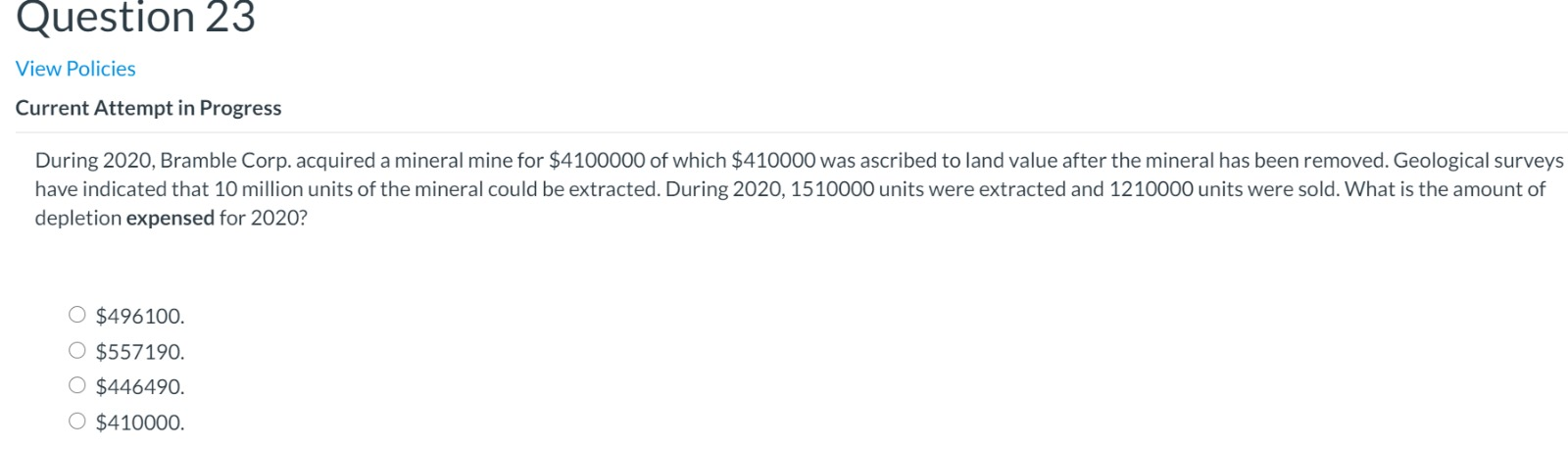

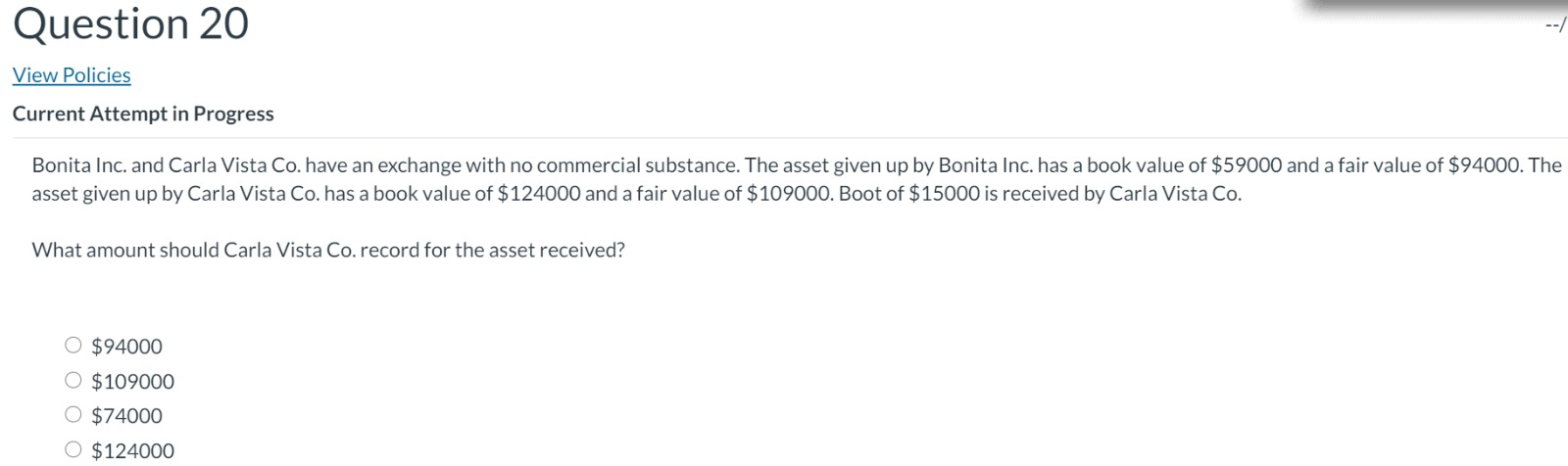

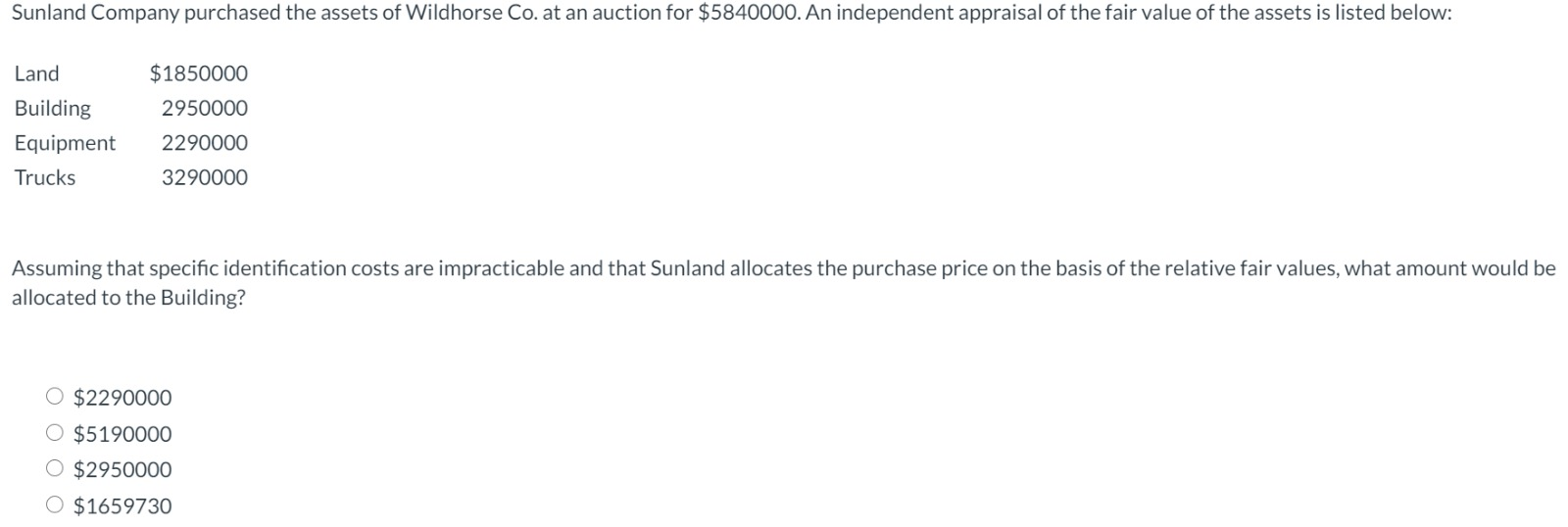

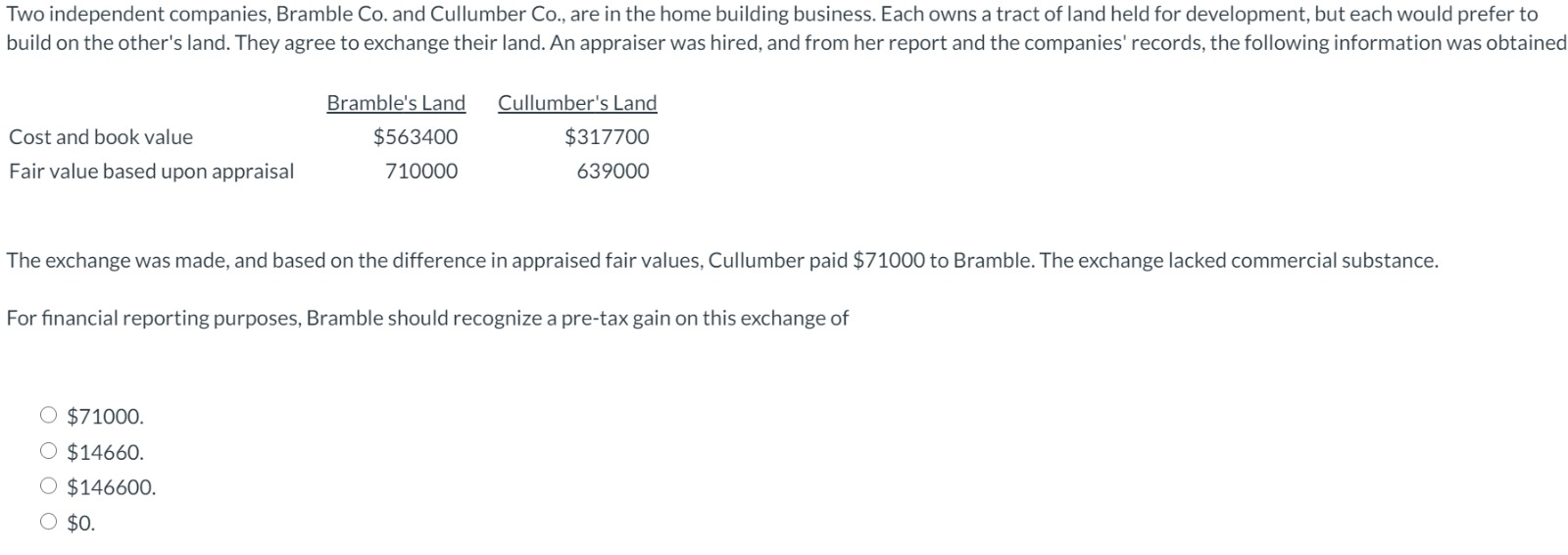

Question 23 View Policies Current Attempt in Progress During 2020, Bramble Corp. acquired a mineral mine for $4100000 of which $410000 was ascribed to land value after the mineral has been removed. Geological surveys have indicated that 10 million units of the mineral could be extracted. During 2020, 1510000 units were extracted and 1210000 units were sold. What is the amount of depletion expensed for 2020? $496100. O $557190. $446490. O $410000. Question 20 View Policies Current Attempt in Progress Bonita Inc. and Carla Vista Co. have an exchange with no commercial substance. The asset given up by Bonita Inc. has a book value of $59000 and a fair value of $94000. The asset given up by Carla Vista Co. has a book value of $124000 and a fair value of $109000. Boot of $15000 is received by Carla Vista Co. What amount should Carla Vista Co.record for the asset received? $94000 O $109000 O $74000 O $124000 Sunland Company purchased the assets of Wildhorse Co. at an auction for $5840000. An independent appraisal of the fair value of the assets is listed below: $1850000 Land Building Equipment Trucks 2950000 2290000 3290000 Assuming that specific identification costs are impracticable and that Sunland allocates the purchase price on the basis of the relative fair values, what amount would be allocated to the Building? O $2290000 O $5190000 $2950000 O $1659730 Two independent companies, Bramble Co. and Cullumber Co., are in the home building business. Each owns a tract of land held for development, but each would prefer to build on the other's land. They agree to exchange their land. An appraiser was hired, and from her report and the companies' records, the following information was obtained Bramble's Land $563400 Cost and book value Fair value based upon appraisal Cullumber's Land $317700 639000 710000 The exchange was made, and based on the difference in appraised fair values, Cullumber paid $71000 to Bramble. The exchange lacked commercial substance. For financial reporting purposes, Bramble should recognize a pre-tax gain on this exchange of O $71000. O $14660. O $146600. O $0